PEEC AI vs Profound: A GEO Tools Comparison

Written by

Ernest Bogore

CEO

Reviewed by

Ibrahim Litinine

Content Marketing Expert

Peec AI positions itself as the fast, simple way to see where your brand shows up. It’s easy to adopt and gives teams immediate clarity. Profound takes a more enterprise approach with deeper analytics, broader competitive modeling, and heavier reporting capabilities.

Both bring value, but each comes with trade-offs in usability, depth, and cost. The next section will break down those differences feature by feature so you can see which one fits your workflow.

There’s also a third option designed to avoid those trade-offs entirely: Analyze AI.

Table of Contents

Peec AI vs Profound: feature-by-feature comparison

Peec AI and Profound both promise the same thing on paper: help you understand how your brand shows up inside AI-generated answers and how that presence evolves over time. Where they differ is in how deep they go, how fast you get value, and who they’re really built for.

Below is a quick TL;DR table you can scan in seconds, followed by deeper takes on each feature so you can decide which platform fits your GEO workflow.

|

Feature |

Peec AI |

Profound |

|

Prompt visibility & tracking |

✅ Strong, clear tracking |

✅ Deeper, real-time enterprise tracking |

|

Prompt suggestion & discovery |

⚠️ Limited suggestions |

✅ More robust discovery patterns |

|

Citation & hallucination analysis |

✅ Good citation insights |

⚠️ Deeper analysis but less intuitive |

|

Competitive benchmarking |

⚠️ Basic but useful |

✅ Advanced benchmarking & market share |

|

AI traffic analytics |

❌ Not native today |

⚠️ Early-stage / limited visibility |

|

Usability & time to value |

✅ Extremely fast onboarding |

⚠️ Slower ramp-up; more complex |

|

Pricing |

✅ Affordable for SMBs |

❌ Enterprise-priced |

Prompt visibility & tracking

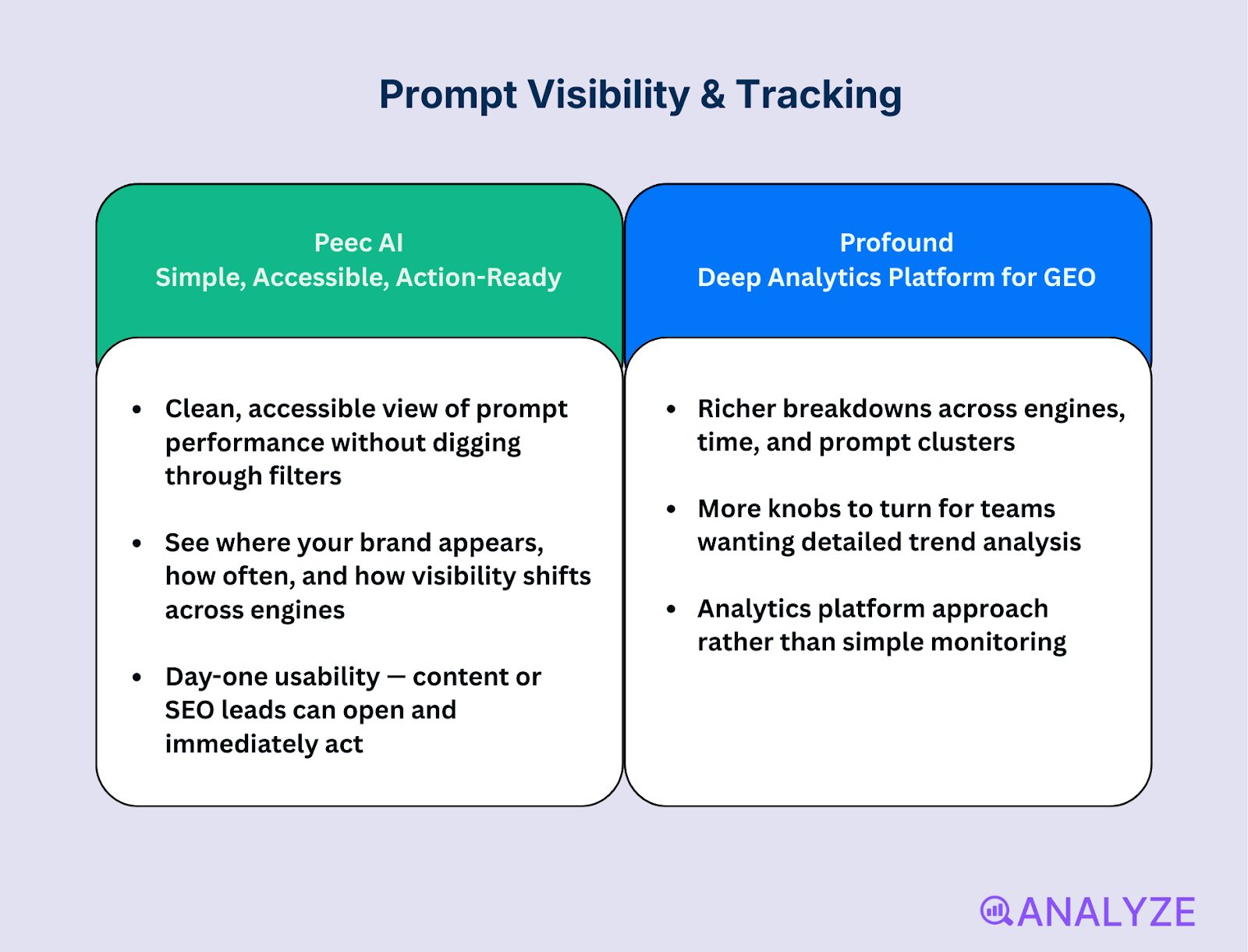

Prompt visibility is the core of GEO: you need to see which questions actually surface your brand, how often you appear across engines, and how that changes over time. If this layer is weak, everything else becomes guesswork — content planning, experimentation, and reporting all drift from reality.

Peec AI gives you a very clean, accessible view of prompt performance. You see where your brand appears, how often, and how visibility shifts across engines without needing to dig through layers of filters. It feels like a monitoring tool your content or SEO lead can open on day one and immediately act on. The tradeoff is that you don’t get as much fine-grained slicing, custom segmenting, or predictive modeling as a larger data team might want.

Profound goes deeper on tracking and granularity. You get richer breakdowns across engines, time, and prompt clusters, with more knobs to turn for teams that want detailed trend analysis. It’s closer to an “analytics platform for GEO” than a simple monitor. The downside is cognitive load: to fully benefit, you need someone comfortable living in dashboards and turning those insights into internal narratives.

Profound has the stronger engine here for teams that need deep, ongoing analysis, while Peec AI wins on simplicity and speed.

Prompt suggestion & discovery

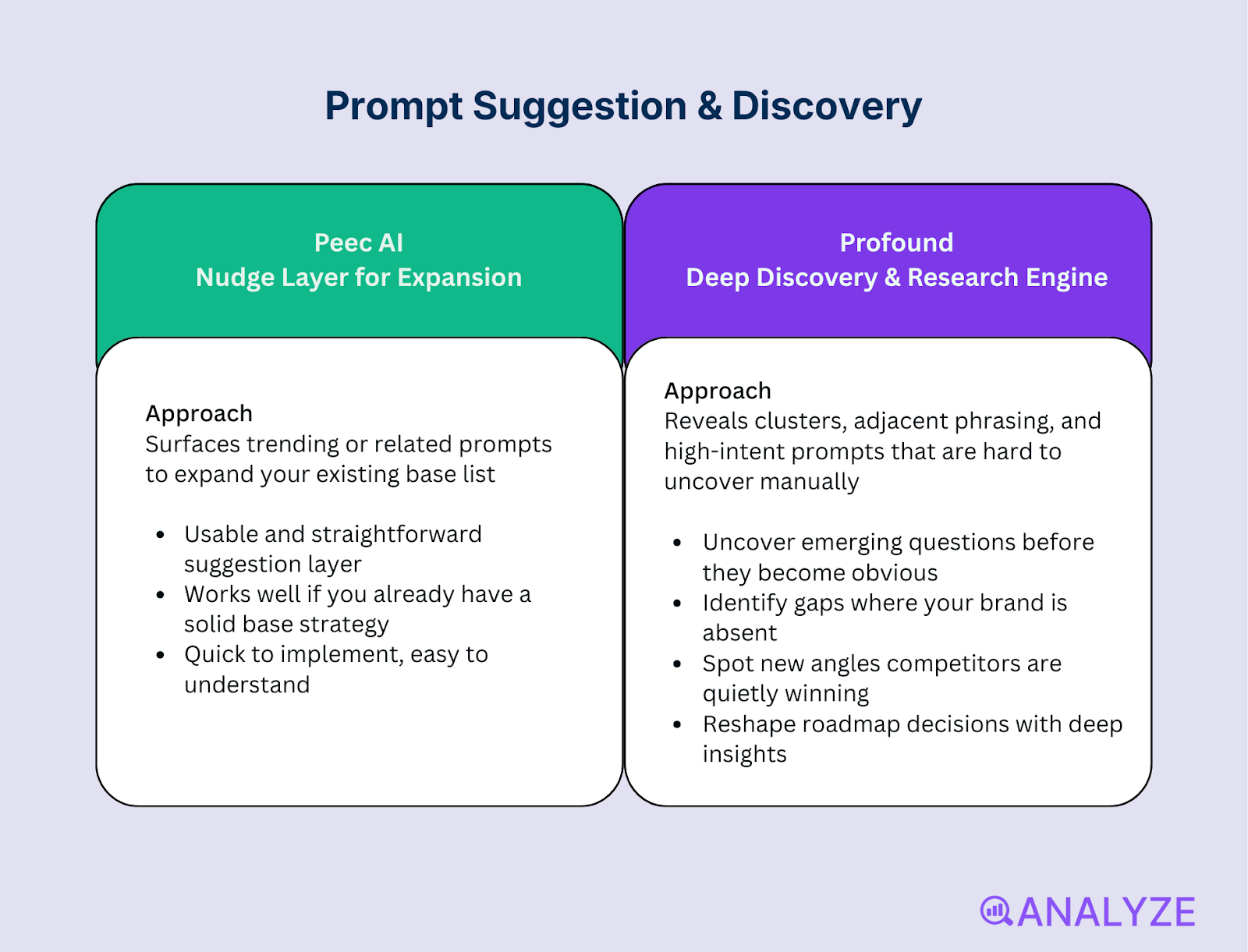

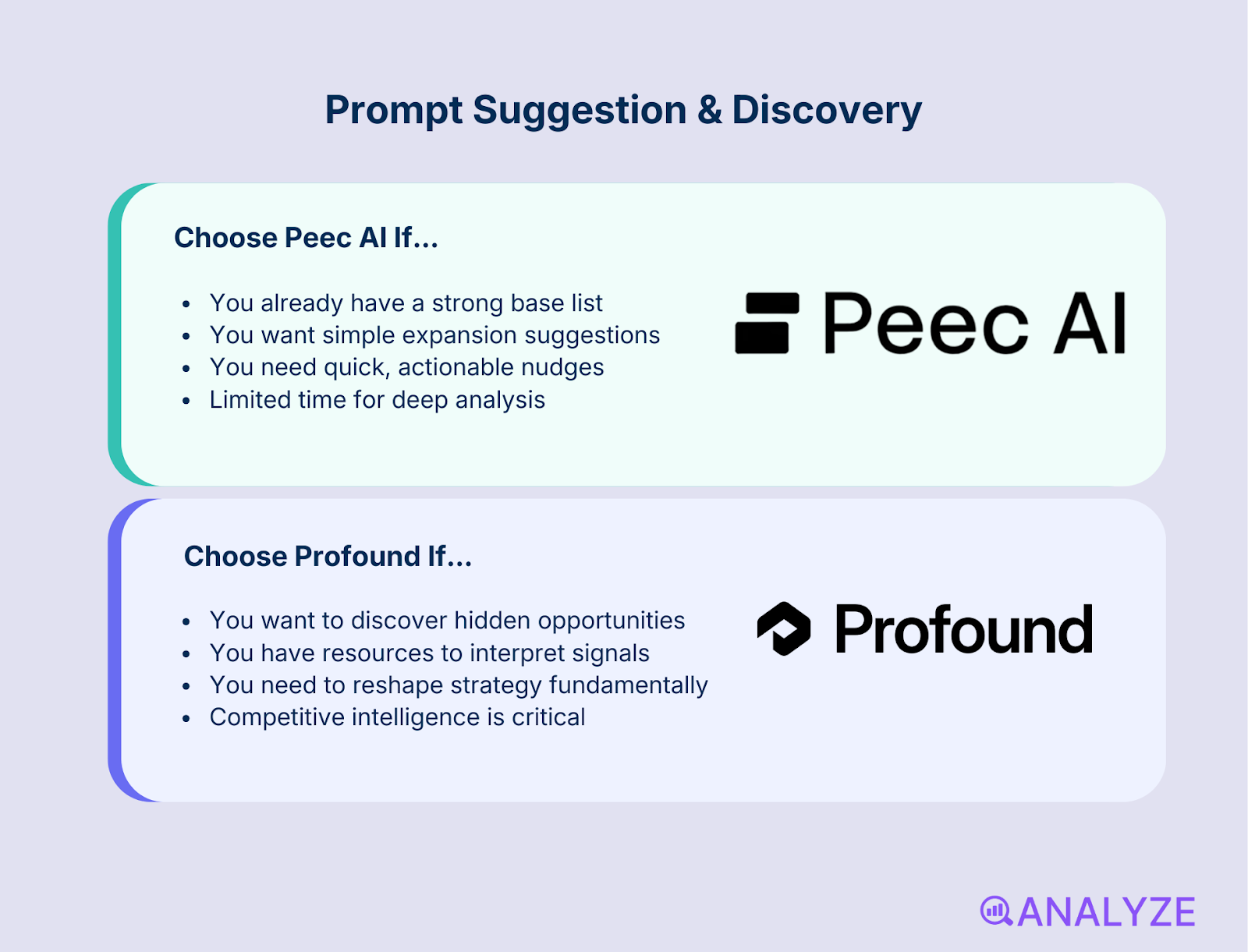

Most markets have far more influential prompts than the handful teams brainstorm in a meeting. A strong GEO tool should surface those hidden queries, adjacent questions, and long-tail patterns that shape how your brand is framed by AI engines.

Peec AI does some suggestion work by surfacing trending or related prompts, which is enough if you already have a solid base list and just want to expand it. It’s very usable but not exhaustive. In practice, it feels like a “nudge” layer on top of your existing strategy, not a full research engine that rewires how you think about demand.

Profound leans further into discovery. It’s better at revealing clusters, adjacent phrasing, and less obvious high-intent prompts that would be hard to uncover manually. For teams willing to dig in, this can reshape roadmap decisions: you start to see emerging questions, gaps where your brand is absent, and new angles competitors are quietly winning. The cost is time and attention — you need someone to interpret and prioritize all that signal.

Profound offers a stronger discovery engine and gives more leverage to teams that want to systematically expand prompt coverage.

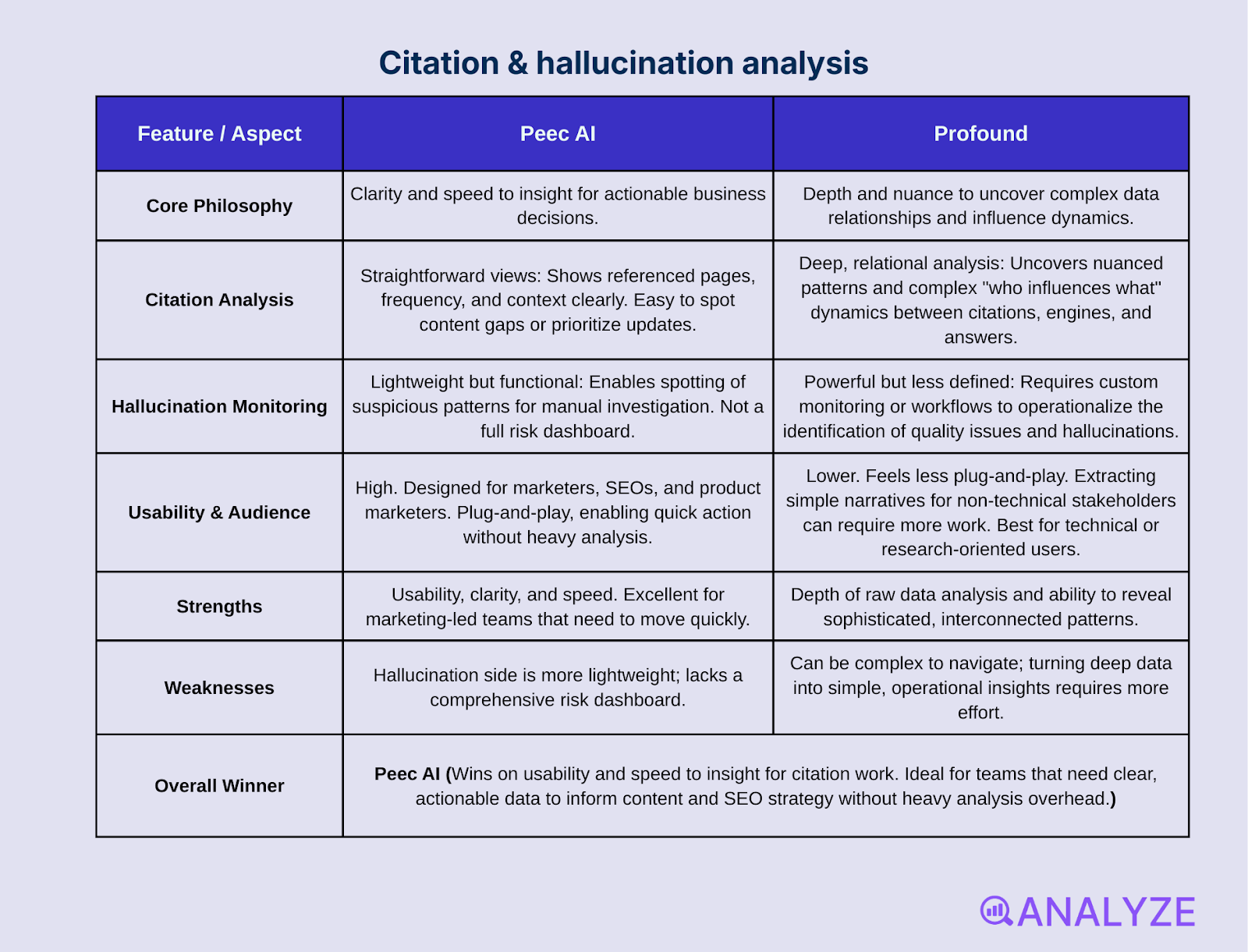

Citation & hallucination analysis

Citations are the closest thing to “source code” for AI answers. If you can see which URLs and domains models lean on, you can understand why your brand appears (or doesn’t). Hallucination monitoring adds a protective layer: catching misleading, outdated, or outright wrong claims about your product.

Peec AI shines in clarity here. Its citation views are straightforward: you see which pages get referenced, how often, and in what context. It’s easy for marketers, SEOs, or product marketers to use this to spot content gaps or prioritize updates. The hallucination side is more lightweight — you won’t get a full risk dashboard, but you can still spot suspicious patterns and dig in manually.

Profound goes deeper on the raw data and relationships between citations, engines, and answers. You can uncover nuanced patterns and more complex “who influences what” dynamics. The challenge is that it feels less plug-and-play: extracting simple narratives for non-technical stakeholders can take work, and hallucination/quality issues might require custom monitoring or workflows to really operationalize.

Peec AI wins on usability and speed to insight for citation work, especially for marketing-led teams that want to move quickly without heavy analysis.

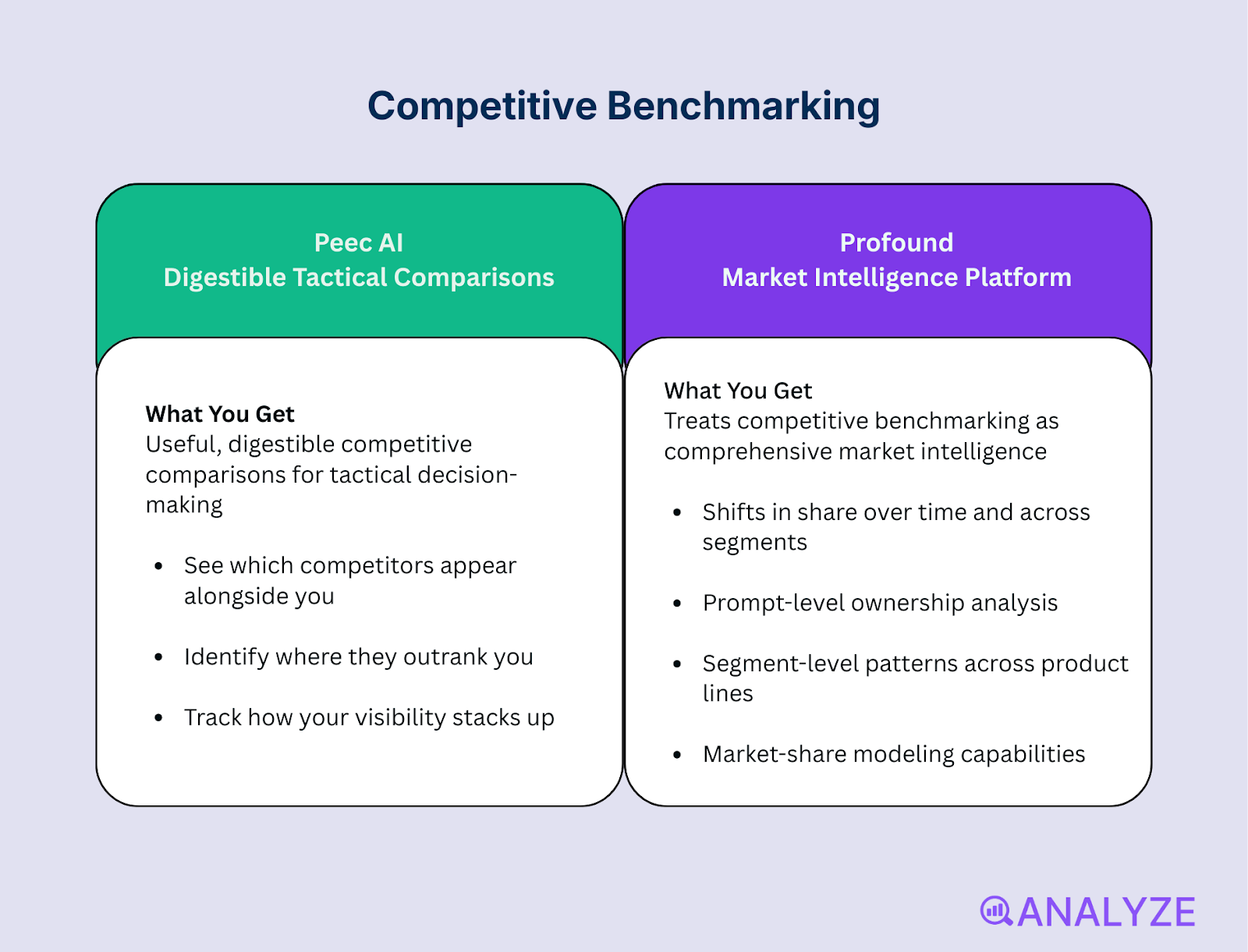

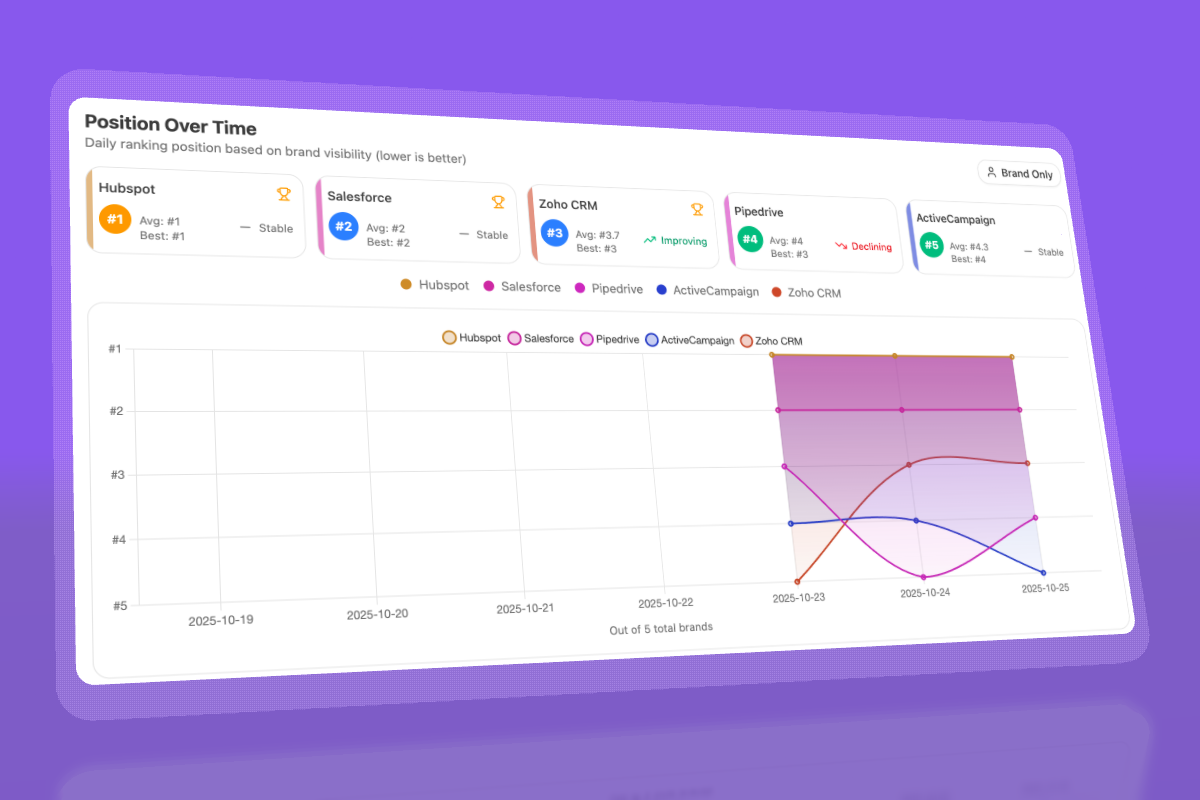

Competitive benchmarking

GEO isn’t just about your brand’s visibility — it’s about who owns the narrative around key prompts and how that shifts over time. Teams need more than a simple “you vs competitor” comparison; they need to see sentiment, share of voice, and which brands are taking over which parts of the journey.

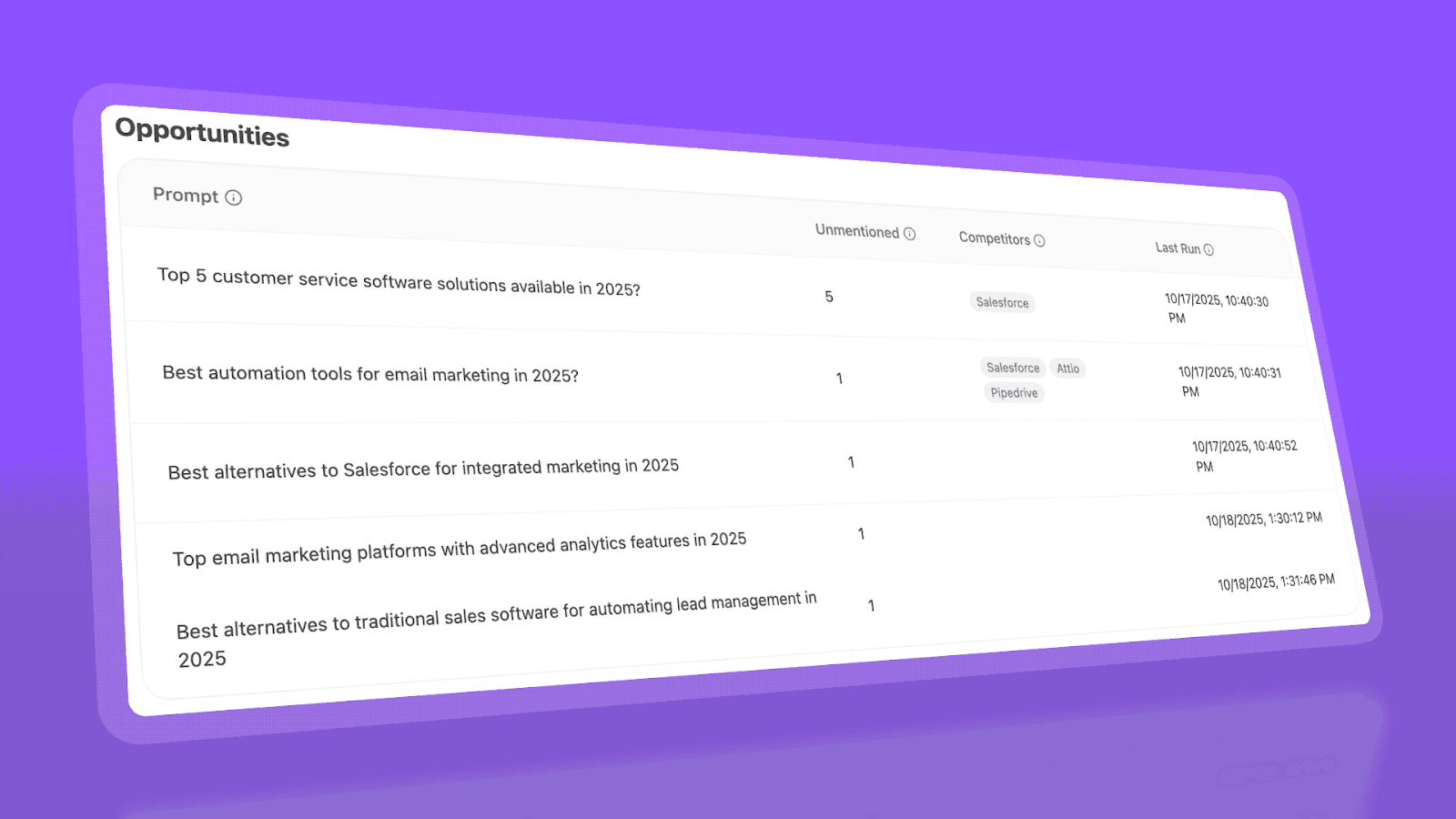

Peec AI offers useful, digestible competitive comparisons. You can see which competitors appear alongside you, where they outrank you, and how your visibility stacks up. For many teams, this is enough to adjust messaging, prioritize new content, and keep an eye on direct rivals. What you give up is depth: you don’t get full-blown market-share modeling or multi-dimensional slicing.

Profound treats competitive benchmarking more like market intelligence. It’s stronger at showing shifts in share, prompt-level ownership, and segment-level patterns. This matters if you’re running GEO for a category-leading brand or multiple product lines and need to report up to leadership. The flipside is that the more complex views can be overwhelming for lean teams without a clear reporting cadence.

Profound is better suited for teams that want competitive GEO to feed into formal strategy and reporting, not just tactical adjustments.

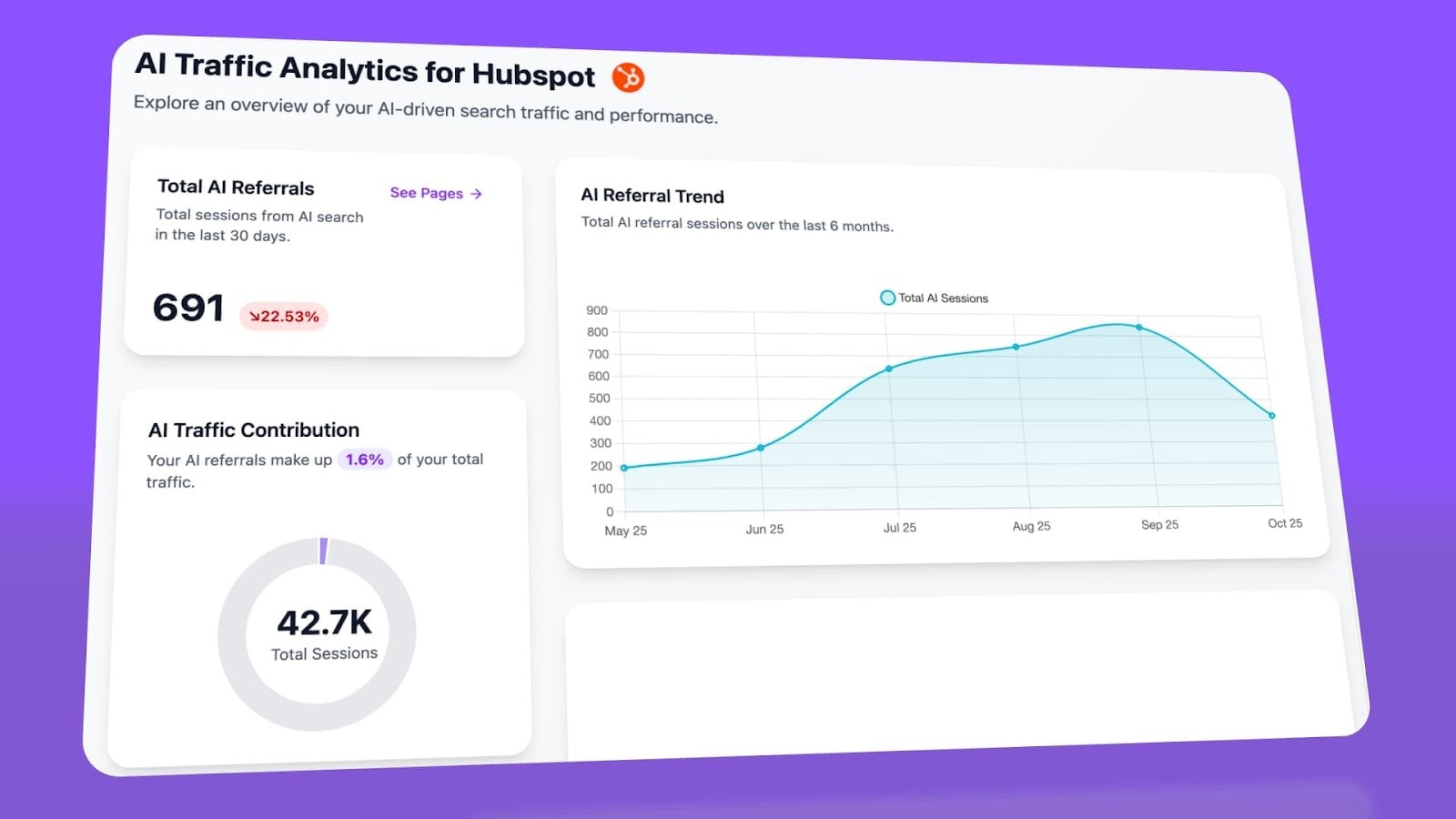

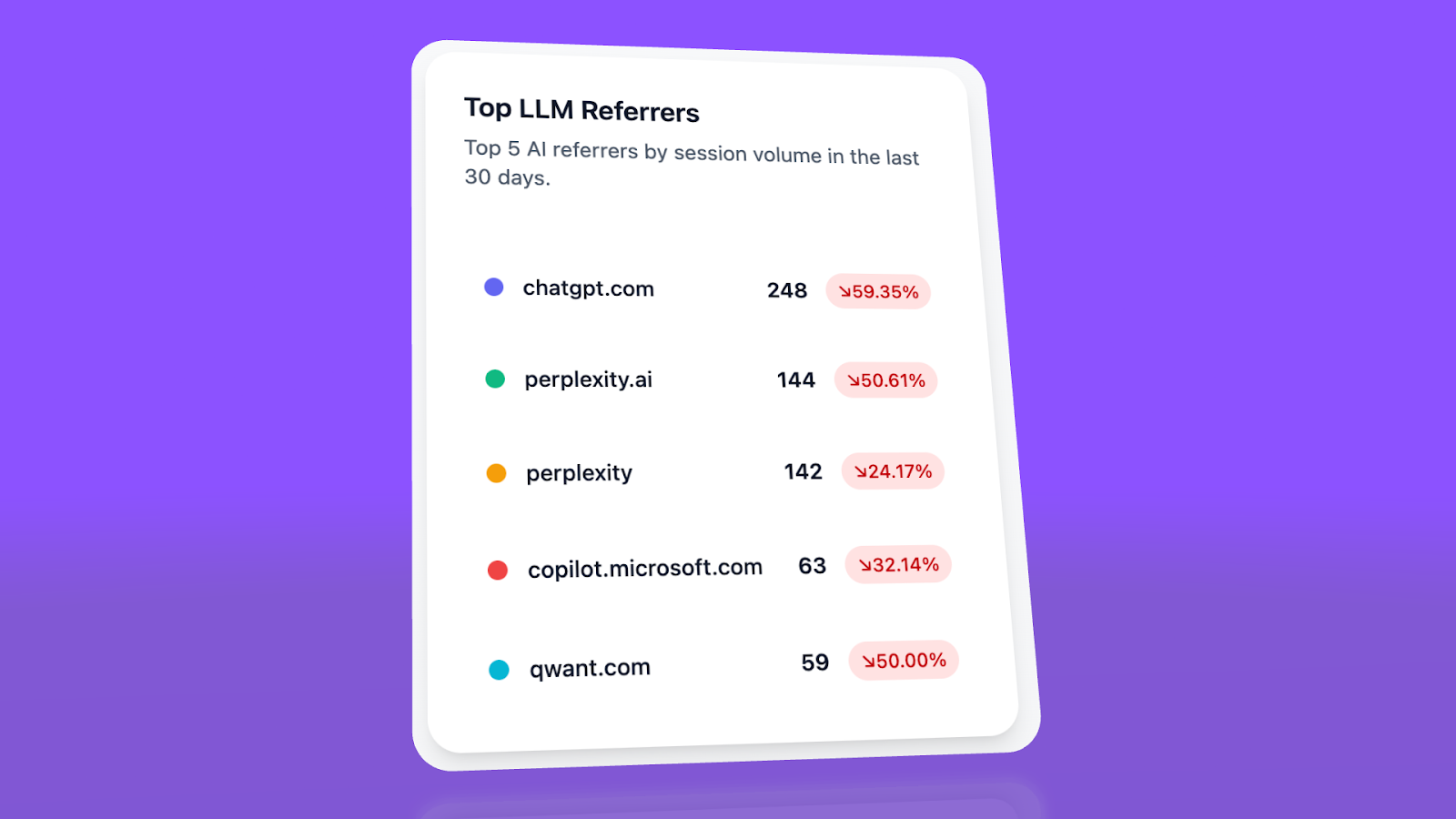

AI traffic analytics

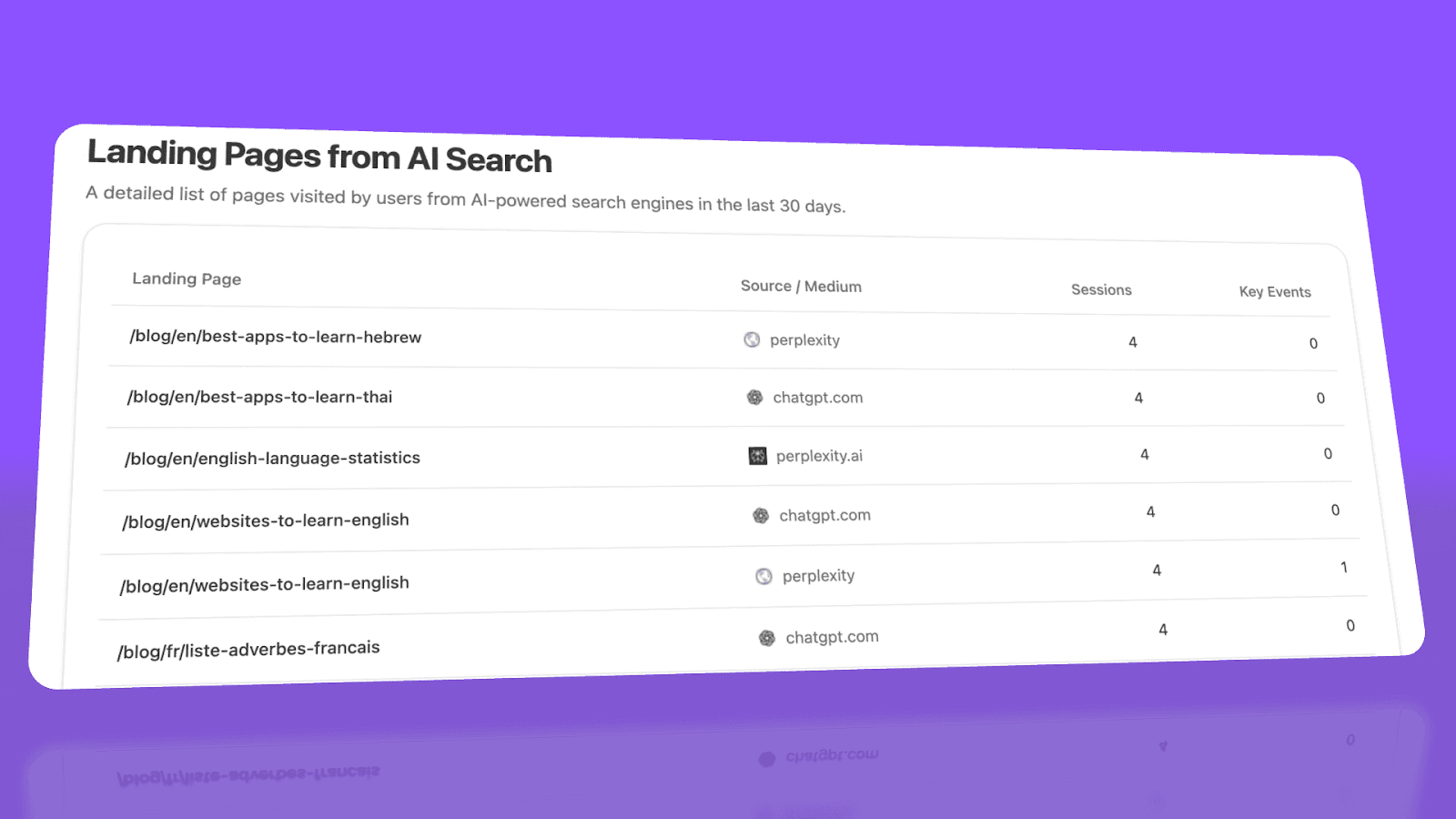

As AI engines start sending more clicks, teams want to see whether GEO translates into real sessions and behavior on-site. The ideal is a clear line from “we showed up in this answer” to “we saw this traffic and these actions.” That’s still early across the whole market, but it’s becoming a critical requirement.

Peec AI doesn’t currently lean into native AI traffic analytics. You can pair it with existing analytics tools and infer some relationships, but there’s no dedicated layer that ties prompts, engines, and on-site behavior together. For now, GEO insights and traffic reporting live in separate systems.

Profound is a bit further along, offering early signals and partial views into AI-driven visits. You can see some directional guidance and incorporate it into your reporting, but it’s not yet the fully mature attribution system most teams dream about. It feels like a step in the right direction rather than a finished solution.

Profound edges ahead here simply because it offers more native visibility, even if the category as a whole is still evolving.

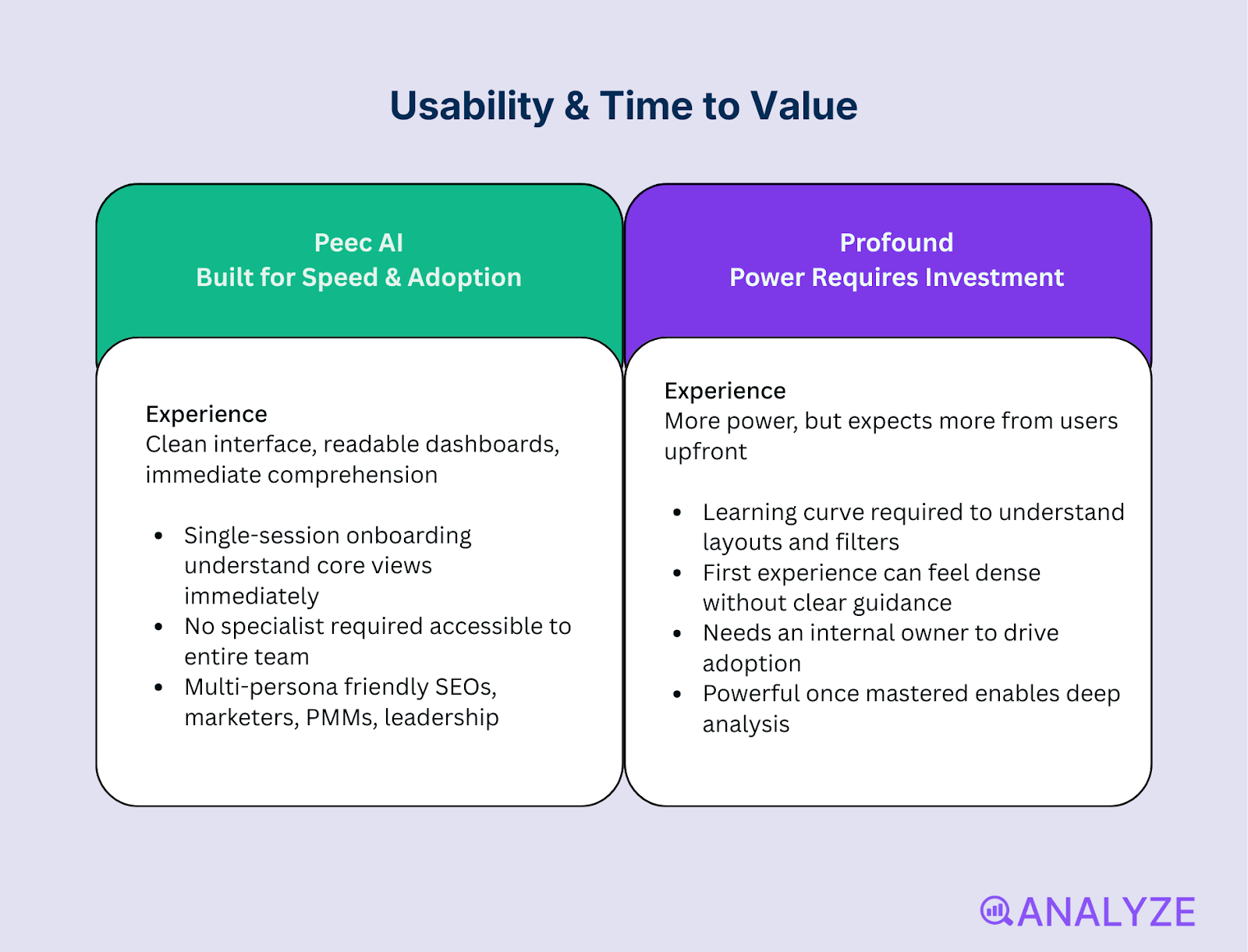

Usability & time to value

A GEO platform only matters if your team actually uses it. Usability and time to value decide whether the tool becomes a weekly habit or an abandoned tab. Teams need to be able to onboard new users quickly and get to meaningful insights without training decks.

Peec AI is built for speed. The interface is clean, the dashboards are readable, and most people can understand the core views in a single session. That makes it ideal for mixed teams — SEOs, marketers, PMMs, and leadership — who don’t want another “tool that requires a specialist.” Within days, it can become a shared source of truth for AI visibility.

Profound offers more power but expects more from its users. Once you understand the layouts and filters, you can do deep analysis. But getting there takes time, and the first experience can feel dense, especially if you don’t have a clear internal owner. It fits better inside organizations where analytics-heavy tools are already part of the culture.

Winner: Peec AI

Peec AI is the clear winner for usability and time to value, especially for lean teams or those just formalizing GEO.

Pricing

Pricing determines who can realistically adopt GEO at scale. The question isn’t just “how much does it cost?” but “what kind of organization is this pricing designed for?”

Peec AI is priced to be approachable for SMBs, agencies, and mid-market teams. Lower entry points, transparent tiers, and the ability to bring multiple stakeholders in without per-seat pricing make it feel like a practical, ongoing line item rather than a big strategic bet.

Profound is priced for enterprises. You get advanced capabilities, support, and security assurances, but the investment matches that positioning. For large organizations with dedicated budget and clear GEO mandates, that can be justified. For smaller teams, it’s often out of reach or hard to defend internally.

Peec AI wins decisively on pricing accessibility and value for most non-enterprise teams.

If you're a modern growth team or an SMB, there's a third—and better—alternative

Peec AI gives you quick visibility into where your brand appears in AI answers, while Profound offers deeper enterprise-grade analysis. Both help you understand prompt-level performance, but each comes with gaps: Peec lacks traffic attribution and revenue insight; Profound delivers depth but still leaves teams guessing about business impact.

That’s exactly the gap Analyze AI was built to close.

Analyze AI connects AI visibility to what happens next. It shows which engines send traffic, which pages those visitors land on, how they convert, and how much revenue they influence. It also uncovers the prompts that drive pipeline, the citations models trust, and the competitive gaps worth fixing—turning GEO from a visibility metric into a measurable growth channel.

Here’s how Analyze AI stacks up.

Feature comparison table

|

Feature |

Analyze AI |

Peec AI |

Profound |

|

Prompt search |

Full prompt tracking with visibility, sentiment, and competitor insights |

Strong tracking; limited sentiment context |

Deep tracking; more complex UX |

|

Daily tracking |

Daily prompt updates + daily AI traffic attribution |

Daily visibility |

Daily visibility; heavier dashboards |

|

Prompt suggest |

Suggests real buyer-intent prompts sourced from actual LLM queries |

Light suggestions |

Robust discovery; not tied to conversions |

|

Citation analysis |

Full citation mapping by model, domain, frequency, and influence |

Clear but lighter |

Deep data; less intuitive |

|

Competitive insights |

Prompt-level share of voice, sentiment shifts, and opportunity scoring |

Basic benchmarking |

Advanced enterprise modeling |

|

AI traffic analytics |

Tracks real AI sessions, landing pages, conversions, and revenue |

Not native |

Early-stage / partial attribution |

|

Price |

$99/month |

Varies (SMB-friendly) |

Enterprise pricing |

Unified GEO stack (all features in one platform)

Most tools solve one part of the problem—visibility, analysis, or traffic. Analyze AI does all three. It’s built to give you total control over how LLMs describe your brand, why competitors are winning prompts, and whether those mentions actually drive traffic.

If AthenaHQ offers ease and Profound offers depth, Analyze AI combines both—with none of the trade-offs. It’s the only platform that gives you prompt-level intelligence across search, ranking, performance, and impact—all under one roof.

Prompt search

Most teams have no idea what ChatGPT, Claude, or Gemini are saying about them until someone on the team manually checks—and by then, it’s too late. Analyze AI eliminates that guesswork with an instant search feature that works just like AI users think: type in a natural-language prompt, hit search, and see how your brand shows up (or doesn’t) across major models.

There’s no setup. No tracking configuration. Just real-time results from real prompts—ranked by relevance, broken down by LLM, and complete with visibility, citations, and brand positioning insights. You can run up to 100 prompt searches per month, giving you a full lens into how LLMs are shaping perception around your brand and your market.

You’ll see:

-

Whether you’re mentioned—and who else is

-

The top 3 brands/models per prompt

-

Position, visibility score, sentiment, and citation density

-

What each model is saying, side-by-side

If you're flying blind on AI perception, this is where clarity starts.

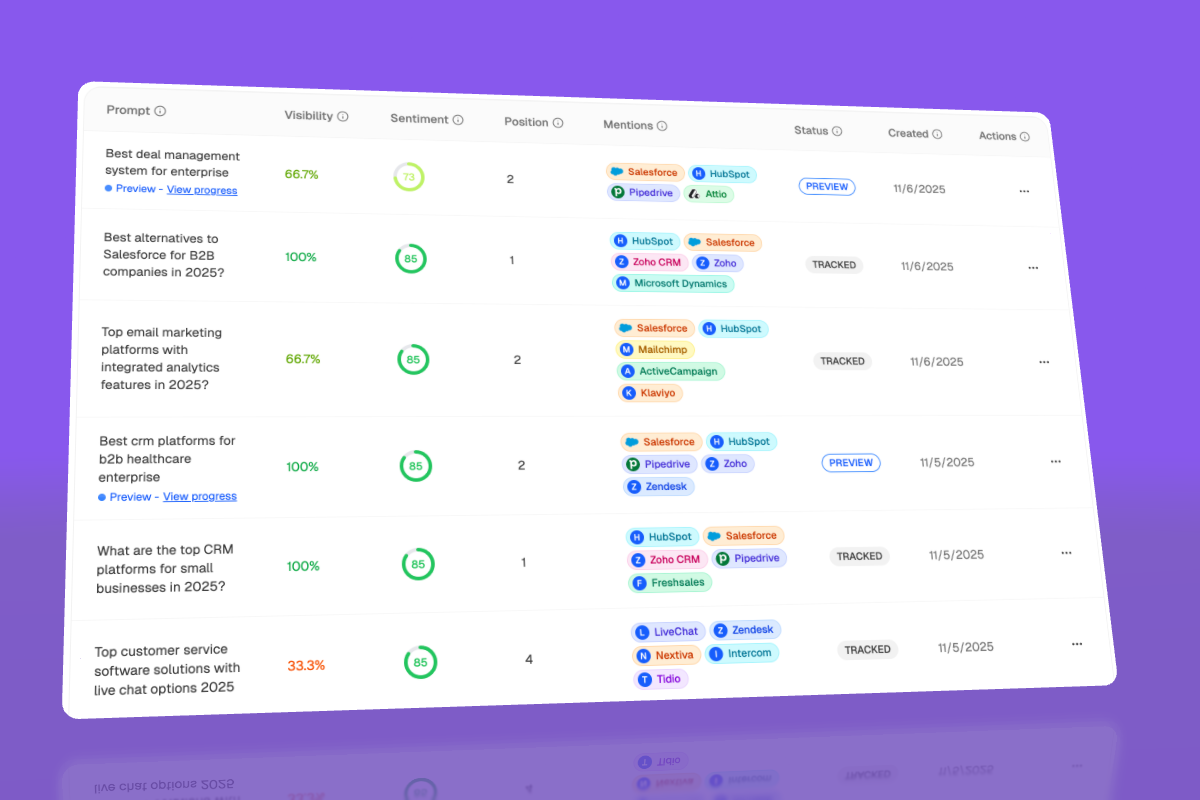

Prompt tracking

Once you’ve identified high-value prompts, you need to monitor them over time—especially for competitive, buyer-intent queries where visibility can change daily. Analyze AI lets you track up to 30 prompts per month (more on custom plans), running daily queries across ChatGPT, Claude, Gemini, and Perplexity to monitor changes in rank, sentiment, and citation behavior.

Each tracked prompt feeds into a real-time dashboard with:

-

Position tracking by model

-

Visibility % over time

-

Mention deltas (e.g. dropped from top 3, replaced by X competitor)

-

Citation trends and sentiment shifts

You don’t just see how you're performing—you see when and how things are changing, so you can react with speed.

Prompt suggest

Knowing what to track is just as important as knowing how you're performing. Analyze AI includes an AI-driven prompt suggestion engine that identifies new prompts you should be monitoring—based on your brand, competitors, and evolving model behavior.

Suggestions are ranked by relevance and visibility potential. Each includes:

-

The exact prompt text

-

Option to accept or reject with one click

This is live prompt mining from the actual AI search layer—showing you the questions real users (and LLMs) are shaping your category around. Whether you’re expanding coverage, filling competitive gaps, or adjusting to how models are shifting, Prompt Suggest keeps your strategy moving with the market.

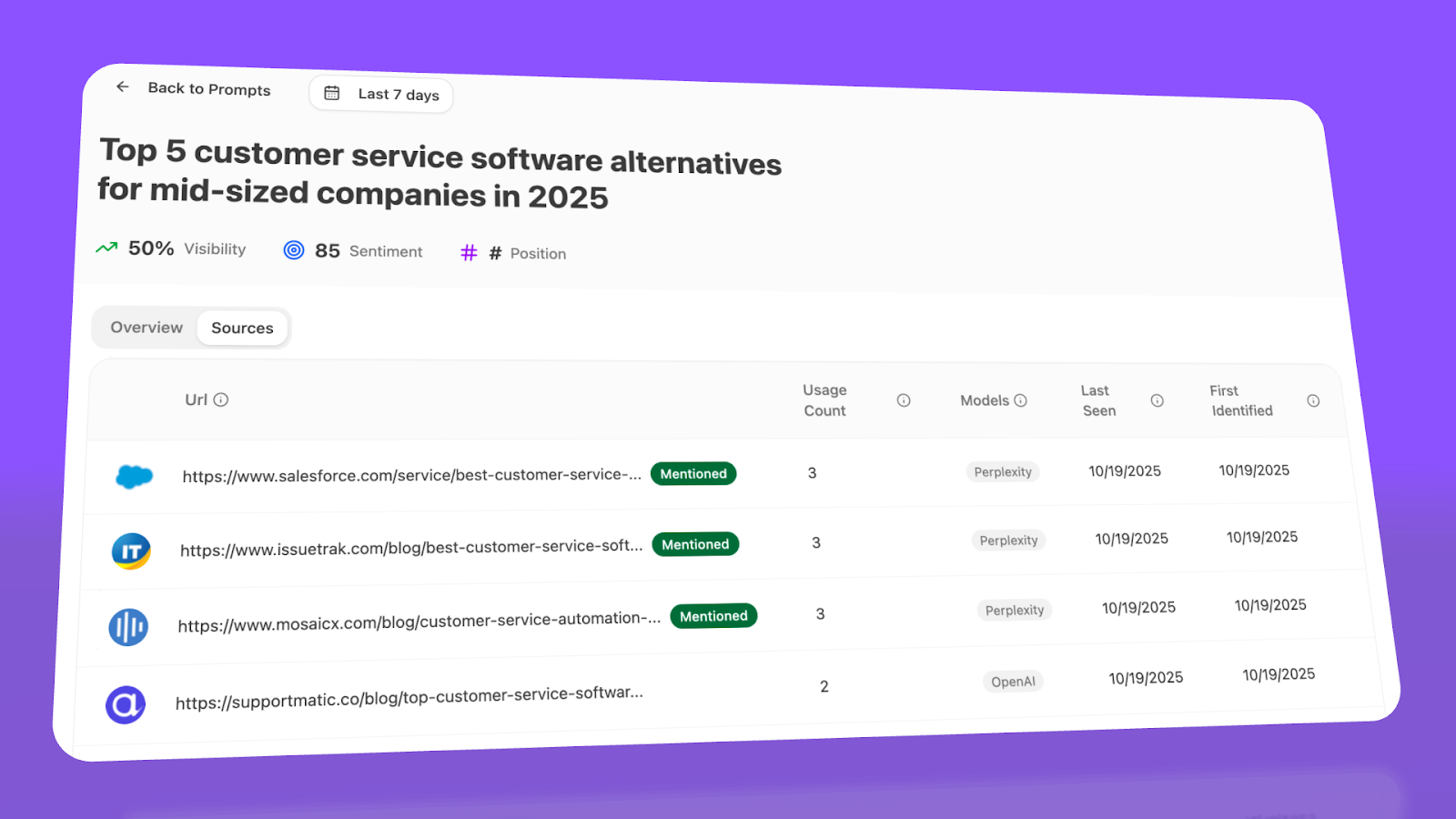

Citation analysis

In AI search, getting mentioned isn’t enough—how you’re mentioned matters. Are LLMs citing your content? Are they hallucinating claims about your brand? Are competitors being cited more often? Analyze AI provides prompt-level analysis with complete citation visibility across all tracked models, enabling you to identify competitors and develop strategies to outrank them.

Every prompt response includes:

-

A list of URLs cited by each model (yours and competitors’)

-

Number of citations per domain or page

-

Which brands were mentioned without being cited (potential hallucinations)

-

Trends in citation volume and source repetition over time

This lets you spot false claims, uncover underperforming assets, and see which content actually earns model trust. You can also correlate changes in citation patterns with visibility shifts—so when you drop in rank, you’ll know if it’s because you lost a link, not just an algorithm tweak.

No other platform makes LLM citations this transparent or actionable.

Competitive insights

If you’re being outranked in AI results, you need to know by who, where, and why. Analyze AI’s competitive insights module aggregates prompt-level tracking into a strategic dashboard that shows how your brand stacks up across your tracked landscape.

Key views include:

-

Share of voice: Brand-level distribution of mentions across all tracked prompts

-

Average rank: How your brand compares to others in model-generated lists

-

Top cited competitors: Who’s earning the most citations per model

-

Prompt-level displacement: Which competitor replaced you and when

You can filter all of this by model (ChatGPT, Claude, Gemini, Perplexity), prompt category, date range, and sentiment. You’ll go from “We’re losing ground” to “We lost position 2 in X prompt to Y competitor due to citation shift”—and that kind of specificity unlocks meaningful strategy. That’s also why we built Analyze AI.

Peec AI vs Profound vs Analyze AI: Which is best for you?

If you’re comparing Peec AI with Profound, wondering which one actually fits your team, the decision almost always comes down to trade-offs.

Peec AI gives you speed and simplicity. Profound gives you depth and enterprise-level insight. Both are strong—but each asks you to compromise somewhere.

Analyze AI closes that gap. It brings Peec’s usability and Profound’s analytical power into one platform, then adds what neither offers: real-time prompt search, smart discovery, full competitive tracking, and AI traffic attribution tied to conversions and revenue. Instead of choosing between “easy” or “powerful,” you finally get both.

So here’s the takeaway:

-

Profound is Best for teams with enterprise budgets and deep analytical needs.

-

Peec AI Best for small teams who want fast, clear GEO visibility without complexity.

-

Analyze AI is best for teams that want the full GEO picture—what’s happening, why it’s happening, and what to do next.

Ready to see how AI search is actually affecting your business?

Try it today !

Tie AI visibility toqualified demand.

Measure the prompts and engines that drive real traffic, conversions, and revenue.

Similar Content You Might Want To Read

Discover more insights and perspectives on related topics

8 AirOps Alternatives for Teams That Need AI Search Visibility Without the Complexity

7 Best Nightwatch Alternatives That Cost Less & Track More LLMs (2026)

How To Outrank Competitors In AI Search? (Based on Real Citation Data)

7 ZipTie Alternatives With Better Pricing & Multi-LLM Tracking (2026 Comparison)

The Top 7 Alternatives to Peec AI for AI Search Visibility