8 Brand Tracking Software Tools You Can’t Afford to Ignore

Written by

Ernest Bogore

CEO

Reviewed by

Ibrahim Litinine

Content Marketing Expert

We dug into the software and tools teams rely on when the story shifts. We spoke with brand, comms and growth leads who deal with these swings every week, reviewed platforms across AI search, social listening and full-funnel brand health, and pushed each one past the polished demo to see which actually holds up under pressure. That work made it obvious which solutions still give a reliable read in 2026 — and which ones fall apart the moment real complexity hits.

This piece distills everything into a practical, straight-to-the-point look at the eight brand-tracking options worth paying attention to. You’ll see which software helps you understand movement across channels that shape demand, which tools give early warning before sentiment flips, and which ones help you take control of the narrative instead of chasing it.

Table of Contents

TL; DR

|

Tool |

Why Pick It |

Best For |

Strengths |

Watch-Outs |

Pricing |

|

Analyze AI |

AI search visibility + traffic & revenue attribution |

Brands & agencies focused on AI discovery |

Tracks AI referral traffic; ties visibility to conversions; prompt insights; citation audits |

Not a survey-based tracker; requires analytics comfort |

From $99/month |

|

YouGov BrandIndex |

Always-on global brand-health tracking |

Global consumer brands |

Huge panel; daily data; strong benchmarks; long time trends |

Limited customisation; enterprise-level pricing |

Custom enterprise pricing |

|

Qualtrics Brand Tracker |

Fully customised enterprise-grade brand tracking |

Large brands with research & insights teams |

Flexible surveys; deep analytics; XM integrations; predictive models |

Complex setup; steep learning curve; expensive |

Enterprise-only pricing |

|

Tracksuit |

Simple, always-on consumer brand tracking |

Challenger brands & fast-moving B2C teams |

Easy onboarding; great visuals; affordable; agile insights |

Limited customisation; not ideal for complex B2B needs |

Custom pricing (lower tier) |

|

Latana |

High-precision tracking for hard-to-reach audiences |

Challenger brands; niche-segment targeting |

ML-driven sampling; high accuracy; modular markets; strong segmentation |

Not a full CX/EX suite; requires some research interpretation |

€7,900–€18,900 per market/year + enterprise |

|

Brandwatch |

Enterprise-scale social listening & global consumer intelligence |

Large brands & agencies |

Massive dataset; global coverage; advanced analytics; strong alerts |

High cost; setup complexity; analyst-required |

Enterprise custom pricing |

|

Meltwater |

Media intelligence across news, social, broadcast |

PR & comms teams; global media monitoring |

Cross-channel coverage; sentiment; SOV; campaign impact |

Heavy setup; pricing increases with modules |

~$7,000–$40,000+/year |

|

Brand24 |

Affordable, real-time brand monitoring |

SMBs & agencies |

Fast setup; strong alerts; broad coverage; simple dashboards |

Limited advanced analytics; mention/keyword limits |

$149–$999/month |

Analyze AI: Best Brand Tracking Software for AI Search Visibility & Attribution

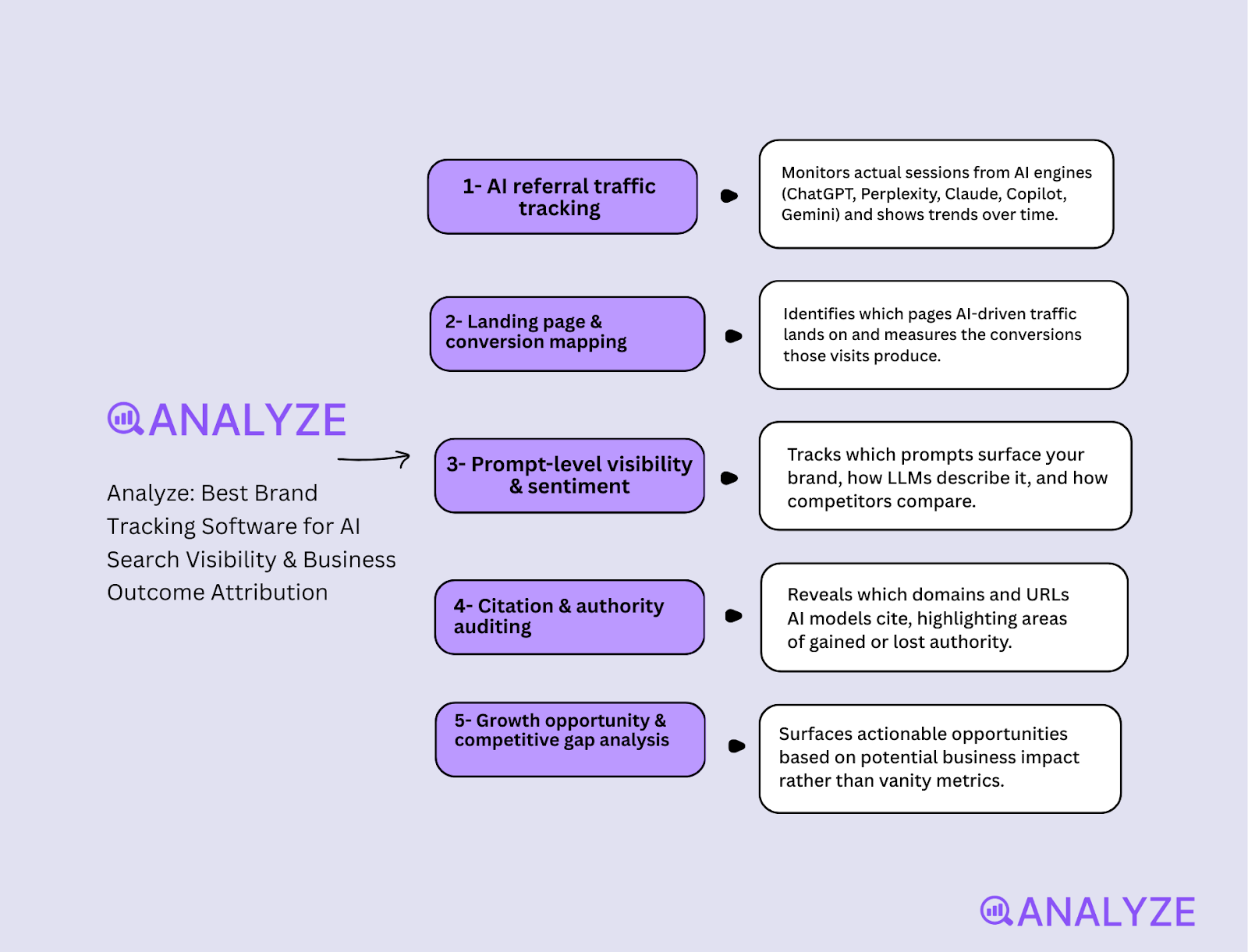

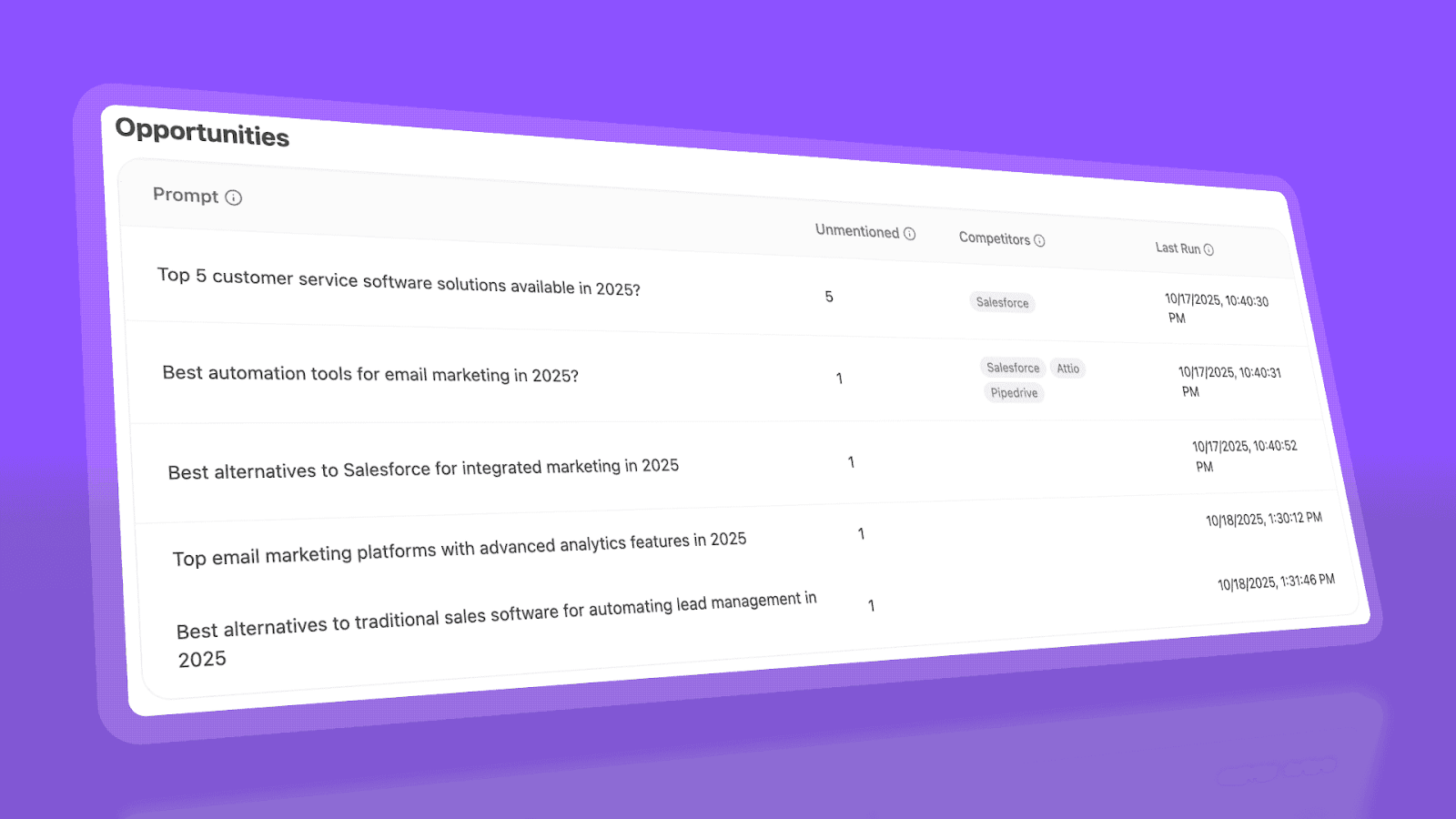

Key Analyze AI standout features

-

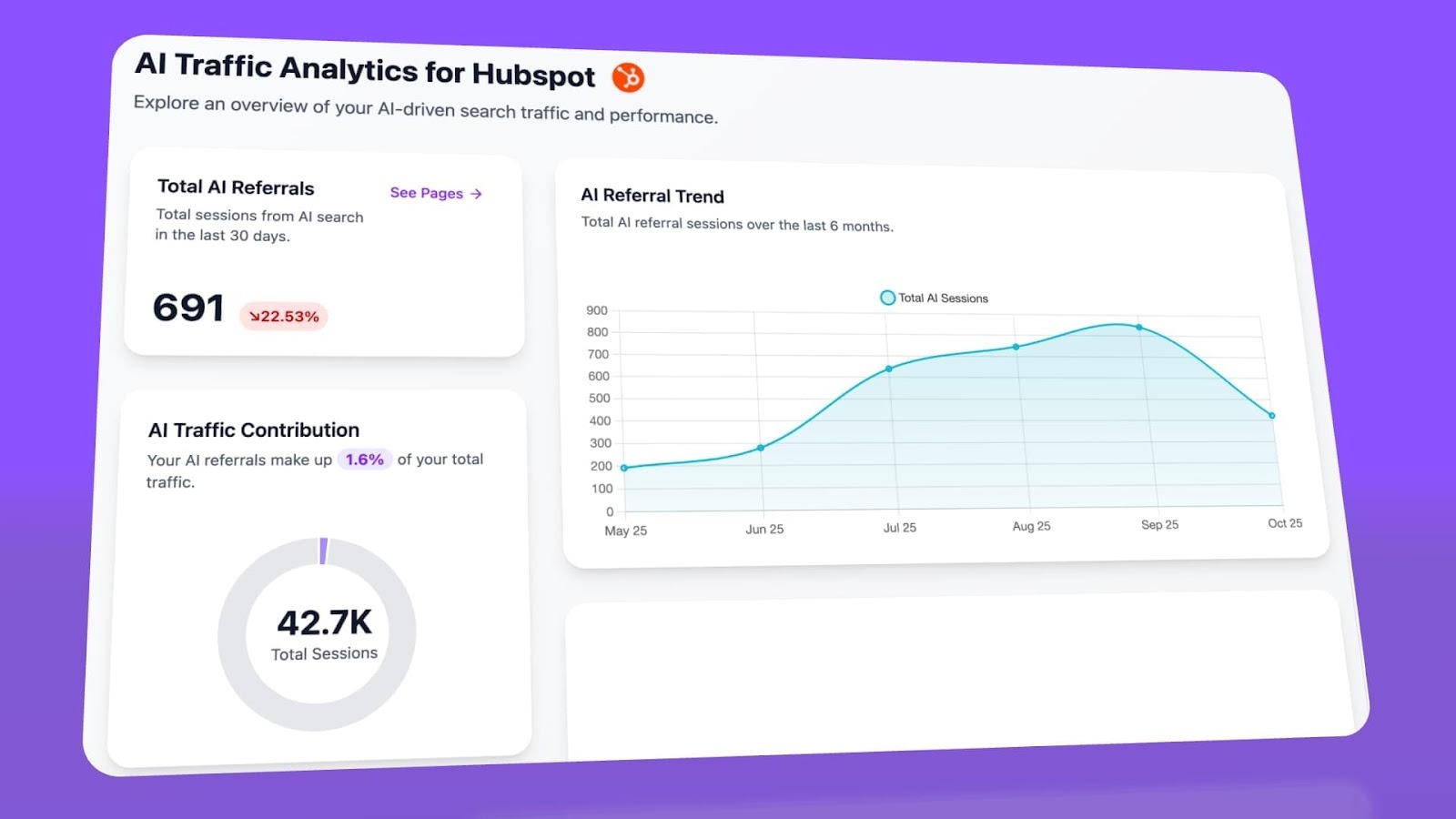

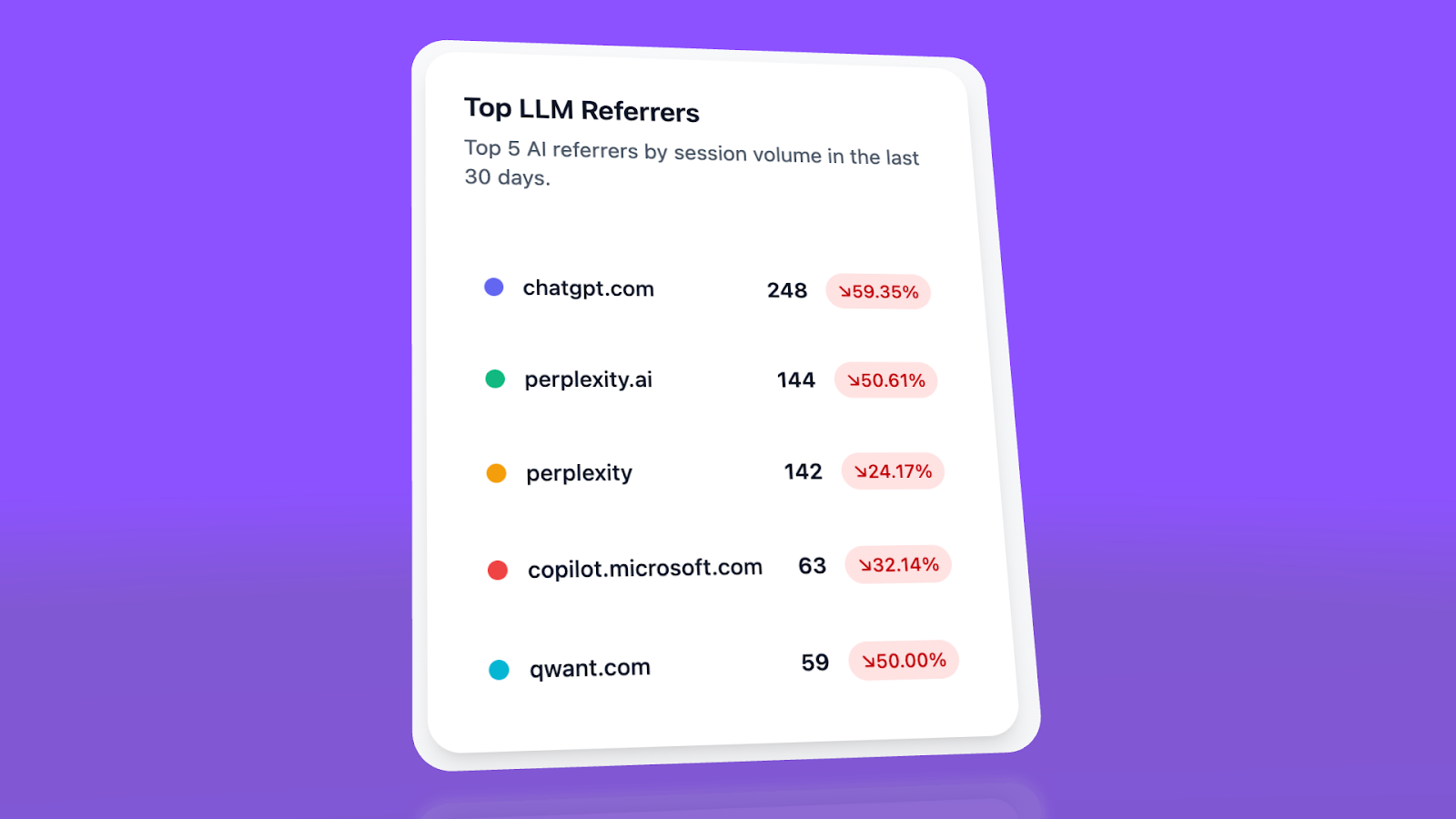

Tracks actual AI referral traffic by engine (ChatGPT, Perplexity, Claude, Copilot, Gemini) and shows how session volumes change over time

-

Identifies which landing pages receive AI-driven visits and what conversions those sessions produce

-

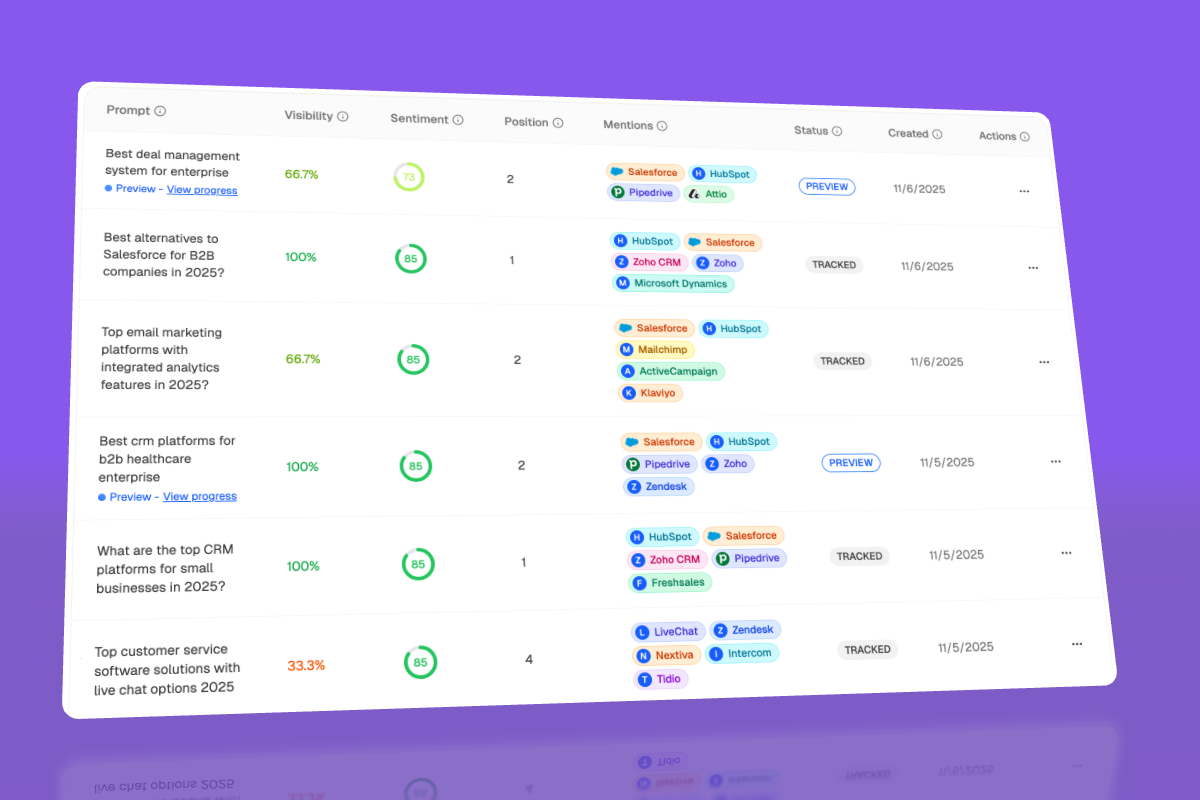

Monitors prompt-level visibility and sentiment so you see how LLMs describe your brand versus competitors

-

Audits which domains and URLs models cite when generating answers, revealing where authority is won or lost

-

Surfaces growth opportunities and competitive gaps based on impact, not vanity metrics

Analyze AI is built for teams that need to understand how AI answer engines shape brand discovery and revenue. The platform goes far beyond simple visibility dashboards by showing which models send traffic, which pages convert that traffic and which prompts influence the buyer journey. Instead of guessing where to allocate effort, teams can see precisely which engines move pipeline and which prompts deserve optimisation. This shift from “mentions” to “measurable demand” gives marketers and growth teams clarity that older brand-tracking methods cannot match.

The tool stands out because it treats AI search as its own discovery channel. Analyze AI tracks prompt performance across major LLMs, reveals how sentiment changes by engine and shows how the models frame your brand in context. The citation-auditing layer gives you visibility into which domains influence those answers, which helps you target authority sources with intention rather than relying on broad SEO tactics. For brands adapting to the reality that AI search is replacing many traditional query patterns, Analyze AI becomes the control centre for understanding where they win, where they lose and why.

Analyze AI’s focus creates natural limits that some teams will feel. Because it specialises in AI search visibility and attribution, it does not measure classic brand-health metrics like awareness, preference or loyalty. Brands that need top-of-funnel survey data may still require a traditional brand tracker. The platform also handles complex data—engine sessions, conversion paths, sentiment, prompt dynamics—which means teams need some analytical comfort to extract full value. While the interface is clear, the insights require interpretation that is best handled by marketers familiar with attribution and funnel behaviour.

Pricing for Analyze AI

Analyze offers transparent pricing, with a starter plan at $99/month covering three answer engines and 25 tracked prompts per day. This tier includes GA4 integration, unlimited competitor tracking and 2,250 answers per month. Higher tiers expand the number of engines, prompt volume and tracked answers for agencies and enterprise teams that need broader monitoring. Pricing scales predictably with usage rather than hidden fees.

Analyze AI snapshot

|

Dimension |

Details |

|

Tracking style |

AI answer-engine visibility + traffic and conversion attribution |

|

Core metrics |

Engine sessions, landing-page conversions, prompt ranking, citations |

|

Sample & coverage |

Major LLMs (ChatGPT, Claude, Perplexity, Copilot, Gemini) + competitors |

|

Strengths |

Links visibility to conversions, deep prompt insight, strong citation analysis |

|

Watch-outs |

Not a survey-based brand tracker, requires some analytics proficiency |

|

Best for |

Brands and agencies focused on AI discovery, revenue attribution and competitive LLM visibility |

Best-fit use cases for Analyze AI

-

You want to see which LLMs actually drive sessions and conversions—not just brand mentions

-

You need to optimise specific high-intent prompts and track how rankings shift over time

-

You want to connect AI visibility to ROI, revenue influence and landing-page performance

-

You operate in an AI-driven discovery landscape and need visibility into how models interpret your brand

Choose Analyze AI when you want a brand-tracking system built for the AI-search era—one that measures not only where your brand appears, but also where traffic flows, which prompts matter and how those sessions turn into real business results.

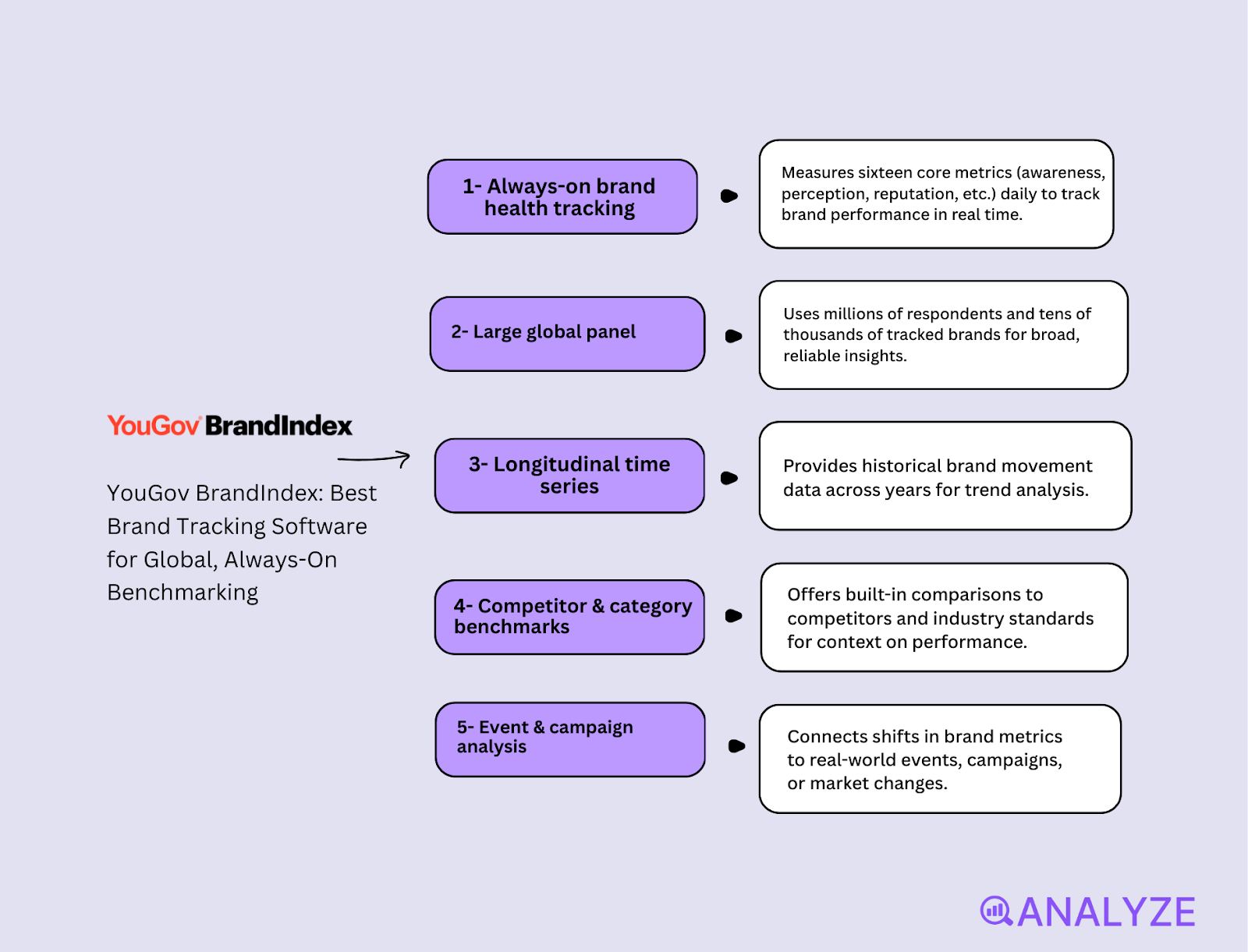

YouGov BrandIndex: Best Brand Tracking Software for Global, Always-On Benchmarking

Key YouGov BrandIndex standout features

-

Always-on tracking of sixteen core brand health metrics updated every day

-

Huge global panel with millions of respondents and tens of thousands of tracked brands

-

Long time series that shows brand movement clearly across many years

-

Built-in competitor and category benchmarks that give strong performance context

-

Event and campaign views that connect brand shifts to real-world moments

YouGov BrandIndex is built for teams that need a steady and trusted view of brand health instead of scattered survey snapshots. The platform collects fresh data every day from many markets, which means you can watch awareness, consideration and sentiment move in real time instead of waiting months for trend clarity. This daily rhythm helps you spot small drifts that often stay hidden when you rely on quarterly or annual fieldwork, and those early signals give your team more time to react.

Its biggest strength comes from the size of the panel and the length of the history behind it, because that combination creates a very solid base for long-term analysis. YouGov tracks thousands of brands on the same metrics, so your team can see how your scores compare with direct rivals or the wider category without recalculating frameworks or sampling rules. This shared structure gives marketing and insight teams a clear “scoreboard” to use during reviews, which reduces debate and makes it easier to track progress across regions.

The same structure that makes BrandIndex stable can also limit teams that need more control. Because the tracker is syndicated, the question set stays fixed across markets, which keeps the data clean but leaves less space for niche questions or tight audience definitions. The system works well for broad funnels and perception metrics, but it becomes harder to get deep insight for narrow segments or new product ideas that fall outside the standard template. Some teams may feel that the tool fits better when the goal is consistent tracking rather than complex exploration.

Budget and skill demands also place BrandIndex more in the world of large or global brands rather than very small teams. The platform delivers great depth, but it works best when a company has someone comfortable with dashboards and trend analysis. Smaller teams may feel that the interface takes time to learn or that the cost does not match lighter tracking needs. When the organisation needs only occasional brand readouts, the system can feel heavier than required.

Pricing for YouGov BrandIndex

YouGov does not publish public pricing, and most contracts are custom depending on the number of markets, the depth of tracking and the level of support you need. The tool usually sits at enterprise price levels, and brands with complex regional structures tend to receive higher quotes. Smaller companies often find the cost difficult to justify, while larger brands view the price as aligned with the scale and statistical strength the platform provides. Expect tiered quotes rather than simple fixed plans.

YouGov BrandIndex snapshot

|

Dimension |

Details |

|

Tracking style |

Always-on syndicated brand tracker based on daily surveys |

|

Core metrics |

Awareness, consideration, buzz, word-of-mouth, intent, reputation and more |

|

Sample and coverage |

Very large global panel with tens of thousands of tracked brands |

|

Strengths |

Long time trends, strong benchmarks, clear links between events and brand shifts |

|

Watch-outs |

Limited customisation, higher cost, steeper learning curve |

|

Best for |

Global consumer brands, major regional brands and insight-driven teams |

Best-fit use cases for YouGov BrandIndex

-

You manage a global or multi-market brand and need one scoreboard across all regions.

-

You want a clear picture of how campaigns or PR events shift brand metrics in real time.

-

You rely on external benchmarks to show whether your brand gains ground against rivals.

-

You want a stable and long-term tracker rather than scattered one-off surveys.

Use YouGov BrandIndex when you want a long-term, always-on scoreboard that tracks your brand and your rivals every day across many markets, with enough history to prove whether your work is truly driving change.

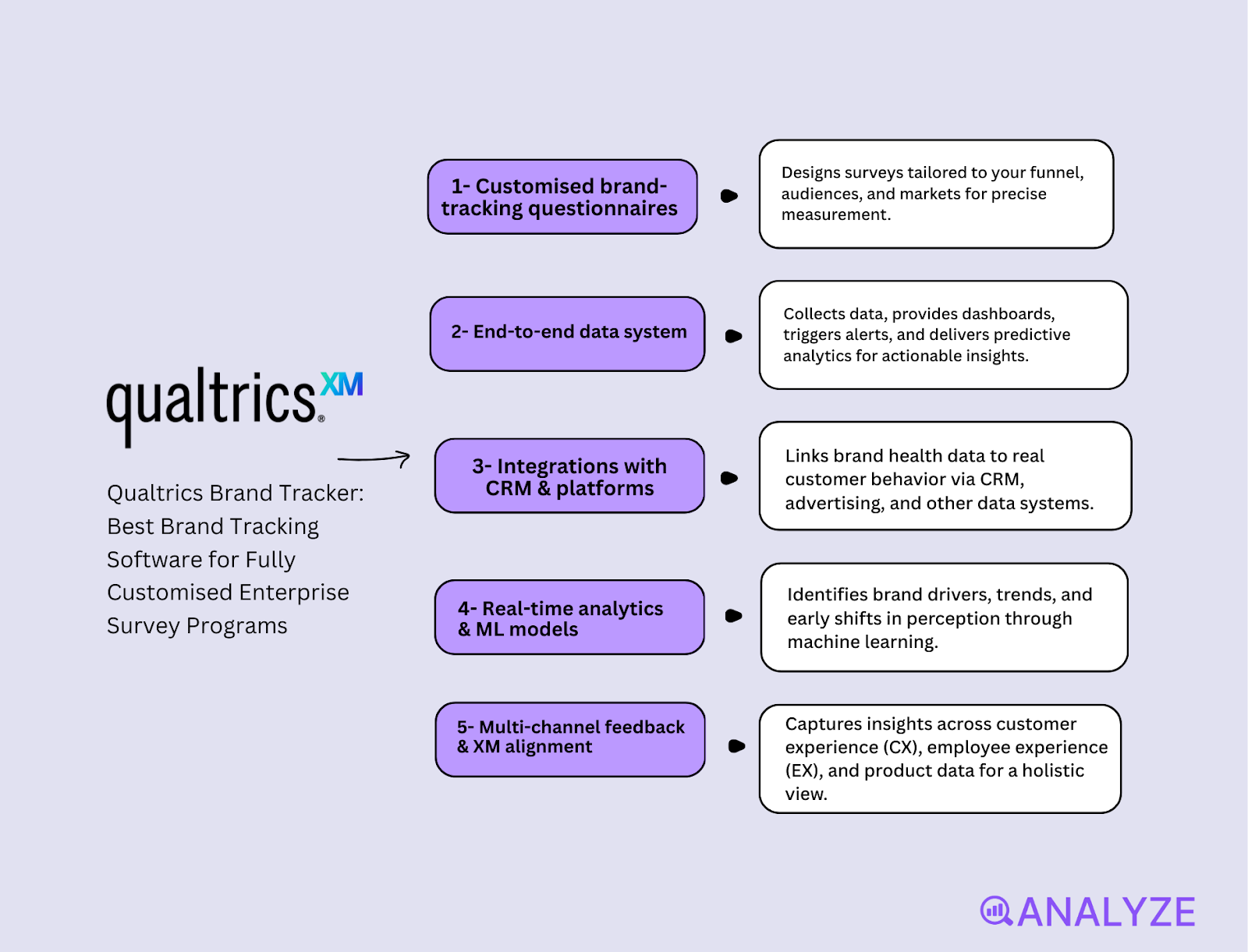

Qualtrics Brand Tracker: Best Brand Tracking Software for Fully Customised Enterprise Survey Programs

Key Qualtrics Brand Tracker standout features

-

Customised brand-tracking questionnaires that match your funnel, your audiences and your markets

-

End-to-end system for data collection, dashboards, alerts and predictive analytics

-

Integrations with CRM, ad platforms and other data systems so brand health links to real behaviour

-

Real-time analytics and machine-learning models that surface drivers and early shifts

-

Multi-channel feedback and full XM alignment across CX, EX and product data

Qualtrics Brand Tracker gives teams a level of control that goes far beyond fixed, syndicated brand-tracking tools. You set the questions, pick the sample design and control the logic, which lets you build a tracker that reflects how your buyers move through your real funnel. This matters when your team needs to measure more than awareness or consideration, because the tracker can follow the exact signals that shape demand inside your category. You also gain the ability to tie brand data into the broader Qualtrics XM system, which turns isolated brand metrics into a connected story about customers, employees and product experience.

The strength of the platform becomes most clear when you scale across many markets, segments and product lines. The tool handles complex cohorts such as lapsed buyers, heavy users or niche B2B roles without breaking the structure of the tracker. Brands that already use Qualtrics for CX or EX also gain a single environment for insight work, which keeps workflows simple and reduces the number of dashboards your team needs to manage. This creates more clarity for leadership teams that want to see how brand, experience and behaviour influence each other over long periods of time.

This flexibility does introduce challenges that smaller teams will feel as soon as they begin implementation. A full Qualtrics tracker needs someone who understands survey design, sample planning and dashboard set-up, because the system does not hide the complexity behind simple templates. Without that support, it becomes hard to build a tracker that stays stable and reliable over many cycles. Some users also mention that the interface feels dense without guidance, which slows adoption for teams that do not work with research tools often.

Another concern is cost, because the platform sits at the higher end of the market. Teams that only need simple brand health updates or very light tracking may feel that the system offers more capability than they need. When budgets are tight or teams are small, a simpler brand-tracking tool or a syndicated solution can be a more comfortable fit. For brands that see brand health as a core asset, however, this level of investment can be justified by the depth and control it delivers.

Pricing for Qualtrics Brand Tracker

Qualtrics does not publish public pricing, and costs vary widely based on modules, seats, markets, integrations and the scale of your tracker. Most teams enter at enterprise-level pricing, with contracts that reflect the full XM ecosystem rather than a single survey license. Smaller companies often find the total cost too high, while larger brands consider the price aligned with the depth and flexibility the platform provides. Expect multi-year agreements and custom quotes shaped by your data and workflow needs.

Qualtrics Brand Tracker: snapshot

|

Dimension |

Details |

|

Tracking style |

Fully customised survey-based brand tracker inside a complete experience-management ecosystem |

|

Core metrics |

Awareness, consideration, loyalty, drivers, associations, purchase intent and other funnel steps you define |

|

Panel & distribution |

Multi-channel feedback across email, web and mobile with options to connect external data sources |

|

Strengths |

High flexibility, strong analytics, XM integrations, predictive insights |

|

Watch-outs |

Complex set-up, steep learning curve and higher cost for smaller teams |

|

Best for |

Global brands with insight teams and a need to connect brand tracking to wider business and experience systems |

Best-fit use cases for Qualtrics Brand Tracker

-

You manage a large brand with many segments and need a tracker that mirrors your full funnel.

-

You run CX or EX programs inside Qualtrics and want brand tracking inside the same workflow.

-

You want brand metrics tied to real outcomes such as revenue, usage or retention.

-

You have research or operations support that can manage complex dashboards and survey logic.

Choose Qualtrics Brand Tracker when you need deep control, strong analytics and one ecosystem that connects brand health with customer experience, employee sentiment and product feedback, especially when your brand is large enough to benefit from that level of scale.

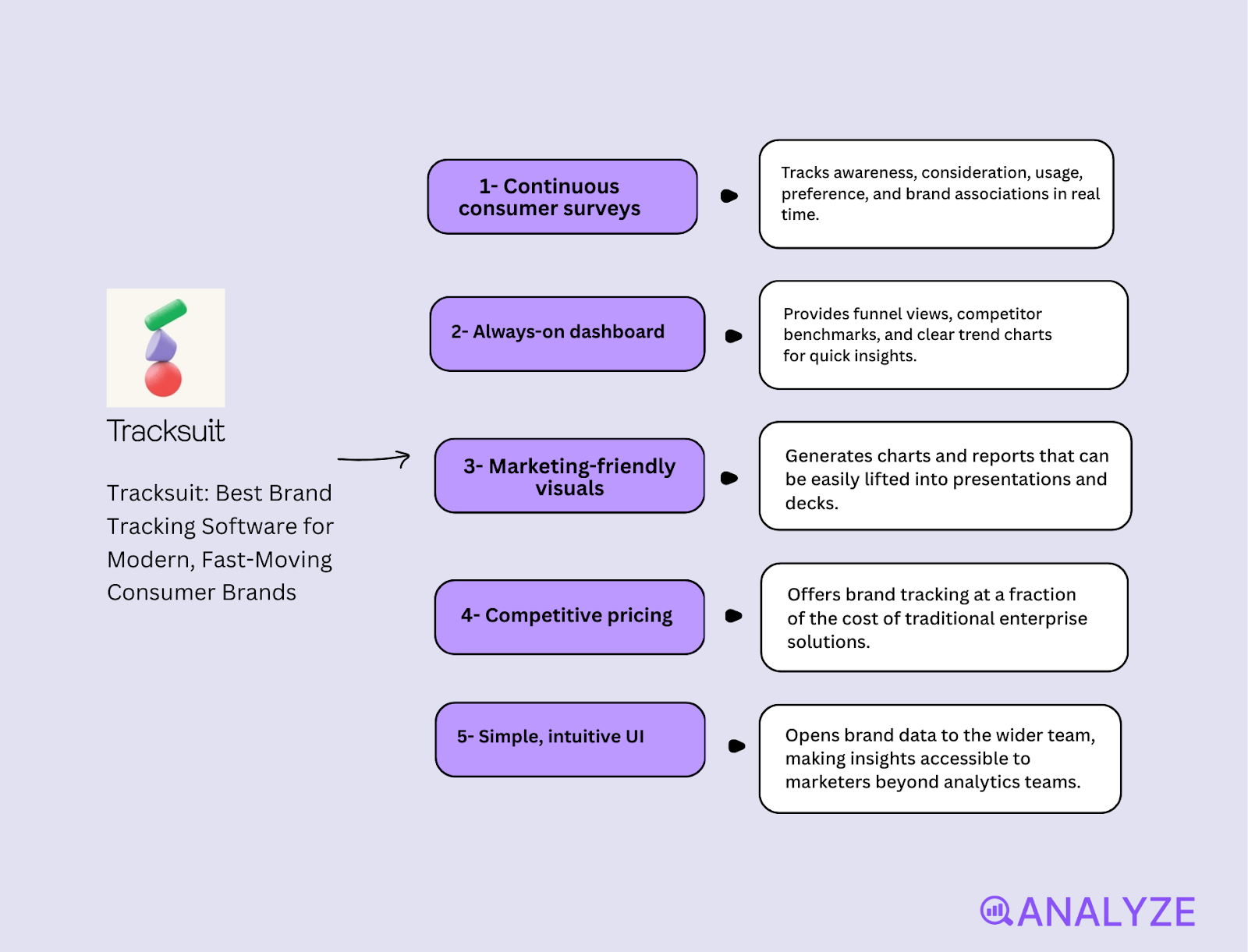

Tracksuit: Best Brand Tracking Software for Modern, Fast-Moving Consumer Brands

Key Tracksuit standout features

-

Continuous consumer surveys that track awareness, consideration, usage, preference and brand associations

-

Always-on dashboard with funnel views, competitor benchmarks and clean trend charts

-

Visuals built for marketers, making reports easy to lift straight into decks

-

Pricing positioned far below classic enterprise brand trackers

-

Simple, marketer-friendly UI that opens brand data to the wider team

Tracksuit gives consumer brands a steady, simple way to track brand health without the heavy price or complexity of classic syndicated systems. The tool runs continuous surveys and shows fresh data inside an always-on dashboard, which makes it easier for teams to see brand shifts as they happen instead of waiting for once-a-year reports. This design keeps the focus on real-world movement inside the brand funnel, helping teams understand whether their work is creating change week by week. The dashboard uses clear visuals rather than dense research charts, which keeps insight work easy to share and simple to act on.

The platform stands out because it removes barriers that normally slow brand tracking down. There is no long onboarding cycle, no need for deep research skills and no pressure to justify big budgets before you begin. Smaller or fast-growing brands can start tracking brand health far earlier in their growth curve, which helps them build a brand narrative that moves with their market. This speed matters in consumer categories where campaigns, social buzz and cultural shifts can change brand perception quickly. Tracksuit helps teams stay close to those changes without drowning in research complexity.

Tracksuit’s focus on the consumer space means it fits less neatly inside complex B2B environments. B2B brands often deal with long sales cycles, narrow roles and deeper segmentation needs, which the platform does not fully optimise for. The tool works best when the audience is broad enough for simple consumer-style sampling and when the funnel resembles a traditional awareness-to-preference path. Teams that need niche targeting or deep segmentation may find the structure too light for their research goals.

The platform also trades some customisation for simplicity. While it covers core brand metrics well, it does not offer the same flexibility you would find in heavy-duty research platforms that support complex survey logic or very detailed custom question sets. Some teams report that features are still expanding and that certain advanced workflows may require more specialised tools. These trade-offs are natural for a platform built to keep things simple, but they matter when your team needs deeper research capability.

Pricing for Tracksuit

Tracksuit positions itself far below the cost of traditional brand trackers, but the company does not publish exact prices. Most teams note that pricing is accessible for mid-market or fast-growing consumer brands and often far lower than syndicated systems. Contracts vary by market coverage and survey scope, and smaller brands usually find annual costs easier to manage than enterprise alternatives. Expect tailored quotes rather than fixed plans, with setup remaining light and fast.

Tracksuit snapshot

|

Dimension |

Details |

|

Tracking style |

Continuous, always-on brand-health tracking for consumer brands |

|

Core metrics |

Awareness, consideration, usage, preference and basic brand associations |

|

Sample and coverage |

Ongoing consumer surveys across broad B2C audiences |

|

Strengths |

Easy onboarding, strong visuals, lower cost, agile insights |

|

Watch-outs |

Limited customisation, consumer-focused design, lighter research depth |

|

Best for |

Challenger brands, fast-moving consumer teams and growing B2C companies |

Best-fit use cases for Tracksuit

-

You run a growing consumer brand and want a simple, always-on view of brand movement

-

You need quick insight that supports agile marketing decisions week by week

-

You want visuals and dashboards that work instantly in presentations

-

You want brand tracking without the cost and weight of enterprise research tools

Tracksuit is the right choice when you want fast, simple and affordable brand tracking that keeps pace with modern consumer marketing, without the complexity or cost of traditional brand-health systems.

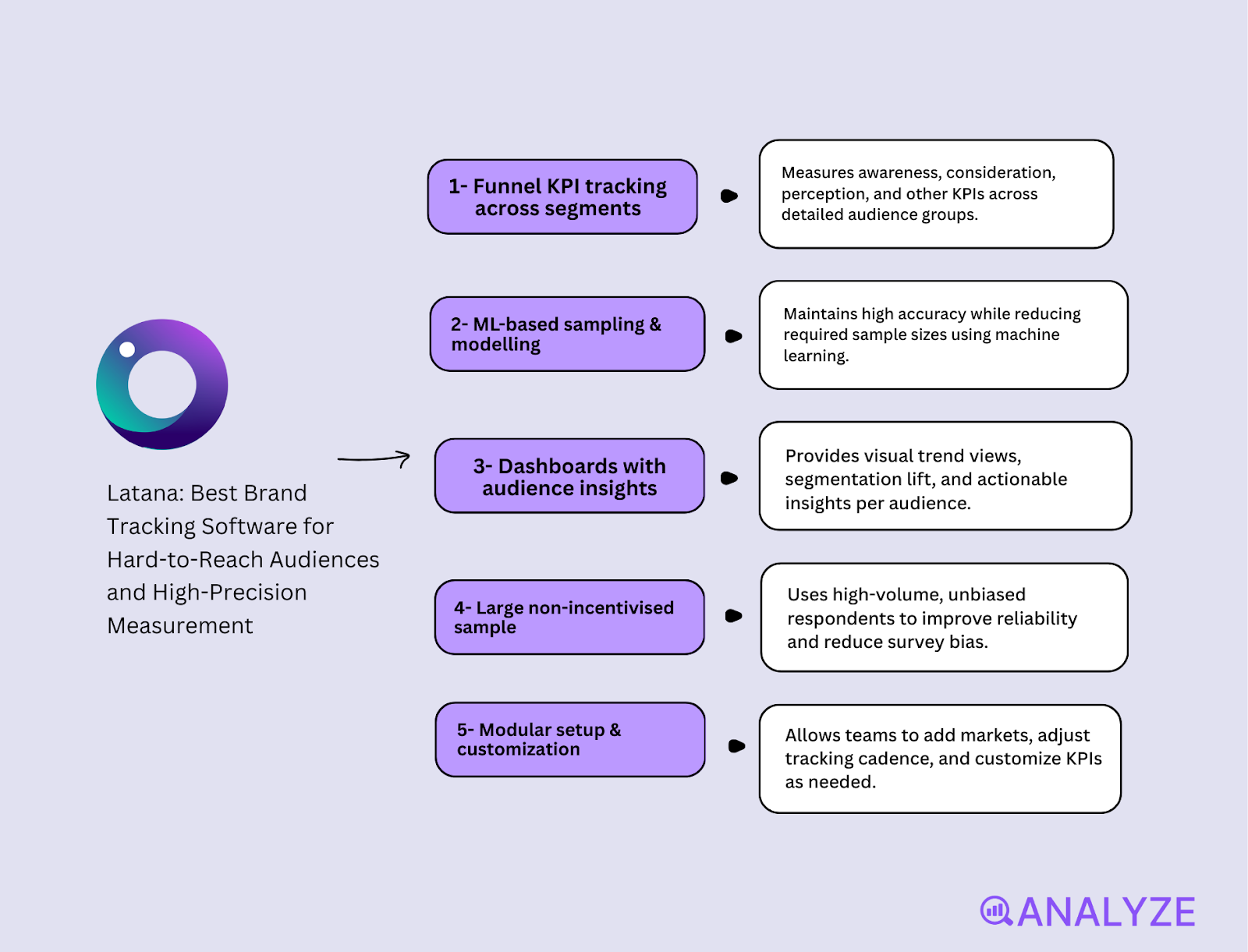

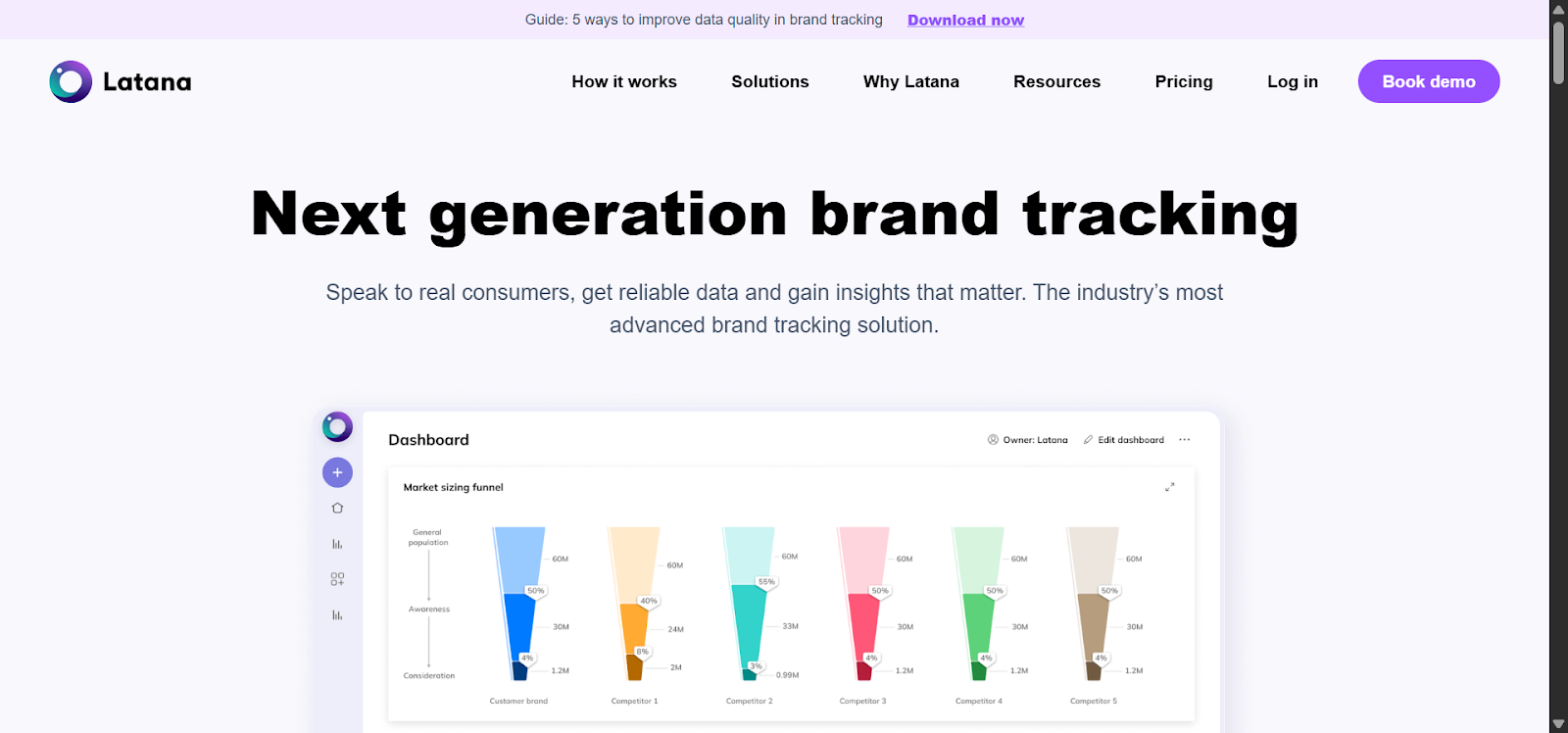

Latana: Best Brand Tracking Software for Hard-to-Reach Audiences and High-Precision Measurement

Key Latana standout features

-

Tracks awareness, consideration, perception and other funnel KPIs across detailed audience segments

-

ML-based sampling and modelling that maintains accuracy while reducing sample needs

-

Dashboards with audience insights, trend views and precise segmentation lift

-

Large annual sample volumes with non-incentivised respondents to reduce bias

-

Modular setup that lets teams add markets, change cadence and customise KPIs easily

Latana is designed for brands that need reliable perception data in markets where traditional research panels often fail. The platform uses a machine-learning sampling model that cleans noise, reduces bias and maintains accuracy even for niche or low-incidence segments. This matters when your audience is small, fragmented or emerging, because the tracker still produces stable metrics without inflating sample costs. The ability to run large volumes of annual interviews gives teams confidence that their data reflects real shifts rather than volatility caused by weak sampling.

The system stands out by bringing rigorous research methodology into a modern, simple dashboard. Teams can choose the markets, KPIs or segments that matter most, and the tracker adapts without breaking consistency. This modularity makes Latana especially valuable for challenger brands or teams operating across several small regions where classic syndicated trackers are either too inflexible or too expensive. The dashboards highlight perception lift and segment-level changes clearly, which helps marketers move quickly from trend recognition to action.

Latana’s focus on perception data means it provides less breadth than full CX/EX suites. Teams that need product-feedback loops, employee-experience data or highly customised survey programming may still require a second system. The statistical modelling also produces more complex output than lighter trackers, which can feel demanding for teams with limited research experience. These challenges do not reduce the value—only the fit for teams without the resources to interpret advanced segmentation or regression-based results.

Pricing for Latana

The Essential plan starts at €7,900 per market per year, covering awareness tracking for up to four brands, two custom segments and 25,000 annual interviews per brand. The Pro plan begins at €18,900 per market per year, adding consideration and perception KPIs, support for more brands and segments and larger sample volumes of up to 50,000 interviews per brand. For large-scale setups, multi-market programmes or deeper segmentation, Latana offers custom enterprise pricing that can scale to 100,000 interviews per market and dozens of tracked brands. Contracts run annually, and teams can expand markets or KPIs as needs grow, making the platform flexible without losing statistical rigor.

Contracts run for 12 months and can expand mid-year as brands add KPIs, markets or segments.

Latana snapshot

|

Dimension |

Details |

|

Tracking style |

ML-powered, modular brand-health tracking |

|

Core metrics |

Awareness, consideration, perception, associations, funnel KPIs |

|

Sample & coverage |

Large annual samples, non-incentivised respondents, global reach |

|

Strengths |

High accuracy, strong modelling, flexible modular design |

|

Watch-outs |

Not an all-in-one CX/EX suite; requires some research proficiency |

|

Best for |

Brands in weak-panel markets, challenger brands, data-driven teams |

Best-fit use cases for Latana

-

You operate in markets where traditional panels are unreliable

-

You target niche or emerging audience segments that generic trackers miss

-

You want high-precision perception data without running a full custom tracker

-

You need modular, multi-market coverage that adapts as strategy changes

Choose Latana when accuracy, segment depth and modularity matter more than broad CX/EX coverage, especially in markets or audiences where other trackers struggle to generate reliable perception data.

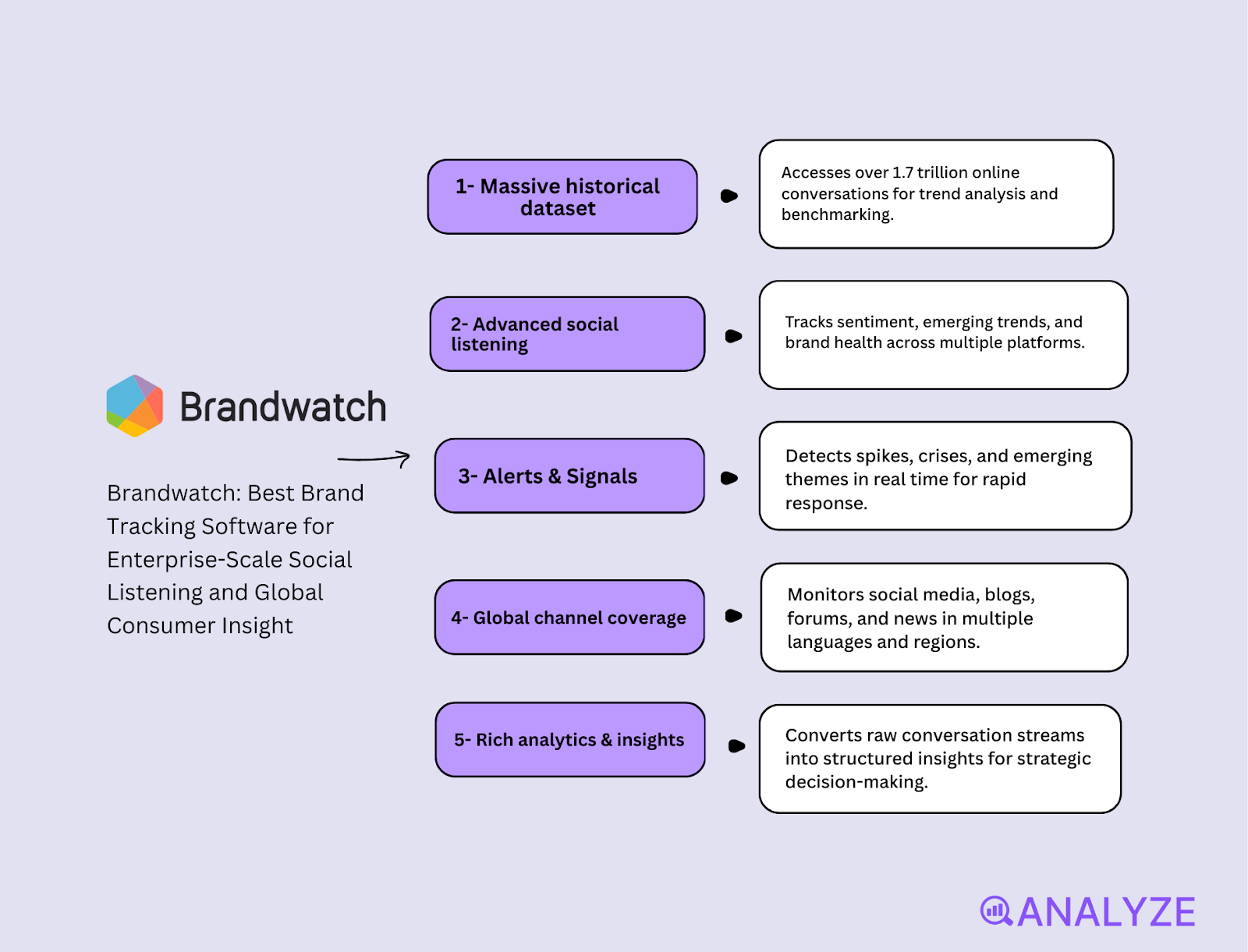

Brandwatch: Best Brand Tracking Software for Enterprise-Scale Social Listening and Global Consumer Insight

Key Brandwatch standout features

-

Access to one of the world’s largest historical datasets with more than 1.7 trillion conversations

-

Advanced social listening technology with sentiment analysis, trend tracking and brand-health metrics

-

Alerts and Signals that detect spikes, crises and emerging themes in real time

-

Deep coverage across channels, languages and regions for global visibility

-

Rich analytics that turn raw conversation streams into structured insight

Brandwatch is built for brands that need a deep and comprehensive view of how people talk about them across the entire digital world. The platform gathers huge volumes of historical and real-time conversations and organises them into clear signals about brand sentiment, cultural shifts and market dynamics. This scale matters when your team needs to understand how brand perception changes over years, not just during short windows, because Brandwatch gives you access to trends that stretch across very long timelines. It helps teams track which stories are growing, which signals are fading and which new themes might shape the next wave of brand movement.

The platform’s strength comes from a blend of reach, data quality and analytic depth. You can track conversations in many languages across many channels and convert that noise into structured insights using Brandwatch’s advanced dashboards. This makes it easier for large teams to use conversation data as a core input for brand strategy rather than a side project. The alerting system also gives teams a way to spot early spikes or crises before they escalate, which helps protect brand reputation and keeps PR, social and marketing teams aligned around a shared source of truth.

Brandwatch’s power and flexibility bring complexity that some teams will feel quickly. The platform requires thoughtful setup to work well, including creating taxonomies, defining queries and designing dashboards that reflect your real brand architecture. Without that structure, the data can feel overwhelming and lead to noisy insight rather than clarity. Teams without dedicated analysts may struggle to build or maintain the logic needed to keep the system clean over time.

The platform also sits at the higher end of the pricing spectrum, which makes it harder for smaller brands or light-use teams to justify. Brandwatch is priced and built for large organisations and agencies that can support the scale of the system. When budgets are tight or needs are simple, the cost and complexity can outweigh the value. For teams with the resources and scale to use it well, though, Brandwatch remains one of the strongest platforms for global brand monitoring and deep consumer intelligence.

Pricing for Brandwatch

Brandwatch does not provide public pricing, and costs vary based on data volume, product modules, user seats and integration depth. Enterprise plans can become significant, especially for global coverage or high historic data access. Most teams receive bespoke quotes, and smaller brands often find the pricing steep compared with lighter social-listening tools. Expect multi-module contracts with enterprise-level pricing.

Brandwatch snapshot

|

Dimension |

Details |

|

Tracking style |

Enterprise social listening and consumer-intelligence platform |

|

Core metrics |

Sentiment, conversation volume, trends, share of voice, brand signals |

|

Sample and coverage |

1.7 trillion+ historic conversations and ~500M new daily mentions |

|

Strengths |

Unmatched data depth, global visibility, strong alerts and analytics |

|

Watch-outs |

High cost, requires structured setup, steep learning for new teams |

|

Best for |

Large brands, agencies and global teams needing deep consumer insight |

Best-fit use cases for Brandwatch

-

You need global visibility into brand conversations across many languages and channels

-

You rely on long-term trend analysis to guide brand strategy and planning

-

You want early-warning alerts for crises, sentiment swings or emerging themes

-

You have an analytics or insights team able to manage taxonomy, queries and dashboards

Choose Brandwatch when your brand needs enterprise-scale social listening, deep data and strong analytics to understand how people talk about you across the digital world — and when you have the resources to use that depth well.

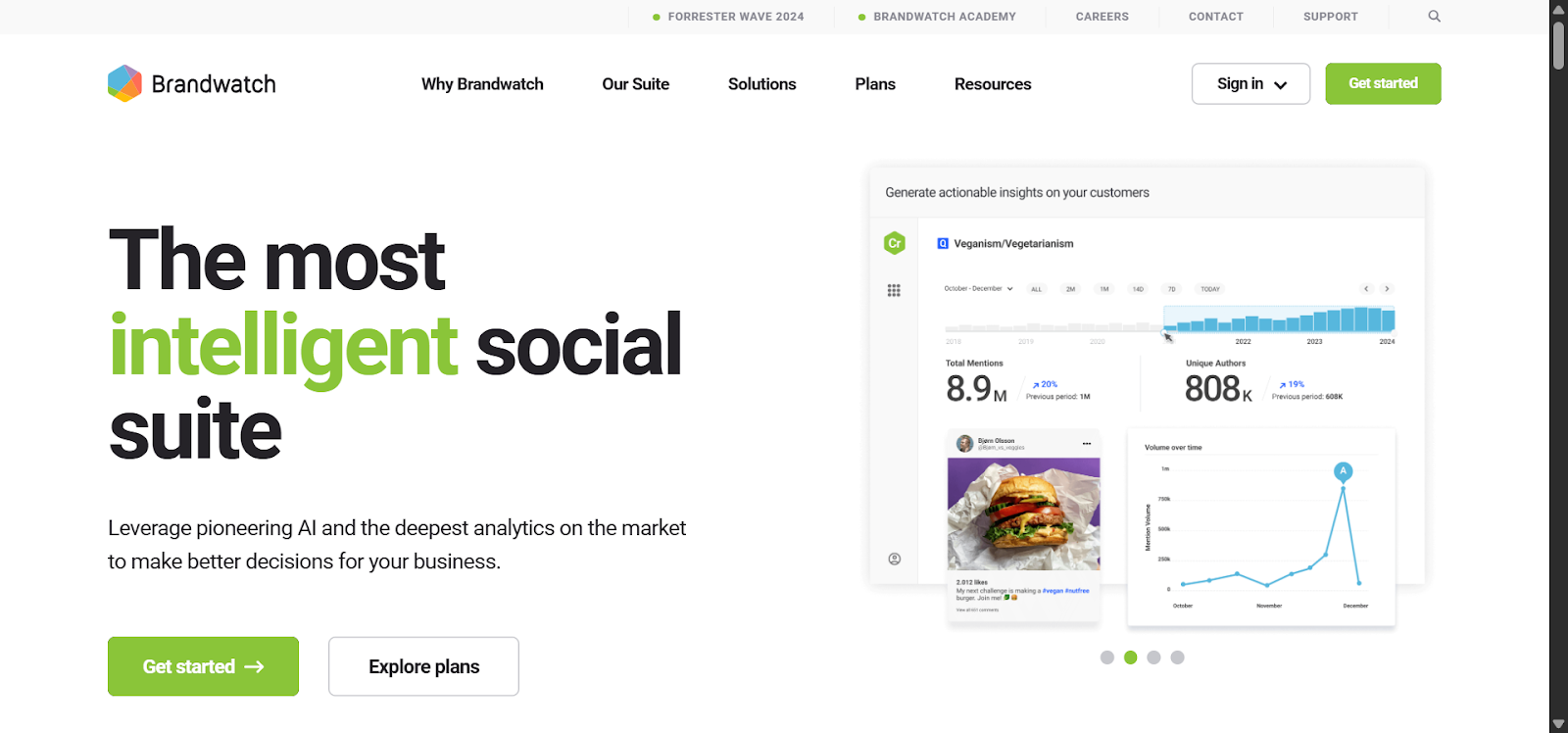

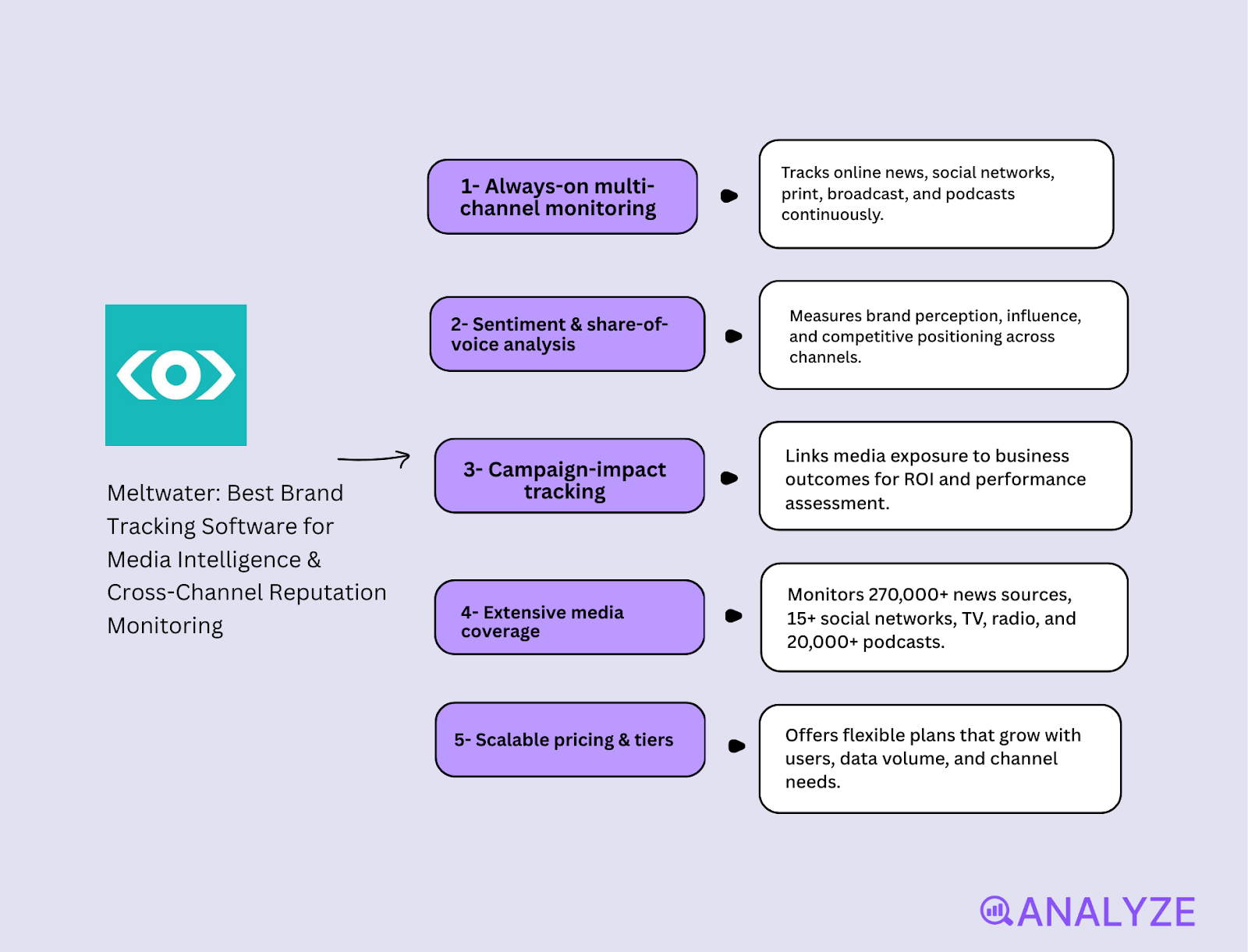

Meltwater: Best Brand Tracking Software for Media Intelligence & Cross-Channel Reputation Monitoring

Key Meltwater standout features

-

Always-on monitoring across online news, social networks, print, broadcast and podcasts

-

Sentiment reporting, share-of-voice analysis and tools for influencer outreach and PR workflows

-

Campaign-impact tracking that links media exposure to business outcomes

-

Coverage across 270,000+ news sources, 15+ social networks, TV, radio and 20,000+ podcasts

-

Tiered pricing structures that scale with users, data volume and channel coverage

Meltwater gives comms and marketing teams a unified view of how the brand appears across all major media types, not just social platforms. The platform pulls mentions from print, broadcast, digital and social sources into one dashboard, which helps teams see how narratives spread and evolve. This makes it especially useful for PR teams that need to track reputation across many markets, connect media hits to campaigns and present clear insights to leadership without stitching together data from different tools.

The system also helps brands catch early changes in sentiment or media coverage. Its monitoring and alerting tools give teams a way to spot spikes, negative turns or emerging trends before they become widespread. When a story begins to climb, or when a campaign starts to gain traction, Meltwater surfaces those signals quickly so teams can respond with confidence. This speed and breadth give brands an edge when the news cycle moves fast or when global coverage matters.

Meltwater’s broad feature set comes with a learning curve, and teams without dedicated support may find the setup work challenging. The platform depends on well-built taxonomies, clean keyword logic and clear dashboards to deliver strong insight, and those pieces often require someone with experience. Some users also feel the interface becomes heavy when only basic monitoring is needed, which makes simple workflows harder than they need to be.

Pricing for Meltwater

Meltwater structures its pricing around modules, data volume, markets and users, offering three major tiers: Essentials, Suite and Enterprise. Costs vary widely depending on how much coverage and how many features a team needs. Public estimates place entry packages near $7,000/year, mid-range use around $15,000–$20,000/year and enterprise deployments at $40,000+ for brands that need global monitoring across many channels.

Meltwater snapshot

|

Dimension |

Details |

|

Tracking style |

Enterprise media & social intelligence across news, print, broadcast, podcasts and social |

|

Core metrics |

Mentions, reach, sentiment, share of voice, trend signals |

|

Sample & coverage |

270,000+ news sources, 15+ social platforms, global media monitoring |

|

Strengths |

Broad channel coverage, strong reputation monitoring, campaign-impact insights |

|

Watch-outs |

Heavy setup, requires taxonomy discipline, fits best with dedicated teams |

|

Best for |

PR and comms teams, global brands, agencies needing full media intelligence |

Best-fit use cases for Meltwater

-

You need to manage brand reputation across news, social and broadcast at the same time

-

You want clear links between media exposure and campaign performance

-

You run PR and comms teams that require one unified monitoring and outreach workflow

-

You have the resources to maintain taxonomies, queries and dashboards at an enterprise level

Choose Meltwater when you need broad media intelligence across channels and markets, and when a full PR-grade system can support your reputation work, campaign tracking and brand-story management.

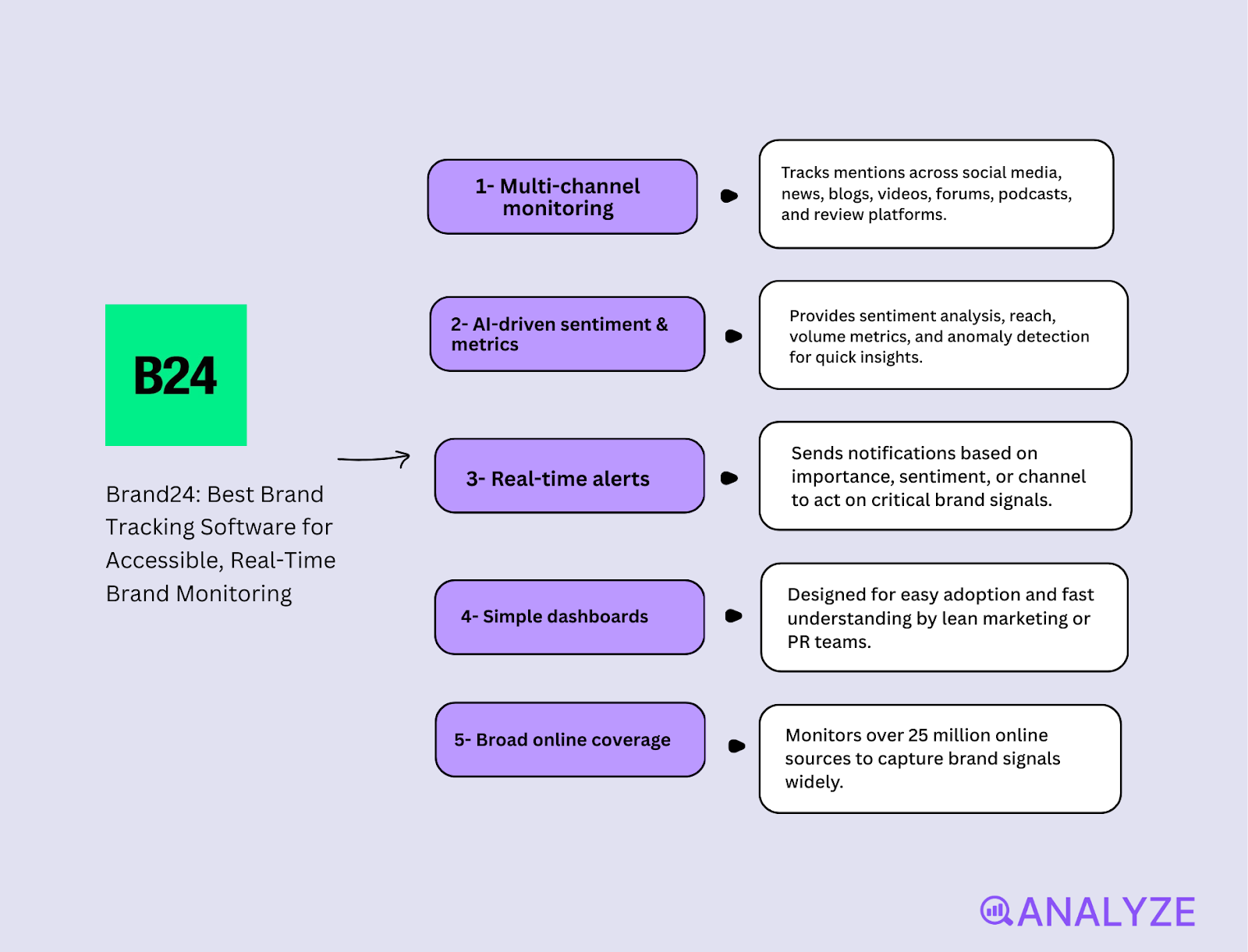

Brand24: Best Brand Tracking Software for Accessible, Real-Time Brand Monitoring

Key Brand24 standout features

-

Monitoring across social media, news, blogs, videos, forums, podcasts and review platforms

-

AI-driven sentiment analysis, reach and volume metrics, plus anomaly detection

-

Real-time alerts with filters for importance, sentiment or channel

-

Simple dashboards built for quick adoption by lean teams

-

Broad source coverage that captures brand signals across 25M+ online locations

Brand24 is built for teams that need fast, simple brand monitoring without the weight or cost of enterprise platforms. The tool scans millions of online sources in real time and surfaces mentions, sentiment shifts and emerging spikes so teams can understand how their brand is discussed across channels. This helps small marketing and PR teams stay aware of what matters without pulling data from many tools or waiting for long reporting cycles. It gives a clean picture of reach, context and tone so teams can act early rather than react late.

The platform also lowers the barrier for teams that want brand-health signals but don’t have the resources for complex social-listening suites. Its visual dashboards, quick setup and simple alerting make it easy to build a monitoring workflow in days rather than months. Agencies and growing brands often use it to catch early reputation trends, track campaign mentions or keep an eye on competitors without needing advanced data skills. This makes Brand24 useful for companies that want value quickly and prefer speed and clarity over deep modelling.

Brand24’s light and accessible design creates natural trade-offs. The tool does not offer the advanced analytics, deep segmentation or complex modelling found in enterprise systems like Brandwatch or Meltwater. This means the insight you get focuses on mentions, sentiment and reach rather than full brand-health funnels or detailed drivers of perception. Teams that need metrics like awareness, preference or purchase intent will need to add a survey-based tool. High-volume brands may also run into keyword or mention limits on lower-tier plans, which requires upgrading when monitoring needs grow.

Pricing for Brand24

Brand24 publishes its pricing openly, and the tiers remain far more affordable than enterprise alternatives. Plans begin around $149/month for smaller teams and can reach $999/month or more for enterprise use. Annual billing lowers costs further. Mid-range plans between $299 and $599/month increase mention quotas and keyword limits, giving agencies and growing brands enough room to scale. This pricing structure makes Brand24 accessible for SMBs and lean PR teams that want strong monitoring without enterprise budgets.

Brand24 snapshot

|

Dimension |

Details |

|

Tracking style |

Real-time AI-powered brand monitoring across social and web sources |

|

Core metrics |

Mentions, reach, sentiment, anomaly detection, channel distribution |

|

Sample & coverage |

25M+ online sources including social, news, blogs, forums and podcasts |

|

Strengths |

Fast setup, affordable pricing, strong alerts, broad channel coverage |

|

Watch-outs |

Limited advanced modelling, not a full brand-health tracker, plan limits |

|

Best for |

SMBs, agencies, lean PR/marketing teams needing real-time monitoring |

Best-fit use cases for Brand24

-

You need quick brand-monitoring insight without enterprise complexity

-

You want real-time alerts across many online channels

-

You run a small team or agency and need a tool that is simple to adopt

-

You want affordable monitoring to support PR, social and campaign work

Choose Brand24 when you want real-time brand monitoring across millions of sources with easy setup and accessible pricing, and when your team needs speed and clarity more than deep enterprise analytics.

Tie AI visibility toqualified demand.

Measure the prompts and engines that drive real traffic, conversions, and revenue.

Similar Content You Might Want To Read

Discover more insights and perspectives on related topics

8 AirOps Alternatives for Teams That Need AI Search Visibility Without the Complexity

AI Keyword Research: How to Use Free Chatbot Tools

7 Ways to Compare Websites (+ Competitor Analysis Tools to Use)

7 Free and Beginner-Friendly Small Business SEO Tools

7 Content Editing Tools Recommended by Our Editors