The 14 Best Competitive Intelligence Tools for Market Research

Written by

Ernest Bogore

CEO

Reviewed by

Ibrahim Litinine

Content Marketing Expert

Teams think competitors beat them with big launches. They don’t. They win in the unnoticed moments — the pricing tweak at 2 a.m., the new headline pushed live for 48 hours, the hiring pattern that hinted at a shift months before anyone reacted.

You see this pattern in the wild every day:

-

Sales hears a new objection long before Product realizes a rival repositioned.

-

Marketing adjusts messaging while leadership still believes the old segment is the priority.

-

Teams monitor competitors, but nothing connects signals to decisions — so the same surprises repeat.

What we should have is a system that captures competitor moves as they happen, interprets what matters, and turns that into actions teams actually use. That idea guided how we evaluated every tool here.

This breakdown gives you a clear, practical view of the 14 platforms that truly support market research: what each excels at, where it fits, and when it fails. By the end, you’ll know exactly which tools help you stay ahead of competitor moves instead of reacting after the damage is done.

Table of Contents

TL;DR

|

Tool |

What it does best |

Best for |

Key limitations |

Why it matters for CI |

|

Analyze AI |

Tracks AI search visibility + actual traffic, conversions, ROI from ChatGPT, Perplexity, Claude, Gemini, Copilot |

Companies serious about winning AI-driven traffic and proving revenue impact |

Focused on AI search—not a replacement for broad CI workflows |

Shows which AI engines send real sessions, which prompts drive revenue, and where to invest in AI visibility |

|

Crayon |

Real-time monitoring of competitor websites, messaging, pricing, and digital signals |

B2B SaaS, marketing, and sales teams needing granular website & asset tracking |

Requires tuning to avoid noise; no deep financial or patent intel |

Ideal for spotting fast tactical moves and enabling sales with fresh battlecards |

|

Contify |

Broad market + competitor monitoring across multilingual sources with AI summarization |

Global companies or multi-region teams needing structured external intelligence |

Setup time; no deep financial/SEC/patent tracking |

Offers wide market awareness that reduces blind spots across regions and industries |

|

SEMrush |

SEO + PPC competitive insight, keyword intelligence, and traffic trend analysis |

SMBs, digital-first teams, SEO/PPC marketers |

Traffic data is estimated; limited non-digital intel |

Reveals how competitors acquire demand through search and paid channels |

|

Similarweb |

Large-scale digital traffic + audience insights, channel mix, and market-share trends |

Teams benchmarking online reach and channel strengths |

Estimates vary; weak for small sites or offline intel |

Shows where competitors’ audiences come from and how their visibility shifts |

|

Kompyte |

Automated tracking of competitor ads, content, messaging, pricing pages, SEO shifts |

Marketing, sales enablement, GTM teams |

Limited corporate/financial intel; pricing not transparent |

Gives fast visibility into competitor campaigns and positioning changes |

|

Klue |

AI-powered battlecards and win-loss insights designed for sales enablement |

Sales teams and CI functions supporting live deals |

Not a full-market intel tool; higher cost |

Turns scattered intel into deal-ready insights that improve win rates |

|

Data.ai |

Tracks app downloads, revenue, retention, rankings across app stores |

Mobile-first companies, gaming studios, publishers |

Focused only on mobile ecosystems |

Helps teams detect emerging app competitors and market momentum early |

|

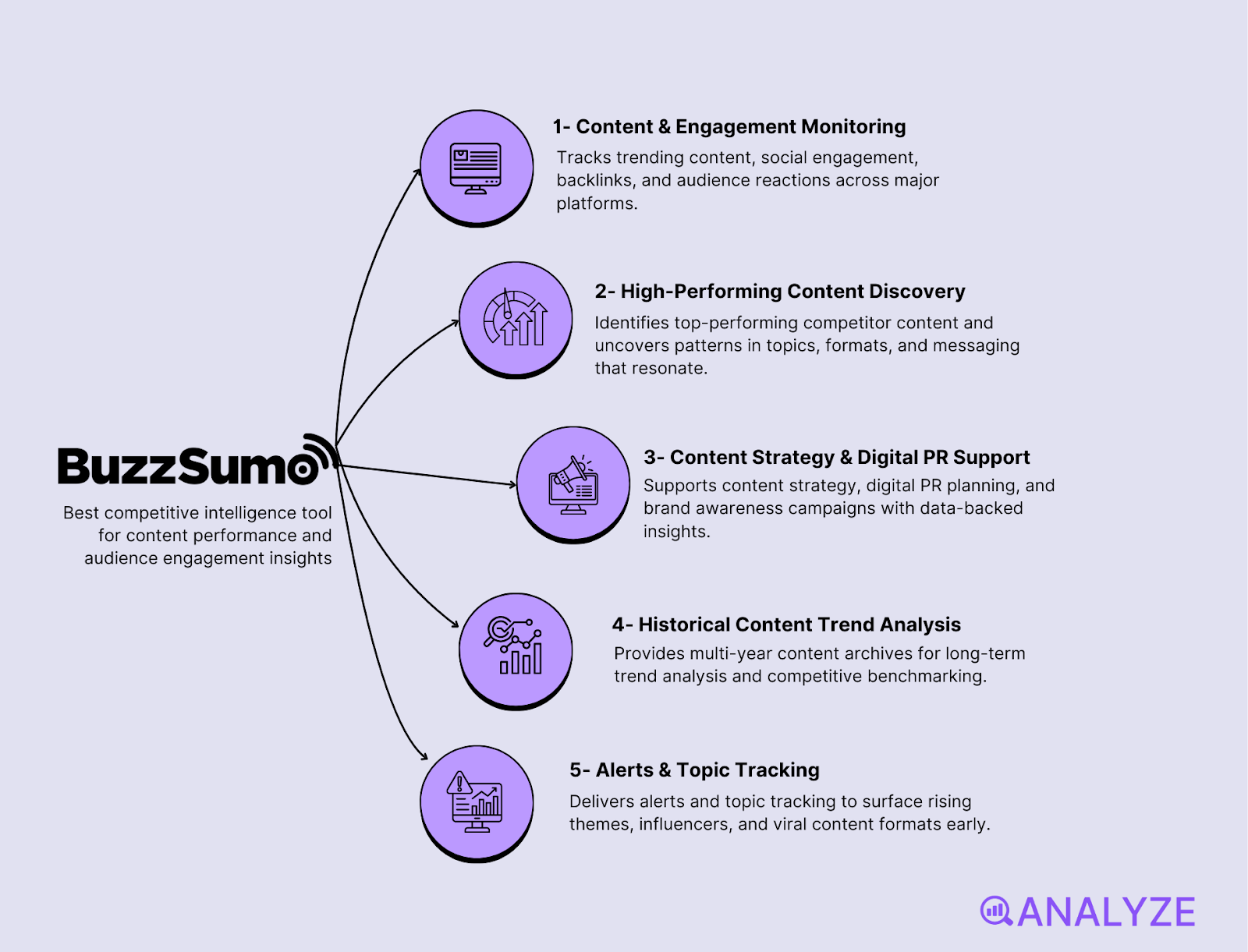

BuzzSumo |

Content performance, trending topics, influencer insights, and engagement metrics |

Content teams, PR, editorial strategy |

Very content-focused; no product or pricing intel |

Shows which competitor content wins and why audiences engage |

|

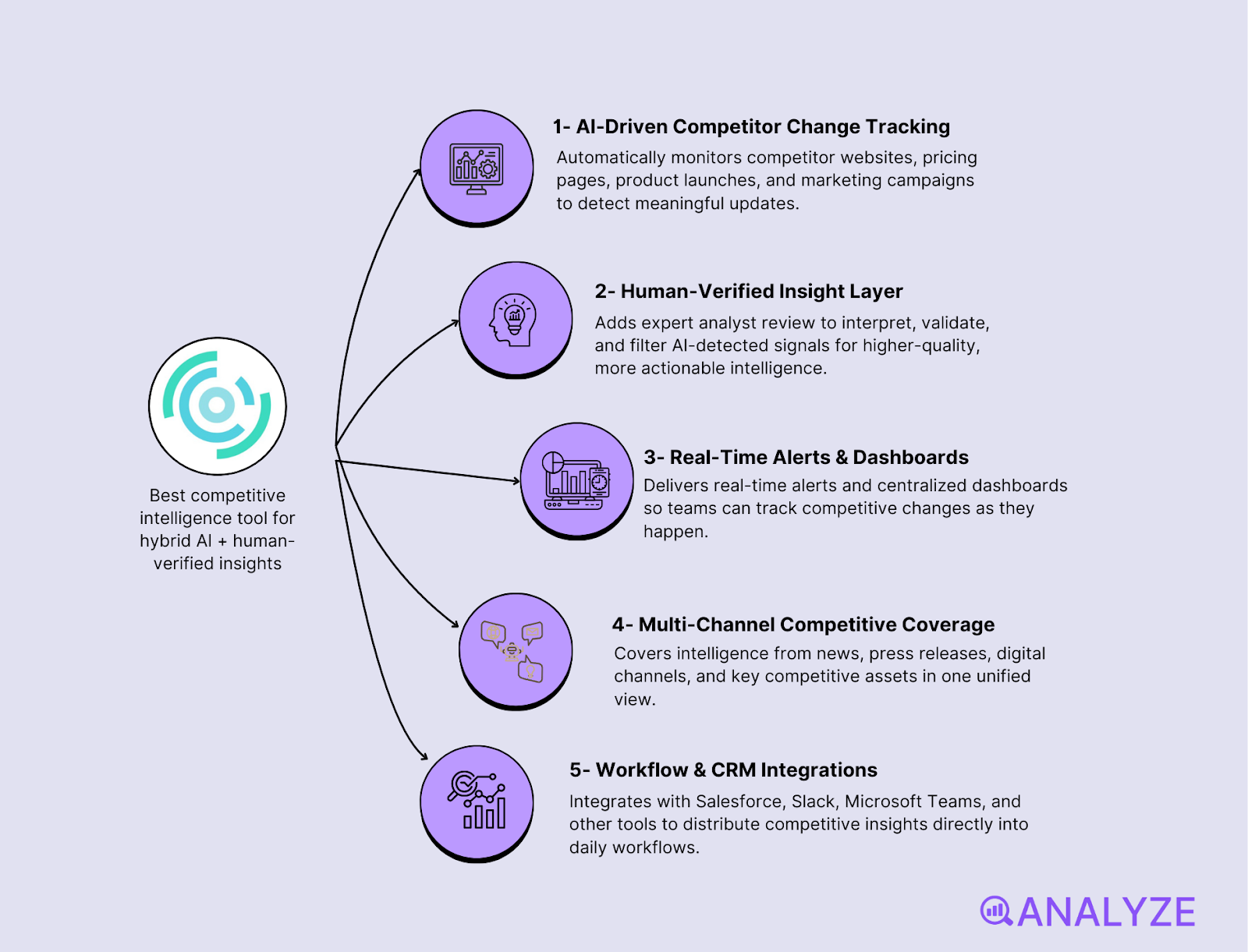

WatchMyCompetitor |

Hybrid model: AI monitoring + human-curated competitive insights |

Mid-market teams wanting curated updates without internal analysts |

Small public footprint; limited review data |

Reduces noise and delivers validated competitor updates in real time |

|

SpyFu |

Budget-friendly SEO/PPC competitor intelligence with long historical archives |

Small teams, freelancers, agencies |

Approximate data; search-only scope |

Great low-cost view into search & ad strategy trends over time |

|

Valona Intelligence |

Enterprise-grade market + competitive foresight with AI + analyst curation |

Large global orgs needing structured insight reports |

Limited public documentation; enterprise pricing |

Supports strategic planning with curated, multilingual, multi-market intelligence |

|

Owler |

Real-time alerts on funding, leadership changes, acquisitions, product announcements |

SMBs, sales teams needing quick competitor updates |

Crowdsourced data can vary; shallow analytical depth |

Provides fast company-level event tracking perfect for sales triggers |

|

Digimind (Onclusive Social) |

Social listening + sentiment analytics across millions of sources |

Enterprises tracking brand perception & competitor sentiment |

Not a full CI suite; lacks corporate/product intel |

Adds emotion and public-narrative insight crucial for PR and market messaging |

Analyze AI: Best competitive intelligence tool for AI search visibility (and performance)

Analyze AI is not a traditional competitive intelligence platform. Competitive intelligence tools usually track broad competitor activity across markets, pricing, product launches, and corporate moves. Analyze AI focuses on a specific layer of competitor intelligence that now shapes marketing outcomes: how your brand and competitors appear inside AI answer engines, and what that visibility actually produces in sessions, conversions, and revenue.

The platform shows which answer engines send sessions to your site (Discover), which pages those visitors land on, what actions they take, and how much revenue they influence (Monitor). You get prompt-level performance across ChatGPT, Perplexity, Claude, Copilot, and Gemini, then you see the downstream impact through conversion rates, assisted revenue, and ROI by referrer.

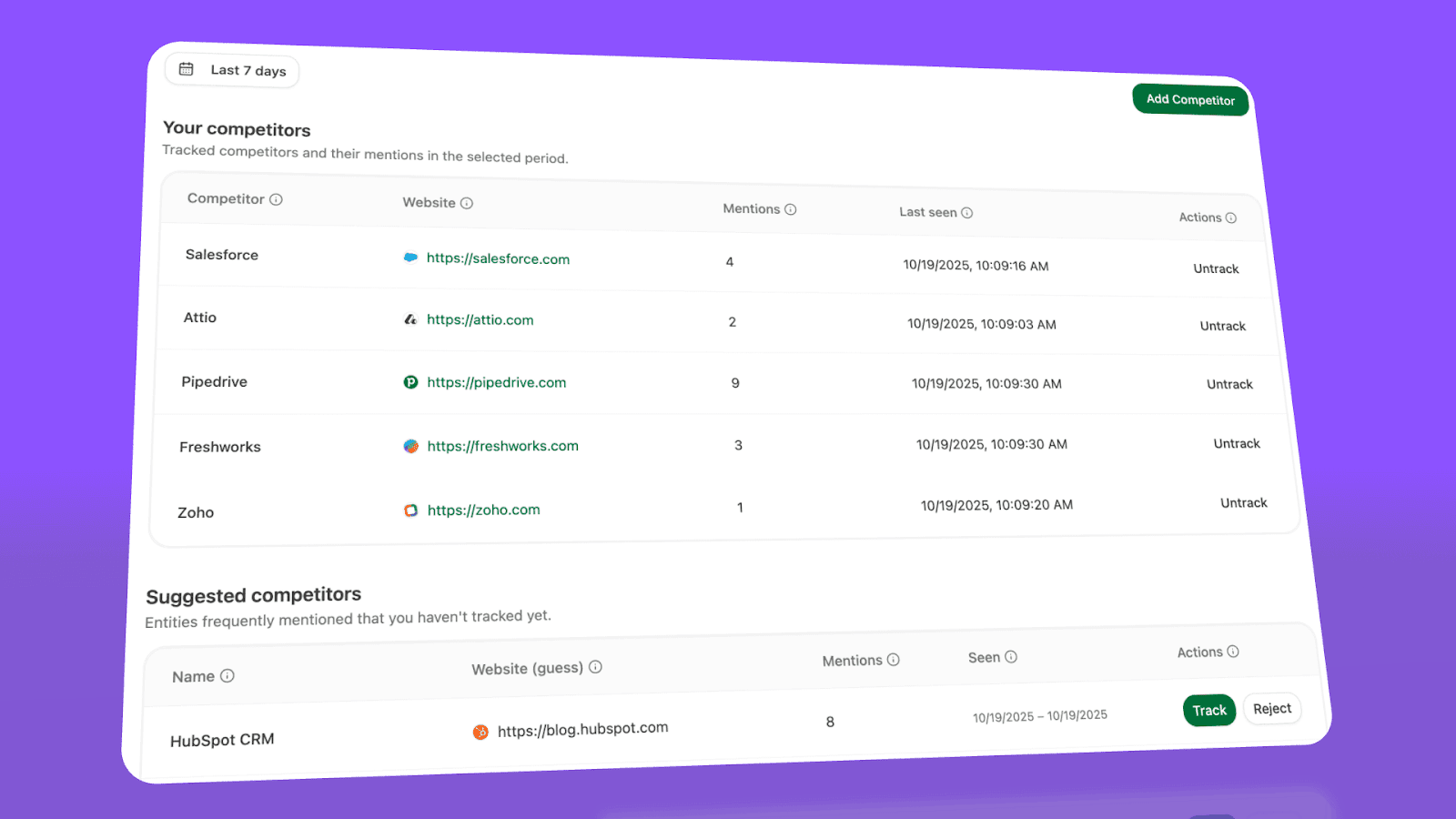

Analyze AI also helps you act on what you learn. You can improve performance with prioritized recommendations and prompt workflows, including suggested prompts to monitor through our prompt suggestion feature (Improve). You can also track competitor presence, brand sentiment, and positioning shifts over time, so you understand when the market narrative changes and who benefits from that change (Govern).

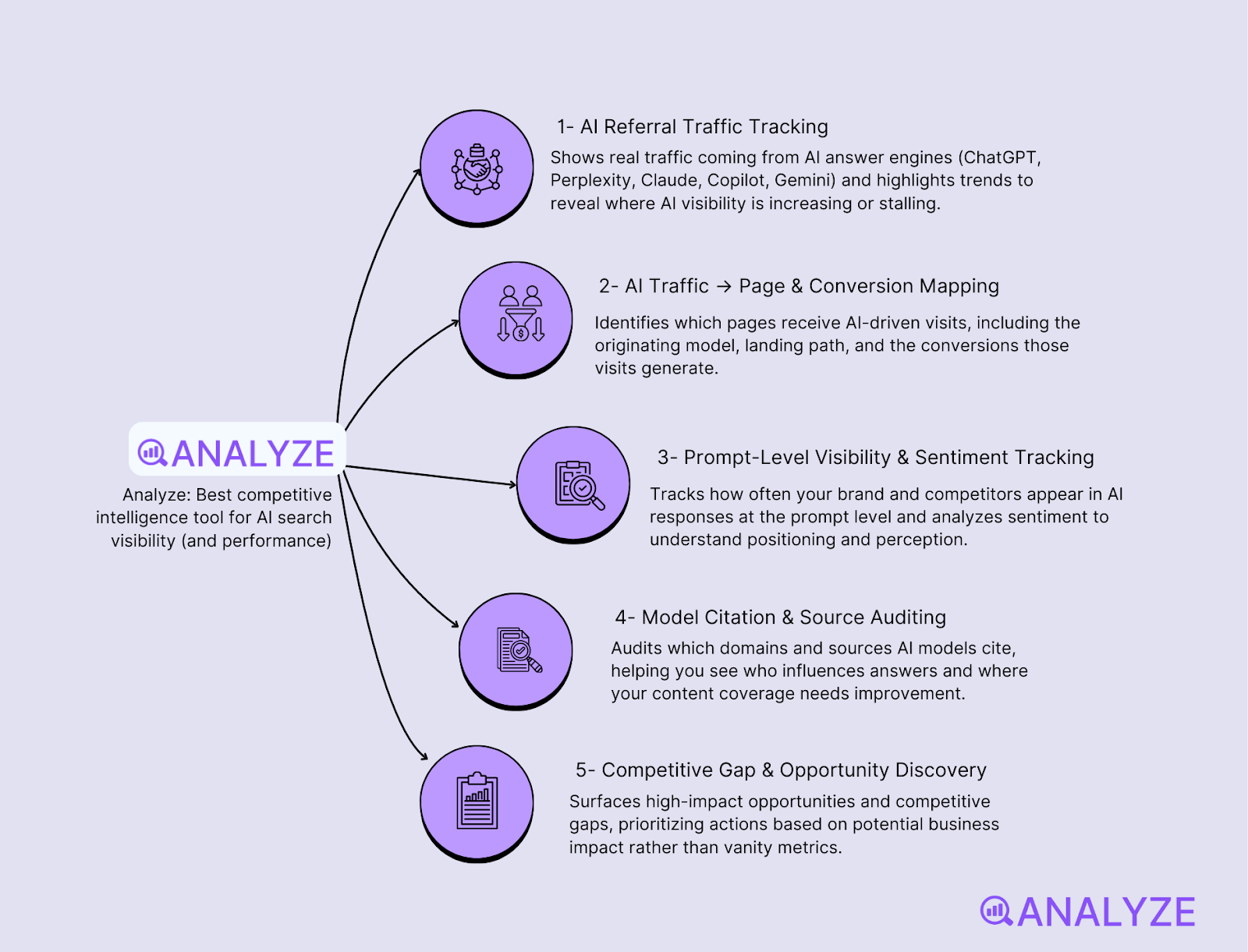

Key Analyze AI features

-

See actual AI referral traffic by engine and track trends that reveal where visibility grows and where it stalls.

-

See the pages that receive that traffic with the originating model, the landing path, and the conversions those visits drive.

-

Track prompt-level visibility and sentiment across major LLMs to understand how models talk about your brand and competitors.

-

Audit model citations and sources to identify which domains shape answers and where your own coverage must improve.

-

Surface opportunities and competitive gaps that prioritize actions by potential impact, not vanity metrics.

Here are in more details how Analyze AI works:

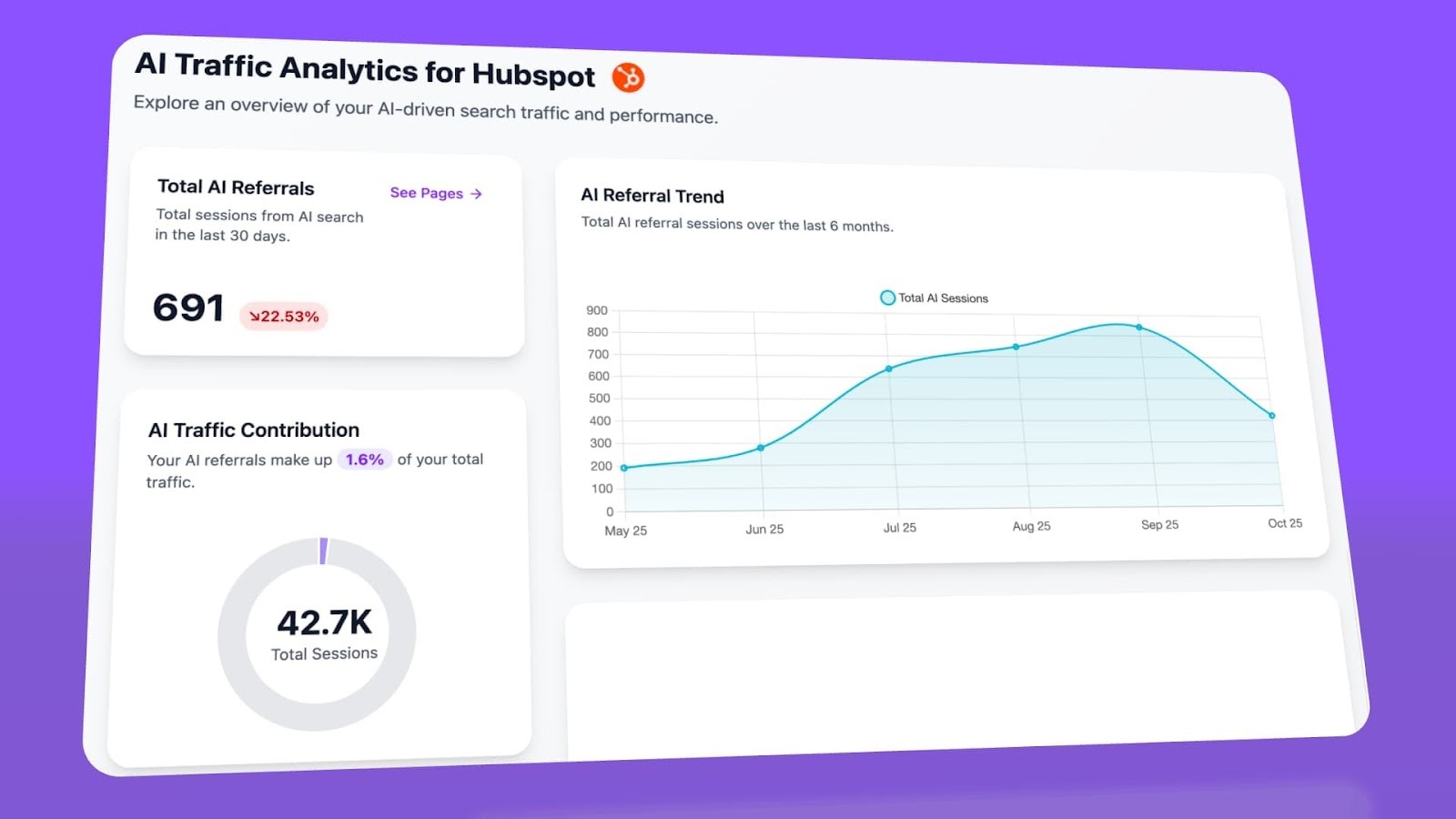

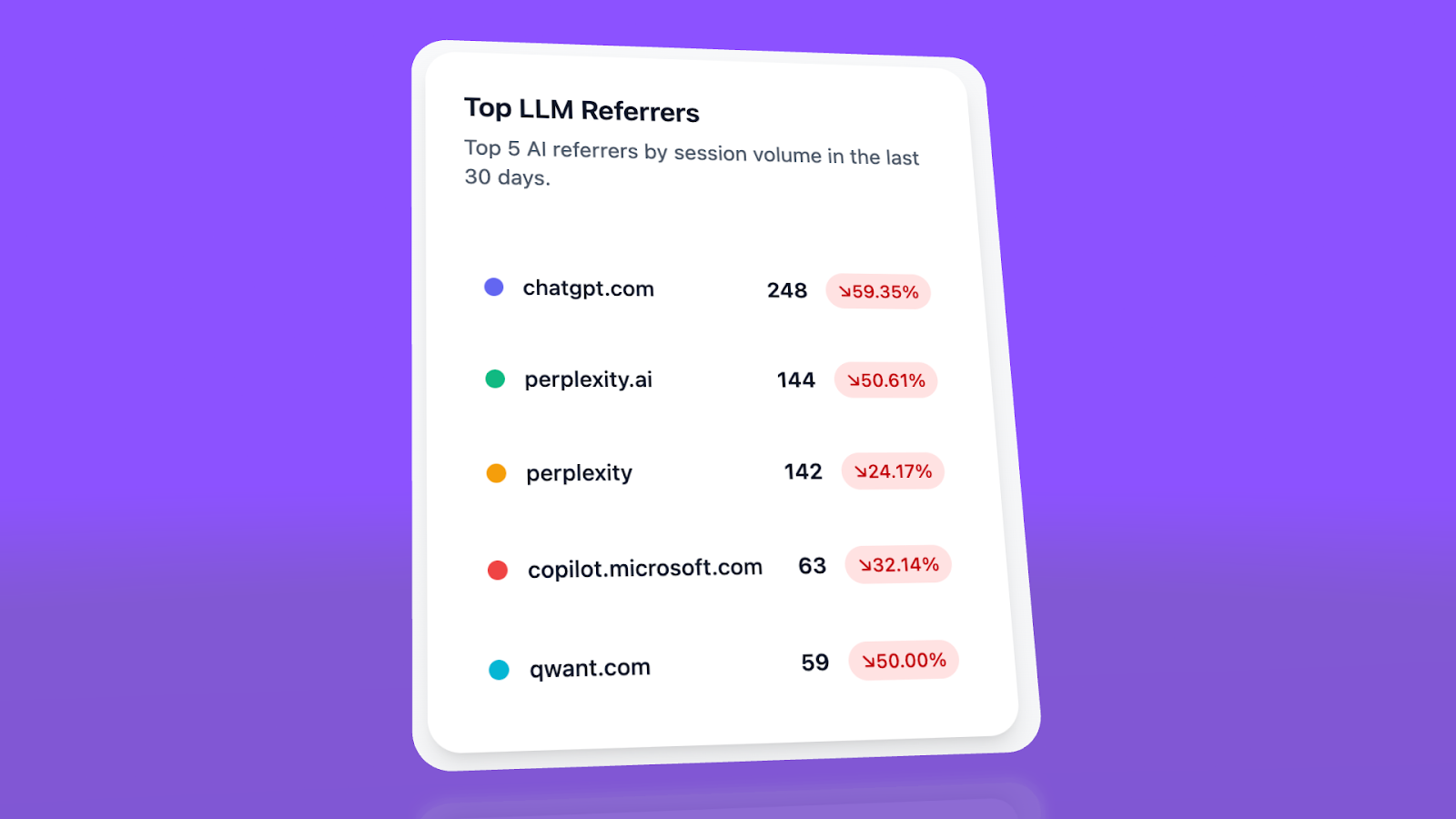

See actual traffic from AI engines, not just mentions

Analyze AI attributes every session from answer engines to its specific source—Perplexity, Claude, ChatGPT, Copilot, or Gemini. You see session volume by engine, trends over six months, and what percentage of your total traffic comes from AI referrers. When ChatGPT sends 248 sessions but Perplexity sends 142, you know exactly where to focus optimization work.

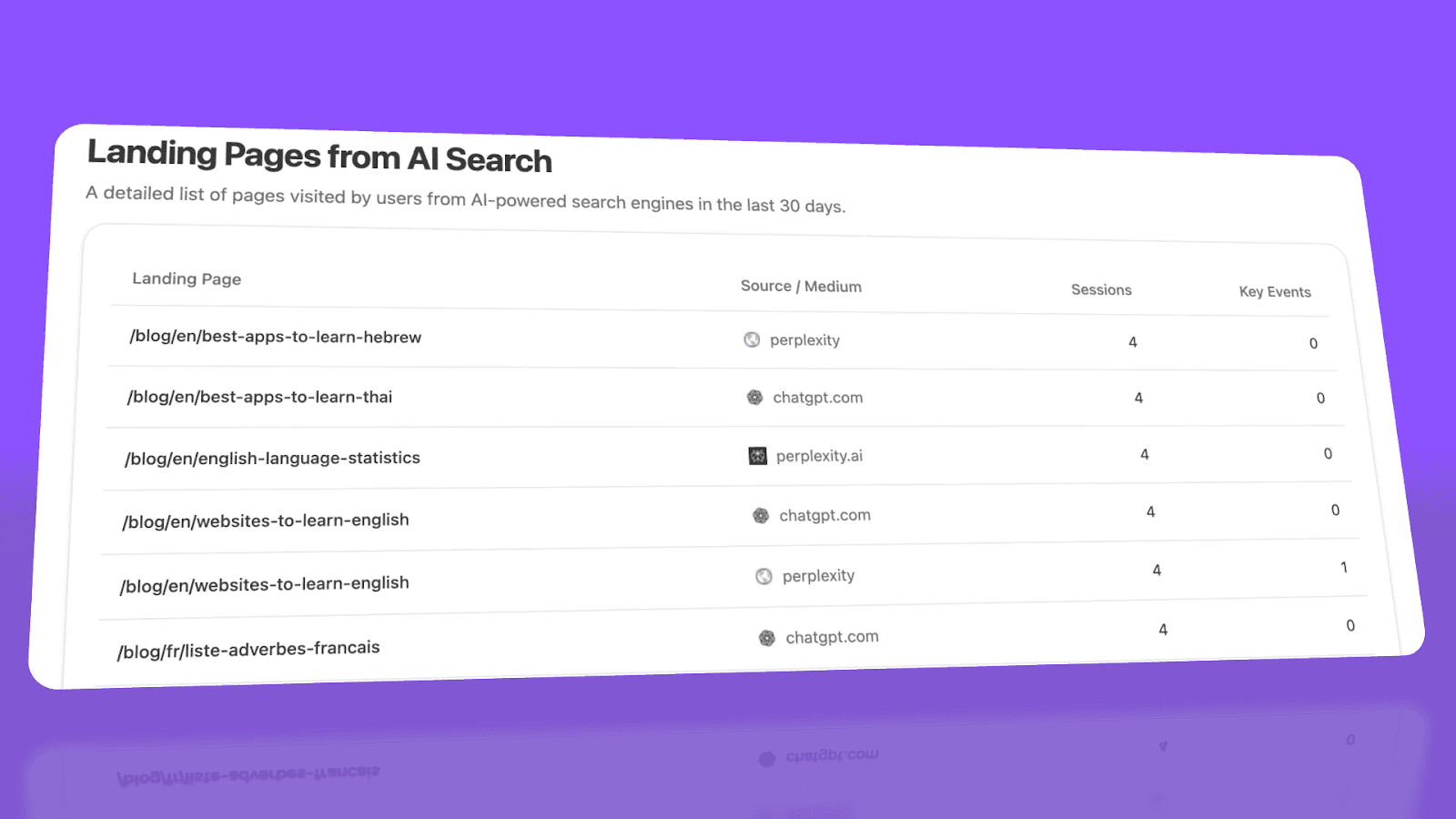

Know which pages convert AI traffic and optimize where revenue moves

Most tools stop at "your brand was mentioned." Analyze AI shows you the complete journey from AI answer to landing page to conversion, so you optimize pages that drive revenue instead of chasing visibility that goes nowhere.

The platform shows which landing pages receive AI referrals, which engine sent each session, and what conversion events those visits trigger.

For instance, when your product comparison page gets 50 sessions from Perplexity and converts 12% to trials, while an old blog post gets 40 sessions from ChatGPT with zero conversions, you know exactly what to strengthen and what to deprioritize.

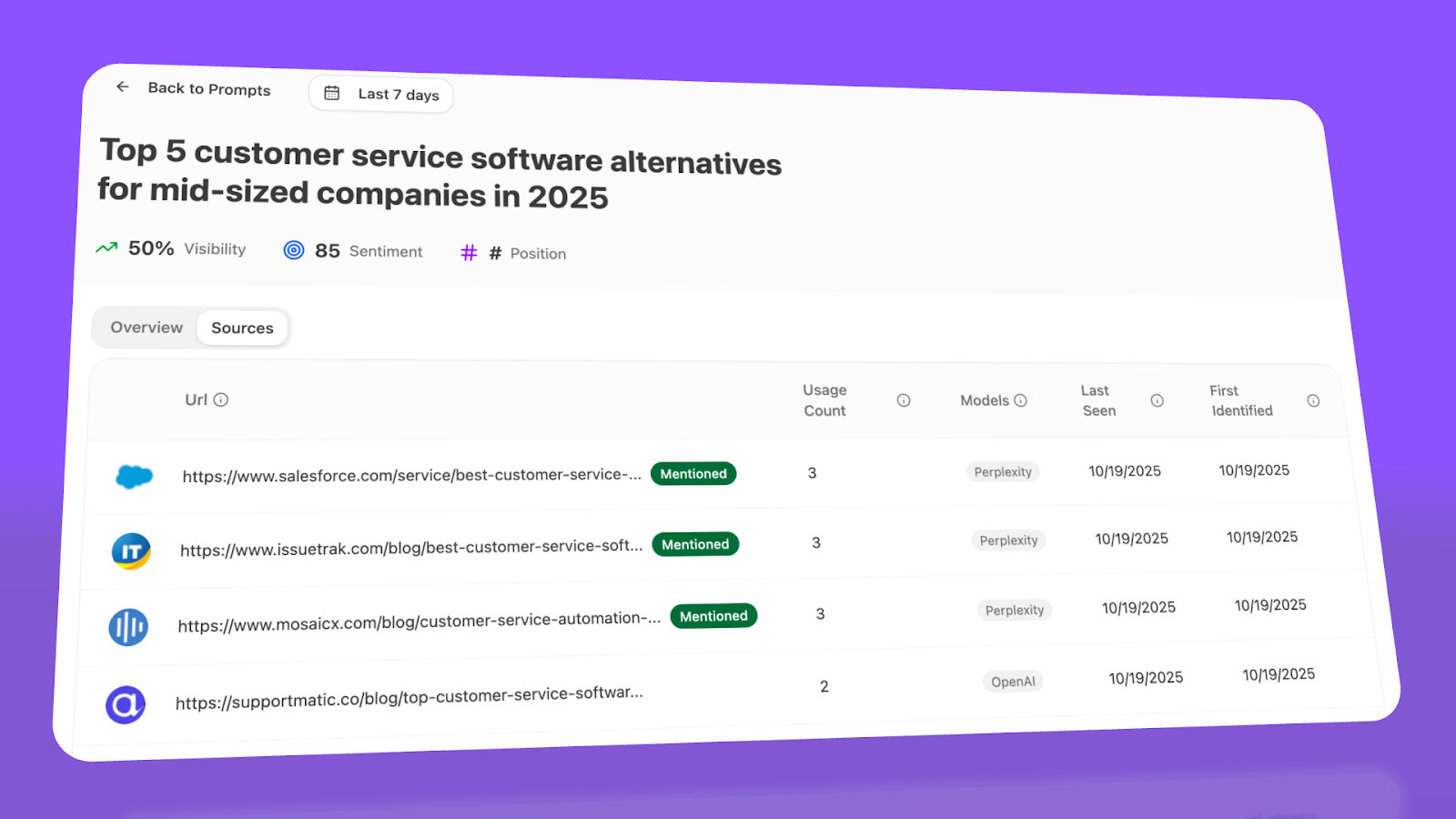

Track the exact prompts buyers use and see where you're winning or losing

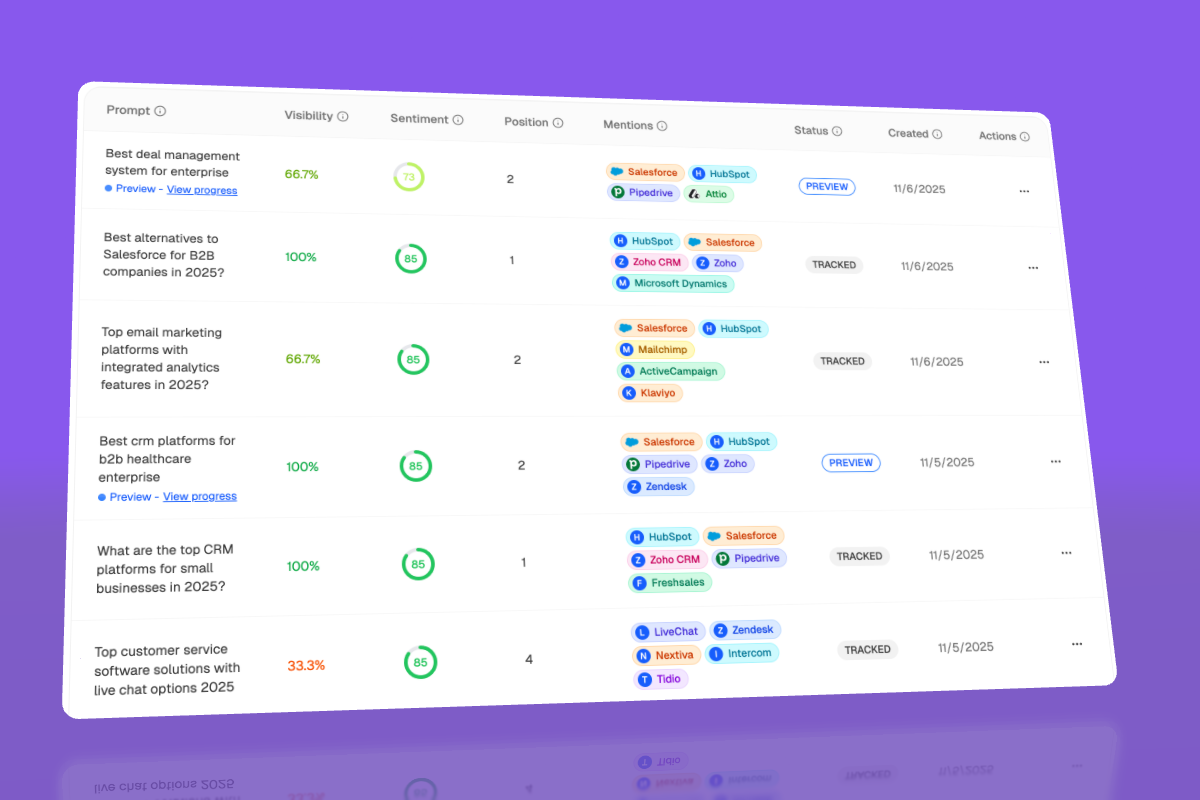

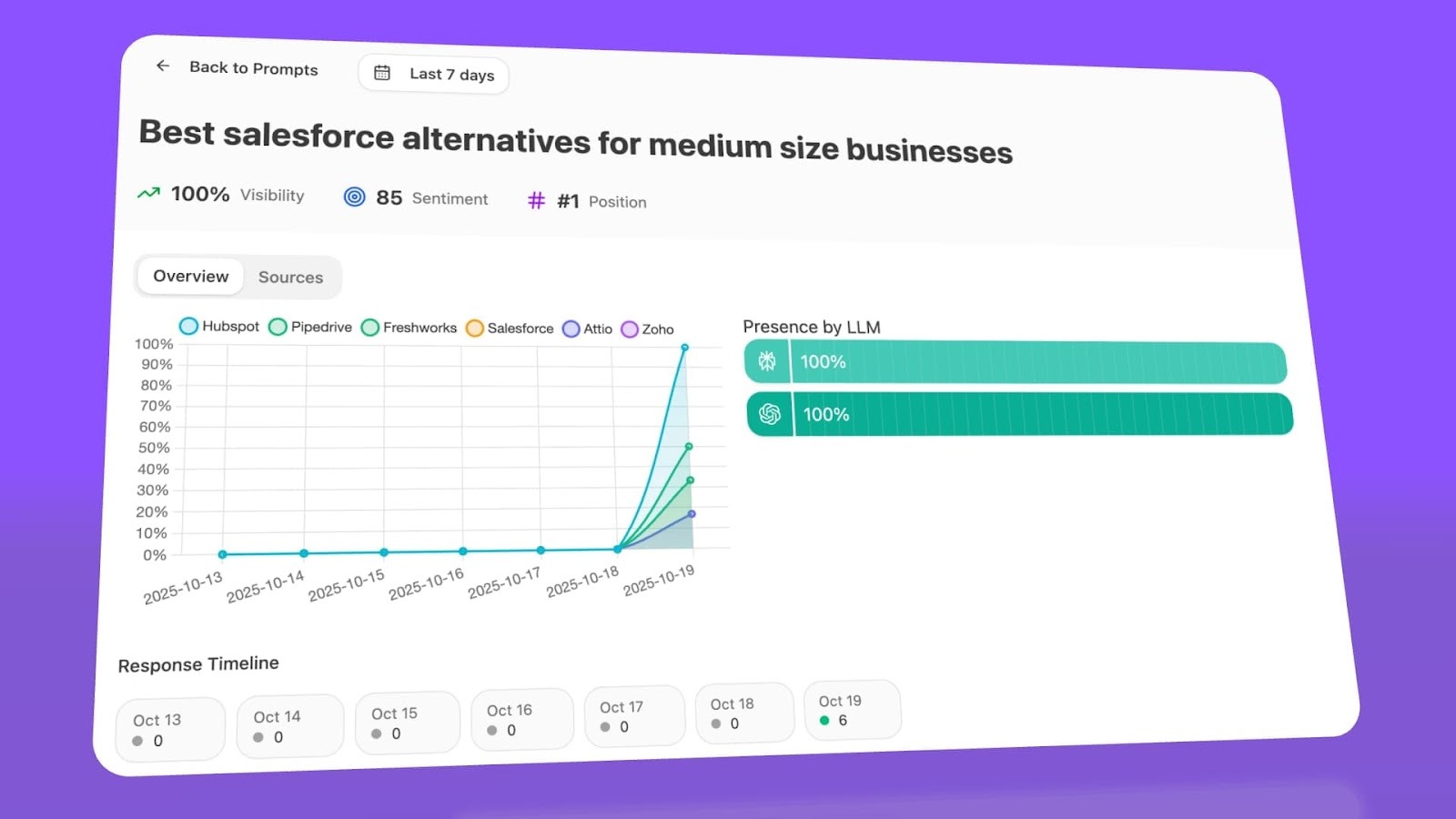

Analyze AI monitors specific prompts across all major LLMs—"best Salesforce alternatives for medium businesses," "top customer service software for mid-sized companies in 2026," "marketing automation tools for e-commerce sites."

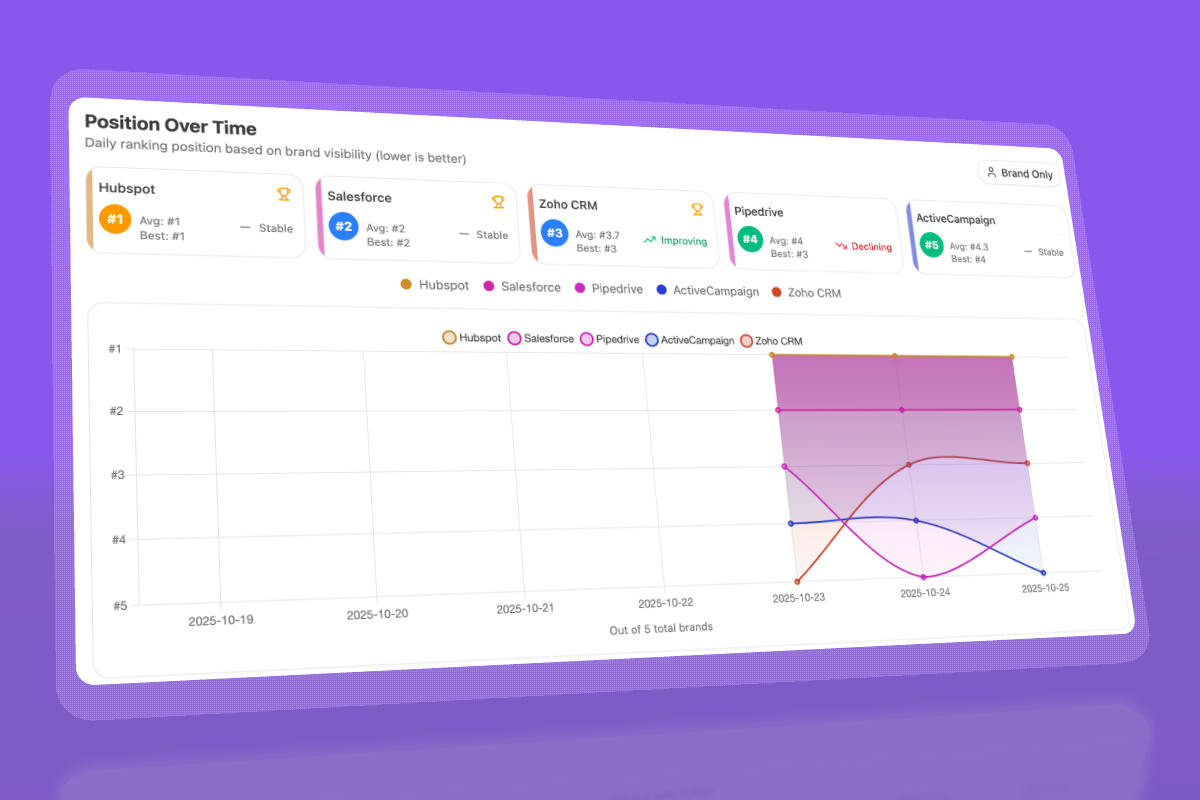

For each prompt, you see your brand's visibility percentage, position relative to competitors, and sentiment score.

You can also see which competitors appear alongside you, how your position changes daily, and whether sentiment is improving or declining.

Don’t know which prompts to track? No worries. Analyze AI has a prompt suggestion feature that suggests the actual bottom of the funnel prompts you should keep your eyes on.

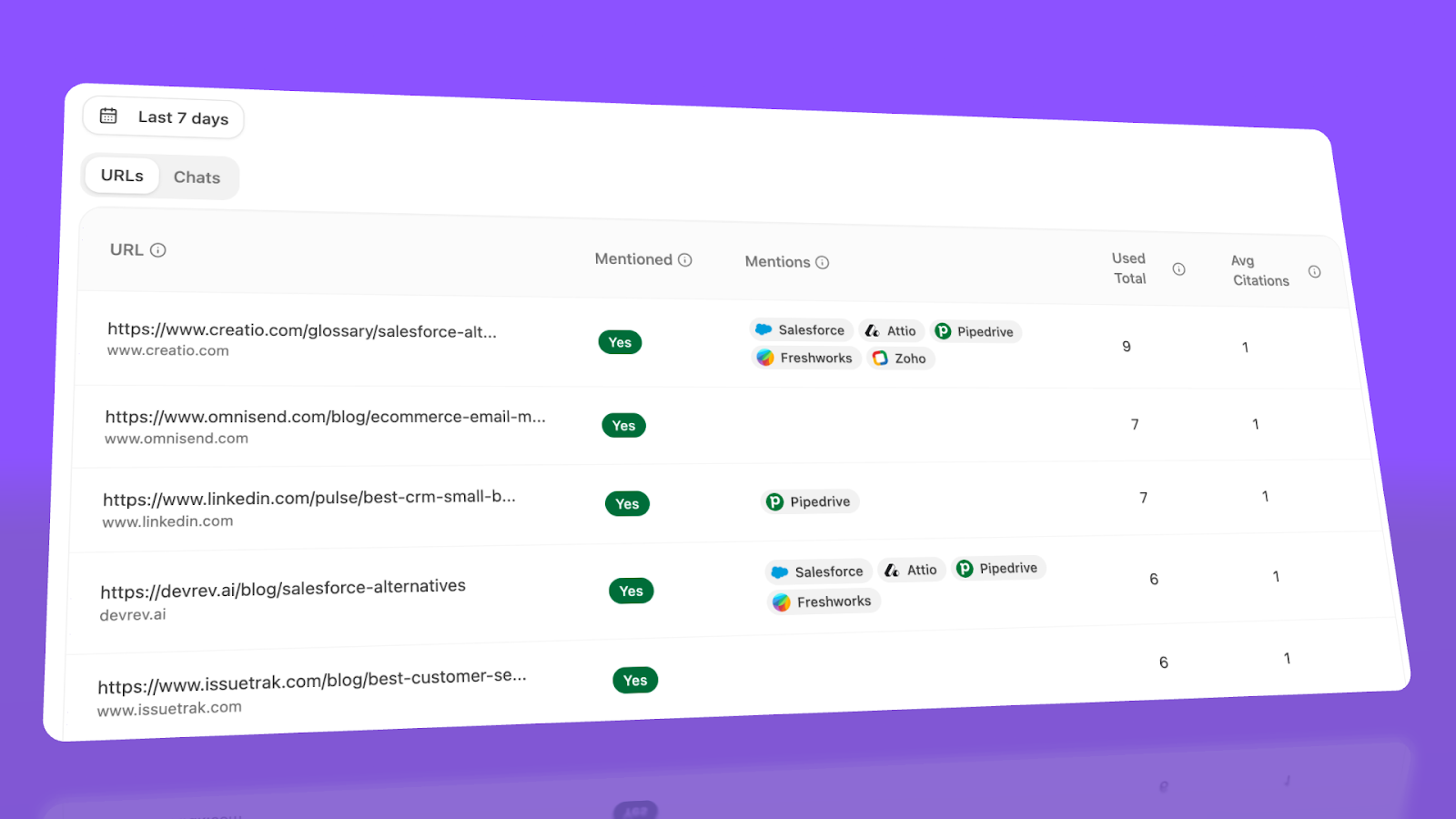

Audit which sources models trust and build authority where it matters

Analyze AI reveals exactly which domains and URLs models cite when answering questions in your category.

You can see, for instance, that Creatio gets mentioned because Salesforce.com's comparison pages rank consistently, or that IssueTrack appears because three specific review sites cite them repeatedly.

Analyze AI shows usage count per source, which models reference each domain, and when those citations first appeared.

Citation visibility matters because it shows you where to invest. Instead of generic link building, you target the specific sources that shape AI answers in your category. You strengthen relationships with domains that models already trust, create content that fills gaps in their coverage, and track whether your citation frequency increases after each initiative.

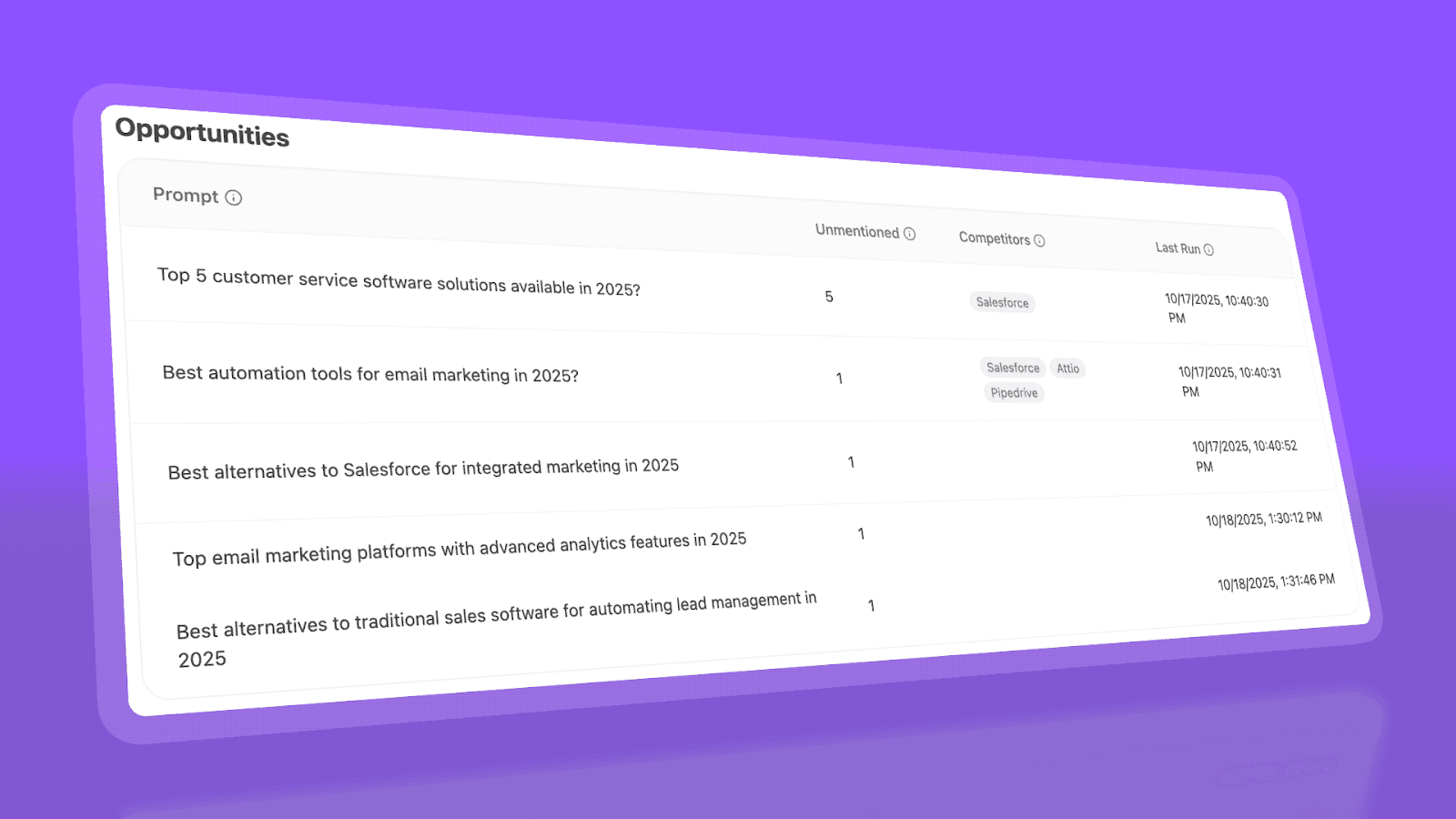

Prioritize opportunities and close competitive gaps

Analyze AI surfaces opportunities based on omissions, weak coverage, rising prompts, and unfavorable sentiment, then pairs each with recommended actions that reflect likely impact and required effort.

For instance, you can run a weekly triage that selects a small set of moves—reinforce a page that nearly wins an important prompt, publish a focused explainer to address a negative narrative, or execute a targeted citation plan for a stubborn head term.

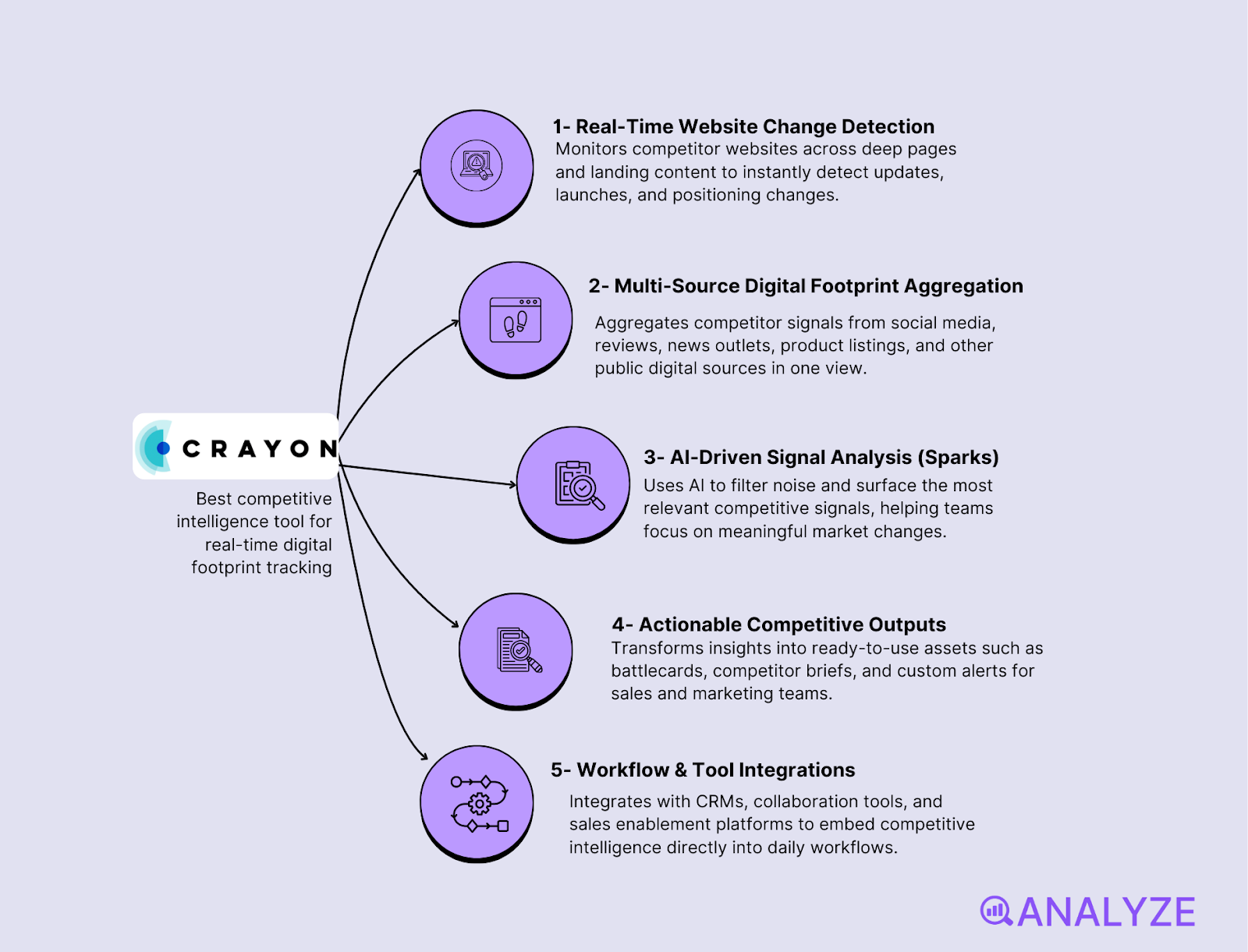

Crayon: best competitive intelligence tool for real-time digital footprint tracking

Key Crayon standout features

-

Real-time website change detection across deep pages and landing content.

-

Multi-source aggregation including social, reviews, news, and product listings.

-

AI-driven analysis (Sparks) that filters noise and surfaces relevant signals.

-

Actionable outputs such as battlecards, competitor briefs, and custom alerts.

-

Workflow integrations with CRMs, collaboration tools, and enablement platforms.

Crayon monitors competitor websites and captures changes across pages, product listings, and pricing with fine granularity so teams can see shifts quickly. The platform also pulls public signals from social networks, review sites, and news feeds to build a broader picture of competitor activity over time and to reveal patterns that single sources miss.

Crayon’s Sparks engine uses AI to surface important changes and reduce the manual work of scanning large volumes of updates, which helps teams stay focused on signals that matter. Outputs such as battlecards and custom alerts turn raw detections into formats that sales and marketing teams can use without extra work, raising the odds that insight becomes action.

That said, the platform requires careful setup and tuning to avoid noisy feeds and irrelevant alerts, which means teams must invest time in workflows and taxonomy. Pricing is also custom and not publicly listed, so smaller organizations should confirm budget fit before adopting it.

Because Crayon centers on public and digital signals, it offers limited depth on financial filings, patents, or offline intelligence. Adoption also depends on steady internal process; without clear owners who curate insights and push them into sales or product channels, value may drop.

|

Item |

Details |

Why it matters for competitive intelligence |

|

Overview |

Automated monitoring and intelligence platform that tracks digital changes, aggregates public signals, and delivers battlecards and alerts. |

Provides real-time visibility into competitor activity, allowing proactive strategy adjustments. |

|

Best for |

B2B SaaS and digital companies that need real-time visibility into competitor website, messaging, and product shifts. |

Ideal for fast-moving markets where early awareness of competitor moves drives tactical advantage. |

|

Pricing |

Custom pricing; quotes required, often aligned with mid-market and enterprise budgets. |

Ensures organizations pay for the level of coverage and integration they actually need, scaling with strategic goals. |

|

Integrations |

Salesforce, HubSpot, Gong, Chorus, Slack, Teams, Highspot, Seismic, Notion. |

Embeds competitive insights into workflows, making intelligence actionable across sales, marketing, and product teams. |

|

Data sources |

Websites (deep crawls), social media, review sites, news, product listings, internal documents. |

Covers multiple public signals to create a comprehensive picture of competitors’ positioning and messaging. |

|

Strengths |

Fast change detection, strong workflow integration, clean battlecards, automated signal filtering. |

Accelerates decision-making by delivering relevant insights quickly and in usable formats. |

|

Weaknesses |

Limited financial/patent intelligence, possible noisy alerts without tuning, unclear pricing for small teams. |

Highlights areas where teams may need complementary tools to get full-spectrum competitive intelligence. |

Best use cases

-

Keep sales teams ready with battlecards that show competitor positioning and pricing updates.

-

Track product and feature launches by watching website changes and release notes.

-

Follow messaging, content, and visual brand shifts to inform marketing and positioning.

-

Use alongside financial or patent tools when deeper strategic intelligence is needed.

Crayon gives fast, actionable insight into competitors’ digital moves and turns signals into usable battlecards. Teams needing financial or patent-level intelligence will need to pair it with other tools.

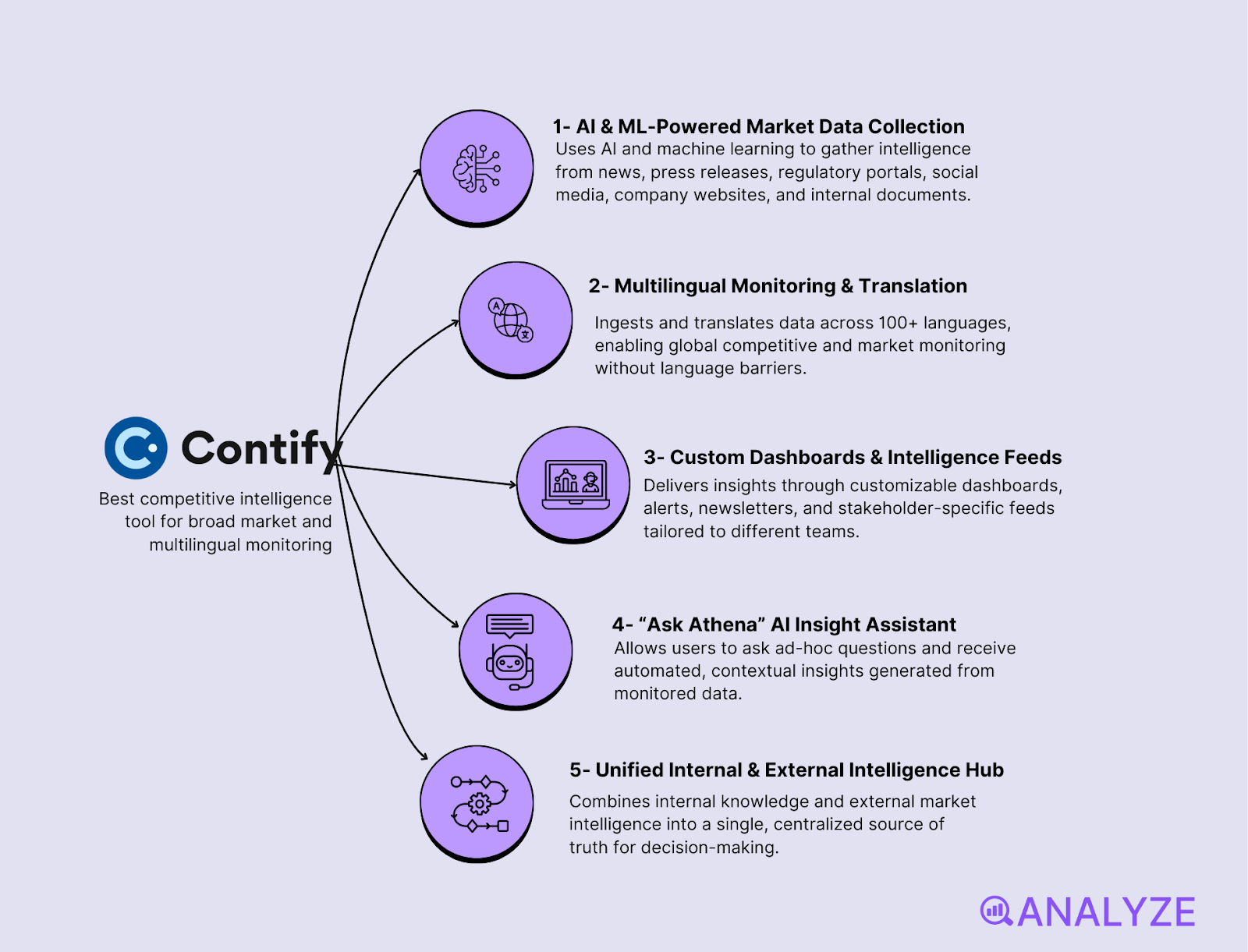

Contify: best competitive intelligence tool for broad market and multilingual monitoring

Key Contify standout features

-

AI and ML engine that gathers data from news, press releases, regulatory portals, social media, company sites, and internal documents

-

Multilingual data ingestion and translation across more than 100 languages

-

Custom dashboards, alerts, newsletters, and stakeholder-specific feeds

-

“Ask Athena” AI assistant for ad-hoc queries and automated insight generation

-

Support for combining internal and external intelligence into a single source of truth

Contify collects information from a wide range of public and internal sources, then filters and structures it so teams can follow market and competitor activity without drowning in noise. The platform uses machine learning and targeted crawling to track news updates, regulatory signals, website changes, and product developments in one steady stream. Because it can also translate content from many languages, companies get visibility into regional developments that often go unnoticed, which helps avoid blind spots in fast-moving global markets.

Its insight engine, Athena, turns long articles and updates into clean summaries and answers to practical questions about competitors, market shifts, or pricing changes. That makes it easier for teams to move from data collection to decision-ready insight without spending hours reading through scattered sources. With dashboards, custom alerts, and newsletters, Contify pushes the right information to the right people, keeping sales, product, and strategy teams aligned on what is happening in their space.

However, the platform requires thoughtful setup to get full value. Teams need to define taxonomies, select relevant sources, and tune workflows so the feed remains focused and manageable. Pricing is not published and is usually quoted for mid-market and enterprise buyers, which may limit adoption among smaller firms or early-stage teams.

Contify also centers its capabilities on public and internal content, not proprietary or deeply technical datasets. It does not claim coverage of SEC filings, detailed financial statements, or patent-level intelligence. Companies needing deep financial or R&D insights will need complementary tools. Integration depth can also vary, and some systems may require custom work to sync Contify data into existing environments.

|

Item |

Details |

Why it matters for competitive intelligence |

|

Overview |

AI-powered market and competitive intelligence platform collecting structured signals from global sources |

Helps teams track markets, competitors, and regulatory shifts with broad and reliable coverage |

|

Best for |

Firms that operate across multiple regions or industries and need constant monitoring |

Supports international visibility and reduces blind spots in multilingual markets |

|

Pricing |

Custom enterprise pricing (not published) |

Allows tailored deployments but may be out of reach for small teams |

|

Integrations & Delivery |

Slack, MS Teams, Salesforce, email, API feeds, newsletters, dashboards |

Delivers insights directly into team workflows so information is acted on quickly |

|

Data Coverage |

News, regulatory portals, websites, social media, job posts, press releases, internal docs, multilingual content |

Builds a holistic view of competitors and markets across channels and geographies |

|

Strengths |

Large global coverage, translation support, AI summaries, customizable alerts, combined internal + external data |

Reduces manual research time and improves clarity in complex markets |

|

Weaknesses |

Setup time, limited deep financial/patent analysis, less flexible integrations in some stacks |

May require complementary tools for full strategic coverage |

Best use cases

-

Follow global competitors across regions where language barriers often hide important market signals.

-

Provide executives and product teams with clean newsletters that summarize market shifts and competitor moves.

-

Monitor regulatory updates, industry announcements, and leadership changes that influence long-term strategy.

-

Connect internal intelligence with public data to build a single source of truth for research and planning.

Contify delivers wide, multilingual coverage and structured insight for teams that track many markets at once. Organizations needing deep financial or patent-level intelligence will get more value by pairing it with specialists.

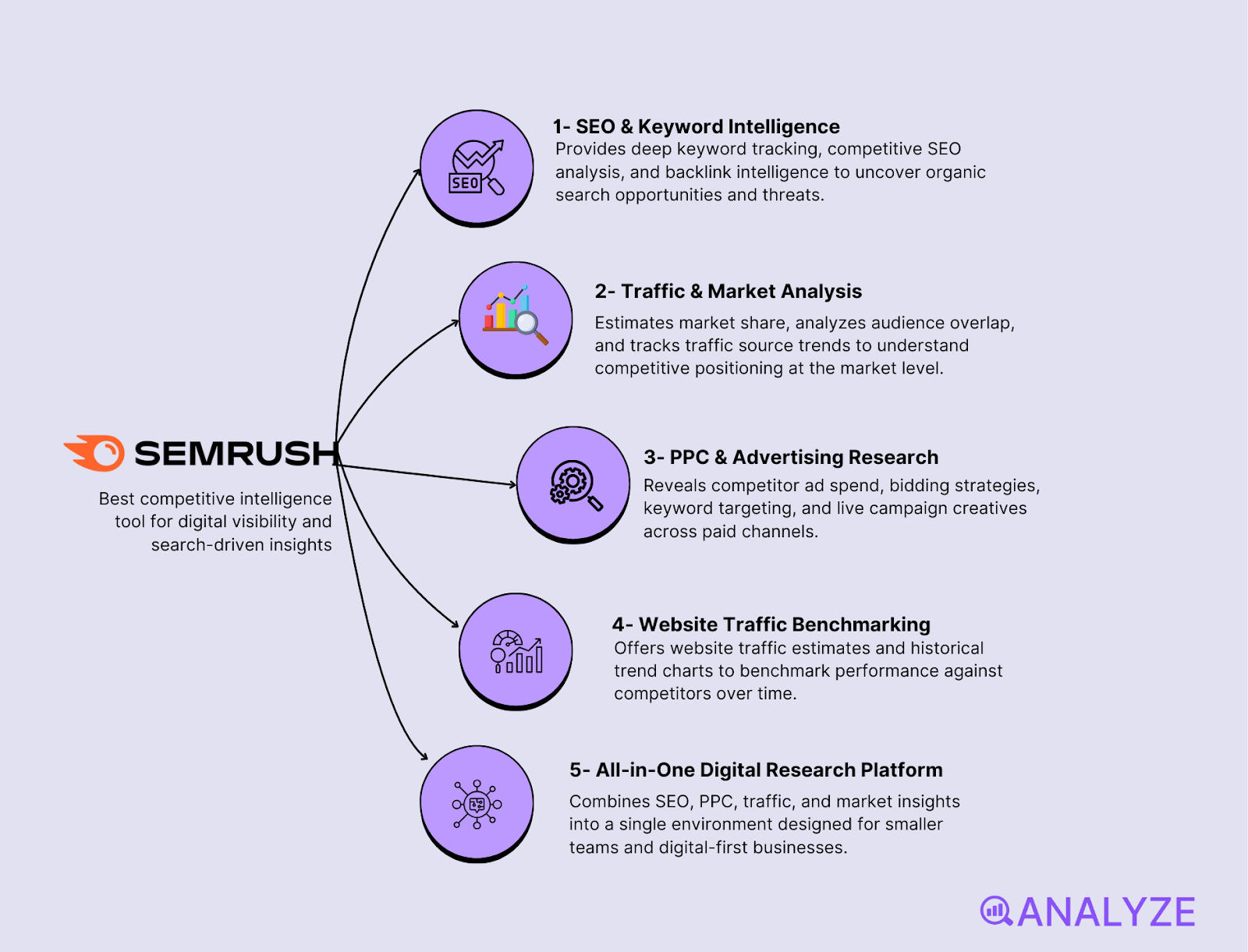

SEMrush: best competitive intelligence tool for digital visibility and search-driven insights

Key SEMrush standout features

-

Deep keyword tracking, competitive SEO analysis, and backlink intelligence

-

Traffic & Market toolkit for market share estimates, audience overlap, and traffic source trends

-

PPC and advertising research that uncovers competitor ad spend, bidding patterns, and campaign creatives

-

Website traffic estimation and historical trend charts for benchmarking

-

All-in-one digital research environment suited for smaller teams and digital-first businesses

SEMrush offers a broad suite of tools that help teams understand how competitors win attention online. It tracks keyword rankings, backlink profiles, organic visibility, and content performance so users can see where rivals gain search momentum and how they build authority. Its Traffic & Market toolkit adds another layer by estimating market share, audience overlap, and traffic sources, which gives a sense of how the digital landscape shifts across segments. These insights help teams spot gaps, evaluate new opportunities, and shape their strategy around competitor strengths or weaknesses.

Its PPC and advertising intelligence provides a look into what competitors invest in paid search, which keywords drive their campaigns, and how their ads evolve over time. This makes SEMrush useful not only for SEO teams but also for performance marketers who want to understand tactical moves in Google Ads and similar channels. The platform’s all-in-one nature appeals to smaller companies or digital-first teams that want broad intelligence without the complexity of enterprise CI tools, since most key functions live under one roof.

Still, the data that powers SEMrush traffic estimates comes from third-party modeling and clickstream sources, meaning its numbers are directionally helpful but rarely exact. Many users compare SEMrush estimates with their own analytics and notice sizable gaps, so decisions should be based on trends rather than precise counts. Because SEMrush focuses on digital presence, it won’t reveal competitor product updates, pricing shifts, offline moves, or broader market dynamics that sit outside search and traffic data.

Some of SEMrush’s more advanced capabilities—such as deeper historical data, wider competitor sets, or expanded traffic analysis—are locked behind higher pricing tiers. Growing teams may find that the tool becomes more expensive as their research needs evolve.

|

Item |

Details |

Why it matters for competitive intelligence |

|

Overview |

Digital marketing intelligence platform focused on SEO, PPC, and traffic analysis |

Helps teams see how competitors gain visibility and what channels drive their reach |

|

Best for |

Digital-first companies, SMBs, SEO and performance teams |

Provides practical, accessible competitive insights without enterprise complexity |

|

Pricing |

Tiered subscription model; advanced features require higher plans |

Offers flexibility but can scale up in cost as needs grow |

|

Integrations & Delivery |

Google tools, reporting dashboards, exports, API on higher tiers |

Eases analysis by blending SEMrush data into existing reporting workflows |

|

Data Coverage |

Search rankings, backlinks, paid ads, keyword trends, estimated traffic and market share |

Gives visibility into how rivals attract and convert demand online |

|

Strengths |

Strong SEO/PPC analytics, accessible interface, robust keyword and ad intelligence |

Supports tactical decision-making in digital acquisition |

|

Weaknesses |

Traffic data is estimated, limited non-digital intelligence, expensive higher tiers |

Requires complementary tools for full market intelligence |

Best use cases

-

Benchmark a competitor’s search visibility and discover which keywords drive their growth

-

Analyze AI paid advertising strategies, bidding patterns, and creative changes over time

-

Understand market share fluctuations and audience overlaps within a digital segment

-

Evaluate opportunities for SEO or PPC expansion based on rival weaknesses

SEMrush gives clear insight into how competitors win traffic and attention online and remains a top choice for search-driven intelligence. Teams needing broader market or offline insights should pair it with tools that offer wider competitive coverage.

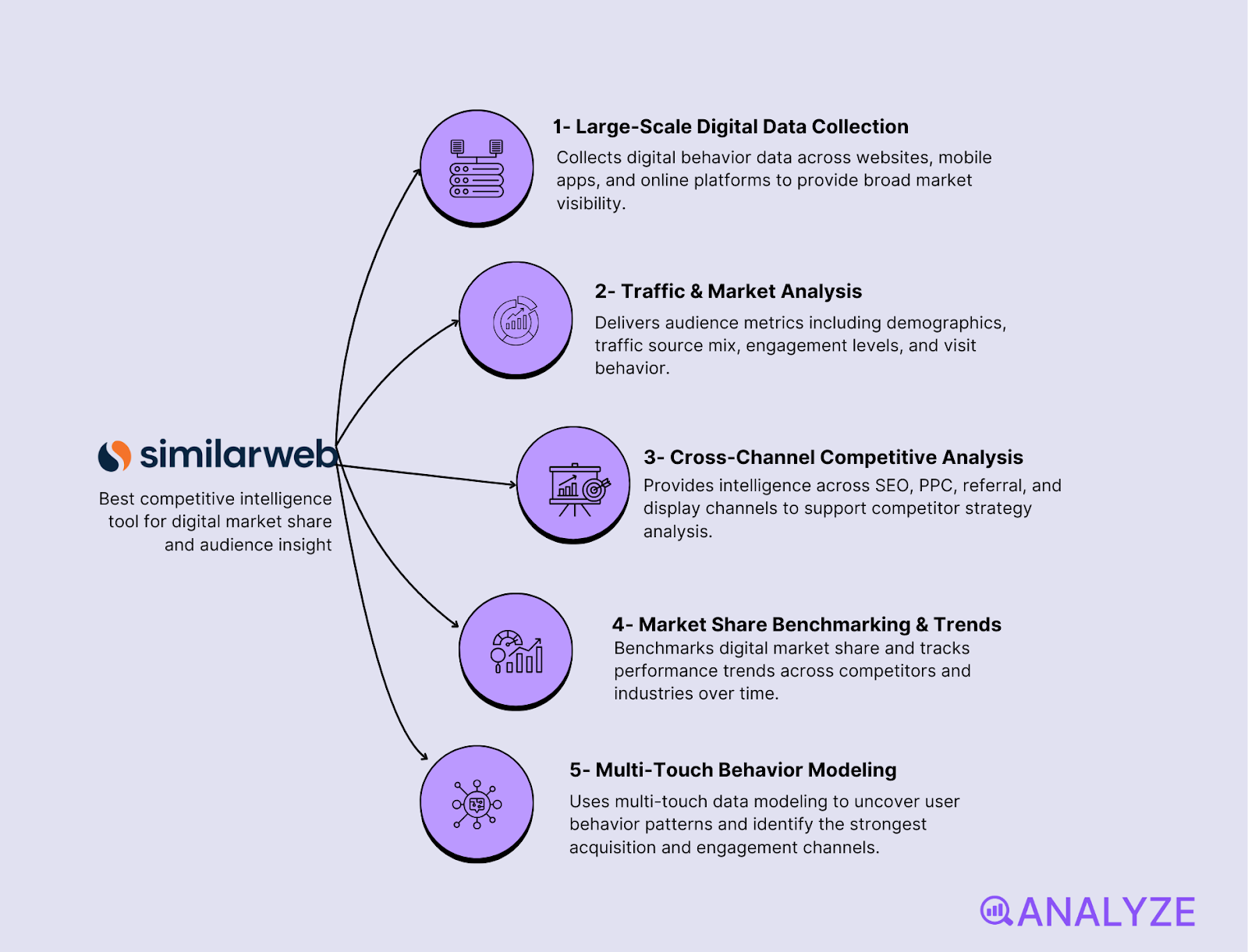

Similarweb: best competitive intelligence tool for digital market share and audience insight

Key Similarweb standout features

-

Large-scale digital data collection across websites, apps, and online platforms

-

Traffic and audience metrics including demographics, source mix, and engagement

-

Cross-channel intelligence for SEO, PPC, and competitor strategy analysis

-

Market share benchmarking and trend tracking across industries

-

Multi-touch data modeling that reveals patterns in user behavior and channel strength

Similarweb gives teams a wide-angle look at how competitors attract and retain digital audiences. It tracks billions of interactions across the web and pulls them into metrics that show traffic volume, user demographics, referral sources, and engagement patterns. With these signals, teams can see where a competitor’s audience comes from, which channels drive their growth, and how their digital reach changes over time. The platform brings together SEO, PPC, and content insights, so users can connect traffic trends with marketing actions across multiple digital channels.

Because it acts as a central hub for digital-marketing intelligence, Similarweb helps teams uncover shifts in market share or sudden jumps in competitor performance. It is often used to benchmark strengths, evaluate demand patterns, or spot early signs of strategy changes. Its breakdown of traffic sources, device usage, and audience profiles helps marketers tailor campaigns and refine budgets based on what actually moves users through the funnel.

Even so, Similarweb’s traffic numbers come from sampling models and third-party data partnerships, which means they should be viewed as broad indicators, not precise metrics. Smaller websites and niche industries often show larger variance, and different traffic-estimation tools may produce conflicting results. Because of this, the platform is most reliable when used to track trends, not exact counts.

Another limitation lies in its digital focus. Similarweb does not capture offline moves such as pricing changes, product launches outside web channels, or organizational shifts. Its coverage is strongest for larger domains with meaningful traffic, while sites with limited activity may appear with sparse or inaccurate data. Teams needing full-market visibility will often pair Similarweb with broader competitive intelligence tools.

|

Item |

Details |

Why it matters for competitive intelligence |

|

Overview |

Digital intelligence platform for traffic, audience, and competitive benchmarking |

Shows how competitors gain visibility and where their digital strategy succeeds |

|

Best for |

Digital-first companies, SEO/PPC teams, analysts tracking market share |

Helps teams understand audience flow, channel strength, and demand shifts |

|

Pricing |

Tiered plans; enterprise features at higher levels |

Offers scalable access but becomes costly as needs expand |

|

Integrations & Delivery |

Export tools, dashboards, API on select plans |

Supports deeper analysis and alignment with internal reporting |

|

Data Coverage |

Traffic estimates, demographics, traffic sources, engagement, keyword and PPC signals |

Reveals how competitors attract users and which channels drive growth |

|

Strengths |

Broad digital visibility, strong market share insights, cross-channel analysis |

Helps teams react to shifts in audience behavior and competitive reach |

|

Weaknesses |

Estimated data, weaker for small sites, limited non-digital insight |

Needs complementary tools for offline or strategic intelligence |

Best use cases

-

Benchmark digital market share and understand how competitor traffic changes over time

-

Evaluate channel performance by analyzing where competitors get their audience

-

Identify trending keywords, content formats, or campaigns that drive engagement

-

Build SEO and PPC strategies informed by real competitor traffic patterns

Similarweb gives a clear, high-level view of how competitors win and retain digital attention, making it a strong choice for benchmarking and channel strategy. Teams needing precise numbers or offline intelligence should combine it with other tools.

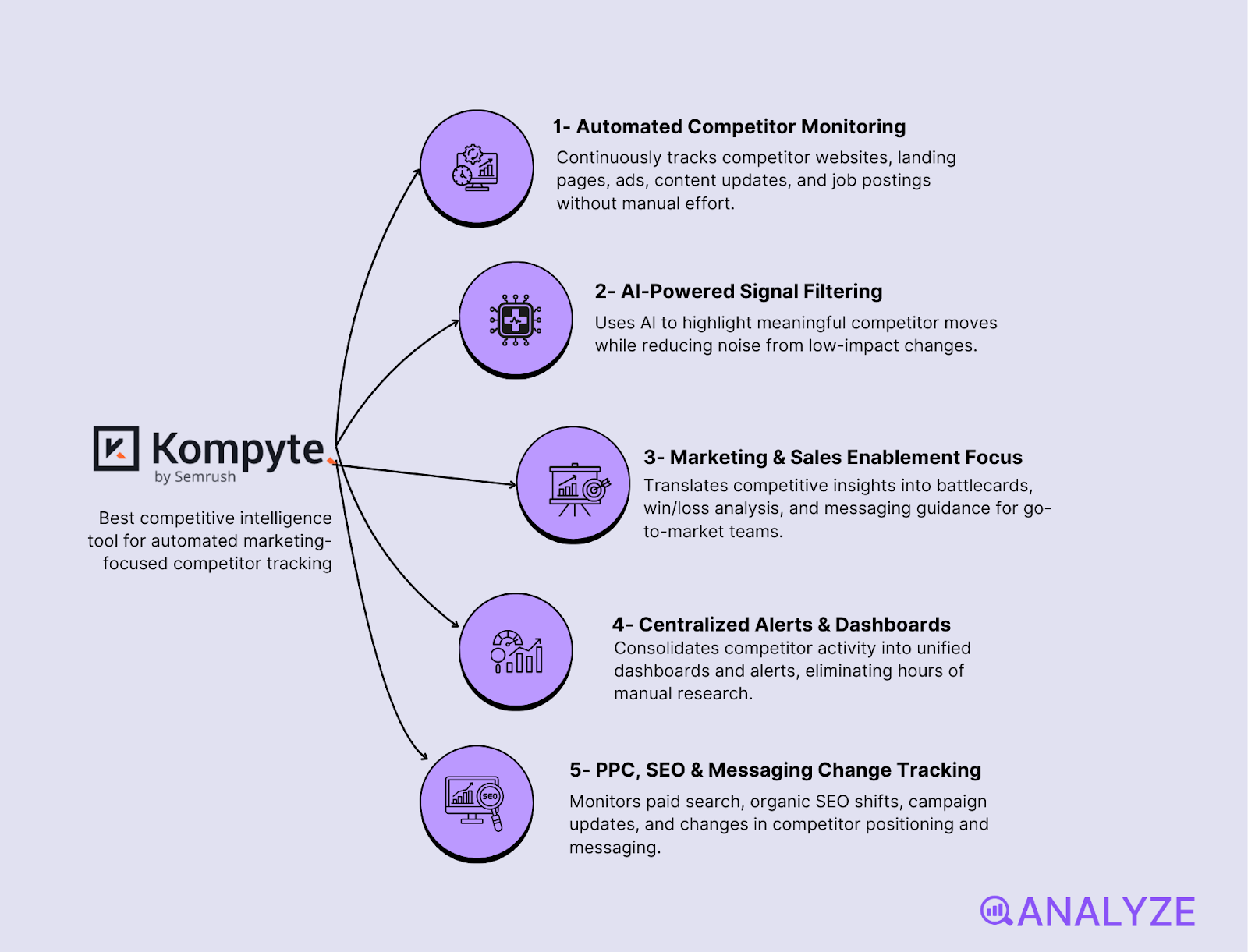

Kompyte: best competitive intelligence tool for automated marketing-focused competitor tracking

Key Kompyte standout features

-

Automated monitoring across websites, landing pages, ads, content updates, and job postings

-

AI-powered filtering that highlights meaningful competitor moves and reduces noise

-

Strong focus on marketing and sales enablement with battlecards and win/loss insights

-

Centralized alerts and dashboards that remove hours of manual research

-

Tracking for PPC, SEO shifts, campaign changes, and competitor messaging

Kompyte scans competitor websites, ads, content, and job postings to catch updates as they happen, giving teams a clear view of changing tactics in digital channels. The platform uses AI to group and filter signals so users don’t need to sift through every small change. Insights become easier to act on because Kompyte turns detected activity into clean alerts and dashboards that help teams respond faster. Its marketing intelligence focus means teams get visibility into competitor campaigns, messaging changes, pricing pages, and positioning updates that can shape strategy or improve sales readiness.

This focus extends into sales workflows as well. Kompyte powers battlecards and win/loss insights to help reps understand how competitors pitch themselves, what claims they make, and how often they update their content. Marketing teams use PPC and SEO monitoring to track which keywords competitors target or how their digital strategy evolves. These features make Kompyte useful for companies that compete heavily in search, paid ads, or content-driven markets.

There are trade-offs. Some integrations exist—such as Slack, HubSpot, Salesforce, Teams, and Trello—but depth varies, and advanced syncing may require higher tiers or custom work. Because Kompyte is geared toward marketing intelligence, it does not offer financial, R&D, or corporate-level insight; companies needing deeper strategic signals often pair it with broader CI tools. Pricing is not fully transparent, and most buyers need to request a quote. Some listings show starting prices for entry plans, but full capabilities lean toward enterprise budgets.

|

Item |

Details |

Why it matters for competitive intelligence |

|

Overview |

Automated competitor monitoring tool centered on marketing, ads, content updates, and messaging |

Helps teams catch and react to digital competitor activity in real time |

|

Best for |

Marketing, sales enablement, and GTM teams tracking campaigns, keywords, and positioning shifts |

Supports daily decisions that impact messaging, ads, and sales conversations |

|

Pricing |

Not publicly listed; requires contacting sales; paid tiers only |

May limit accessibility for small teams but aligns pricing to enterprise needs |

|

Integrations & Delivery |

Slack, Salesforce, HubSpot, Trello, Teams; API on select plans |

Brings competitor updates into daily workflows without manual checking |

|

Data Coverage |

Websites, PPC ads, social content, job postings, SEO signals, pricing pages |

Reveals competitor strategy changes across marketing touchpoints |

|

Strengths |

Strong marketing intel, automated tracking, clean alerts, useful battlecards |

Saves time and improves market awareness for marketing and sales teams |

|

Weaknesses |

Not built for corporate or financial intel; pricing not transparent; integration depth varies |

Teams may need complementary tools for full enterprise-level intelligence |

Best use cases

-

Track competitor ad campaigns, keyword bidding, and messaging updates in real time

-

Equip sales teams with fresh battlecards showing shifts in competitor value propositions

-

Monitor content, pricing, and landing page changes to refine positioning

-

Identify early strategic moves through job postings, campaign pushes, or SEO adjustments

Kompyte excels at surfacing competitor marketing moves fast and turning them into usable insights for GTM teams. Companies needing deeper corporate or financial intel will need to pair it with broader intelligence platforms.

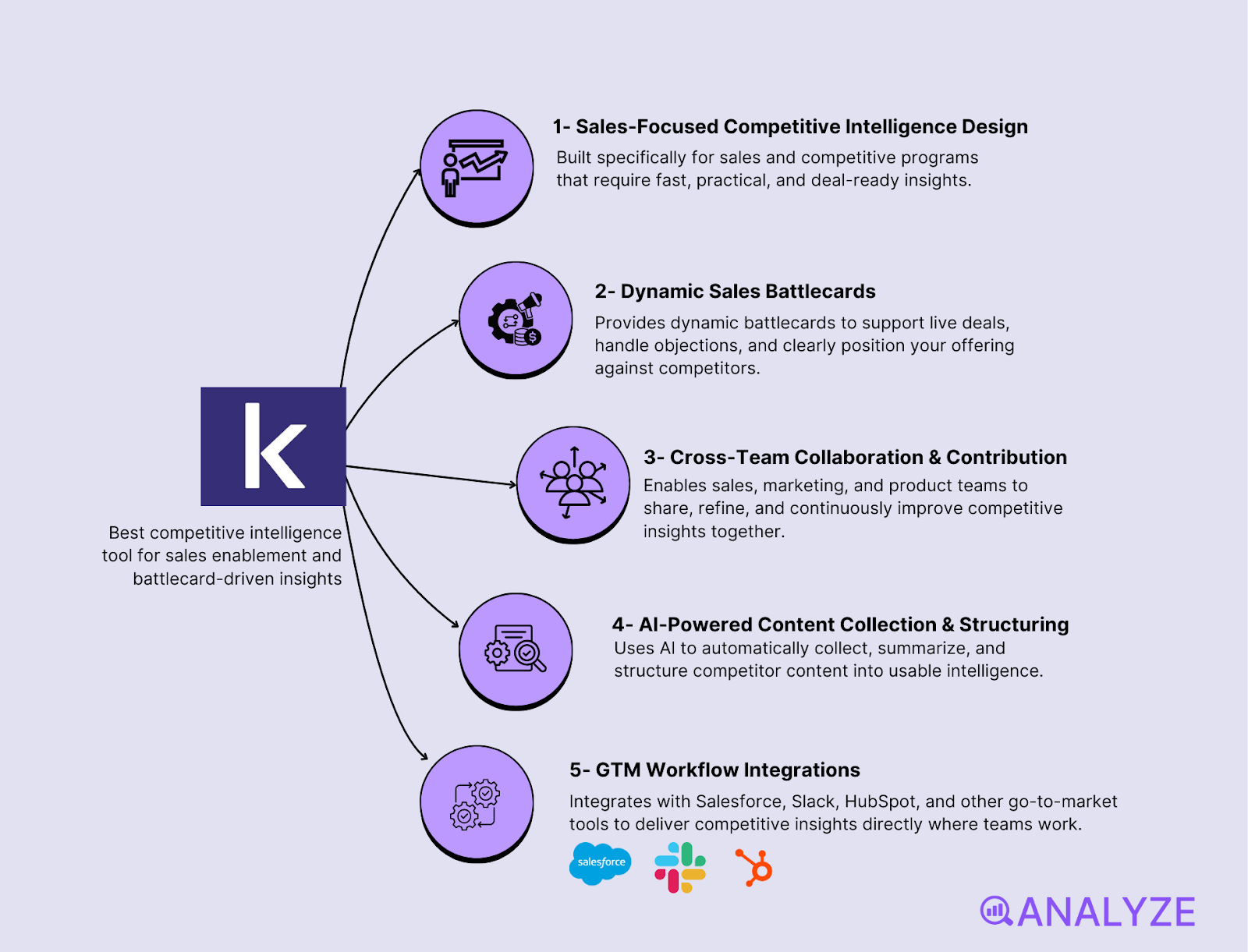

Klue: best competitive intelligence tool for sales enablement and battlecard-driven insights

Key Klue standout features

-

Designed specifically for sales and competitive programs that need fast, usable intel

-

Dynamic battlecards for deal support, objection handling, and competitor positioning

-

Collaboration tools that let multiple teams share, refine, and contribute insights

-

AI modules that collect, summarize, and structure competitor content automatically

-

Integrations with Salesforce, Slack, HubSpot, and other GTM tools for seamless delivery

Klue helps sales and revenue teams act on competitive intelligence by transforming scattered inputs into clean, structured battlecards and competitor profiles. It gathers intel from win–loss interviews, review sites, websites, and sales calls, then uses AI to summarize the most important points so teams have what they need before a deal. These workflows make Klue a strong fit for organizations that want practical competitive insights, not just dashboards or lists of updates. Its focus on sales contexts means every piece of intel answers a clear question: how do we win against this competitor?

The platform also supports cross-team collaboration. Different departments can add insights, comment on findings, and align on messaging. Klue integrates directly into the tools sales teams already use, such as Salesforce, Slack, and HubSpot, which helps ensure competitive content shows up in daily workflows. Departments no longer rely on scattered documents or ad-hoc updates; the system maintains a shared space where the most recent intel is always available.

Still, Klue focuses mainly on sales and marketing intelligence rather than full-spectrum corporate or financial insights. It does not seek to replace broader market research tools that track R&D trends, M&A signals, or deep financial data. Teams needing those forms of intelligence usually pair Klue with other solutions. Pricing is also not publicly listed, and many reviews suggest that Klue’s strongest value appears in organizations with established CI functions or mature sales enablement teams. Smaller teams may find it less accessible from a budget standpoint.

|

Item |

Details |

Why it matters for competitive intelligence |

|

Overview |

Sales-focused competitive intelligence platform centered on battlecards and structured insights |

Helps sales teams win deals with clear messaging, positioning, and responses to competitor claims |

|

Best for |

Sales enablement, revenue teams, and CI programs supporting active deal cycles |

Makes competitive intel usable during real sales conversations |

|

Pricing |

Custom enterprise pricing; requires demo or sales engagement |

Fits organizations with CI budgets but may be harder for smaller teams |

|

Integrations & Delivery |

Salesforce, Slack, HubSpot, Teams, browser extensions, AI summaries |

Delivers competitive intel inside tools reps already use |

|

Data Coverage |

Web content, review sites, win/loss interviews, sales calls, competitor updates |

Gives a practical view of how competitors position themselves in the market |

|

Strengths |

Strong battlecards, collaboration features, AI summarization, sales alignment |

Improves team readiness and ensures consistent competitive messaging |

|

Weaknesses |

Limited corporate/financial intelligence, custom pricing, better fit for mid-size/enterprise |

Needs complementary tools for deep strategic or market-wide insight |

Best use cases

-

Equip sales teams with always-updated battlecards that help win competitive deals

-

Centralize competitor content and break down silos between marketing, product, and sales

-

Summarize competitor messaging, claims, and positioning using AI to save analyst time

-

Track win/loss insights to refine positioning and improve sales playbooks

Klue is a powerful choice for teams that need actionable, sales-ready competitive intel, but companies looking for deeper strategic or financial intelligence will need additional tools.

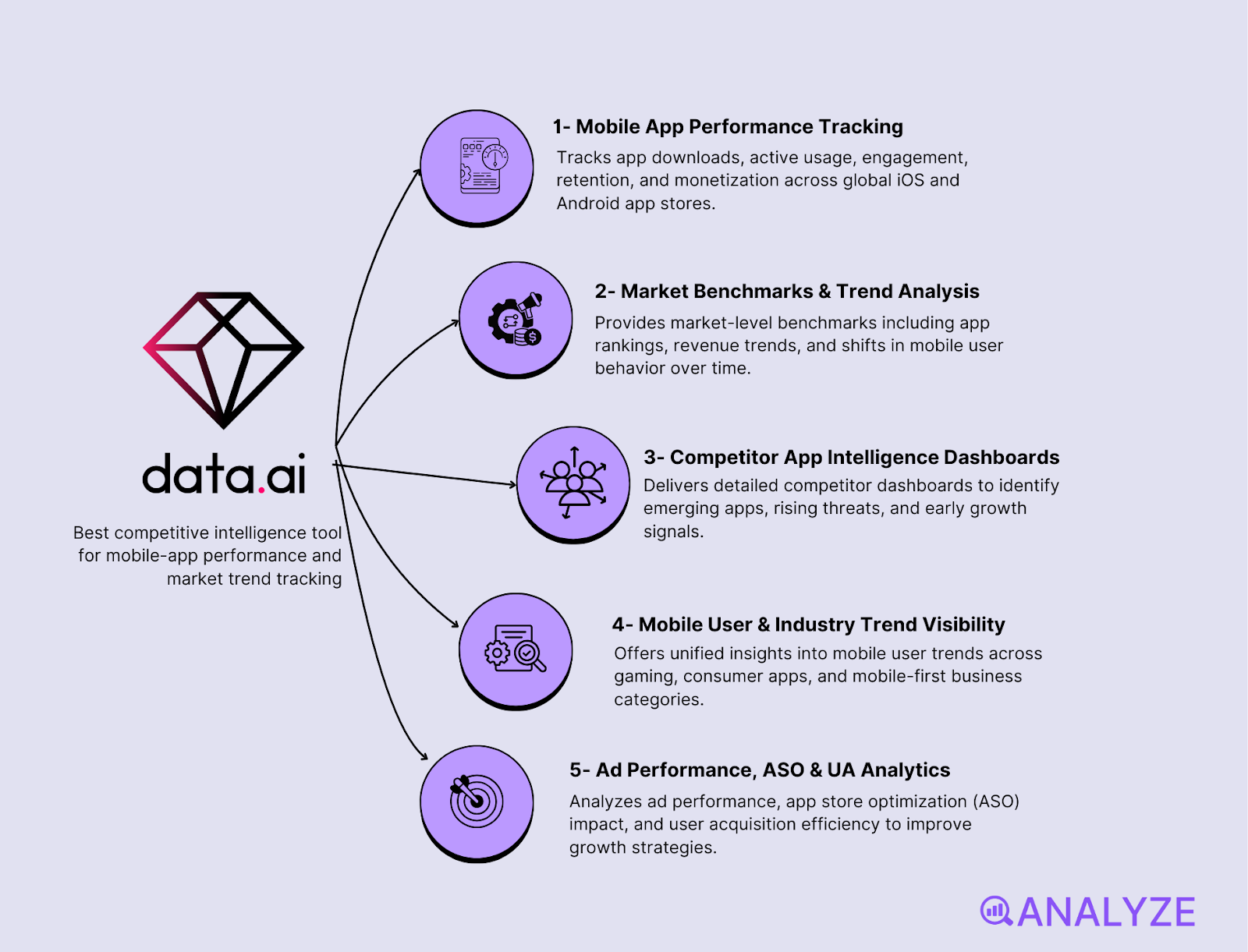

Data.ai: best competitive intelligence tool for mobile-app performance and market trend tracking

Key Data.ai standout features

-

Tracks app downloads, usage, engagement, retention, and monetization across global app stores

-

Market-level benchmarks showing rankings, revenue trends, and shifts in user behavior

-

Detailed competitor dashboards for identifying emerging apps, rising threats, and growth signals

-

Unified visibility into mobile user trends for gaming, consumer apps, and mobile-first businesses

-

Analytics for tracking ad performance, ASO impact, and user acquisition efficiency

Data.ai gives companies a clear view of how apps perform across major stores by tracking downloads, user activity, monetization patterns, and engagement signals. These metrics help teams benchmark themselves against competitors and understand which players gain traction in crowded categories. It is widely used in gaming, consumer apps, and mobile-first businesses where real-time insight into audience behavior and market shifts can shape product decisions. Because the platform highlights growth surges, retention changes, and user trends, it becomes easier to spot early opportunities or threats.

Beyond performance metrics, the platform supports competitive tracking through rankings, market share indicators, and trend lines that show how new entrants or established competitors move across segments. These insights help teams understand which apps rise quickly, where categories expand, and which monetization strategies succeed. For companies that run paid campaigns or depend heavily on app store optimization, Data.ai also offers visibility into UA performance and ASO-related changes.

However, the tool’s scope remains centered on mobile ecosystems. Data.ai shines in app-driven markets but offers limited value for companies needing broader intelligence on offline activity, B2B strategy, or financial-level signals. For organizations that operate across multiple product channels or markets outside mobile apps, Data.ai serves as a specialized component rather than a full CI solution. Many teams pair it with tools that track web traffic, pricing changes, or corporate-level events for a complete picture.

Because it focuses on mobile signals, Data.ai doesn’t replace platforms that offer financial filings, corporate structure updates, R&D indicators, or offline strategic movement. Companies wanting full-spectrum market awareness usually treat Data.ai as one layer in a larger competitive stack rather than a standalone competitive intelligence platform.

|

Item |

Details |

Why it matters for competitive intelligence |

|

Overview |

Mobile app intelligence platform that tracks downloads, usage, revenue, and rankings |

Reveals how competitors perform across app stores and where the market shifts |

|

Best for |

Mobile-first teams, gaming studios, publishers, and consumer app companies |

Helps teams adjust product, UA, and ASO strategies with real-time signals |

|

Pricing |

Custom enterprise pricing; requires contacting sales |

Fits companies deeply invested in mobile analytics and growth |

|

Integrations & Delivery |

Dashboards, exports, APIs, ASO and UA reporting |

Makes app market intelligence easy to share across product and marketing teams |

|

Data Coverage |

App performance metrics, revenue, retention, market trends, rankings, ad performance |

Supports early detection of rising competitors or new category leaders |

|

Strengths |

Best-in-class mobile insights, strong trend detection, competitive benchmarking |

Helps teams react quickly in fast-moving mobile categories |

|

Weaknesses |

Narrow focus outside mobile, requires other tools for offline or corporate intelligence |

Works best as part of a broader CI stack for multi-channel organizations |

Best use cases

-

Benchmark app performance against competitors to guide product and growth strategy

-

Detect rising apps or category shifts early by watching download and engagement patterns

-

Analyze AI monetization trends and refine UA or ASO strategies using real-time signals

-

Support decision-making for gaming, consumer apps, and mobile-first product teams

Data.ai excels at tracking mobile-app performance and spotting early market trends, making it indispensable for mobile-focused companies. Teams needing broader competitive intelligence will want to complement it with tools that cover non-mobile channels.

BuzzSumo: best competitive intelligence tool for content performance and audience engagement insights

Key BuzzSumo standout features

-

Monitors trending content, social engagement, backlinks, and audience reactions across platforms

-

Identifies high-performing competitor content and reveals patterns in what resonates

-

Supports content strategy, digital PR planning, and brand awareness campaigns

-

Multi-year content archives for historical trend analysis and competitive benchmarking

-

Alerts and topic tracking to catch rising themes, influencers, or viral formats early

BuzzSumo gives marketing and content teams clear visibility into what types of content succeed across social platforms and the open web. It highlights which competitor articles, videos, or campaigns gain traction through shares, backlinks, and engagement metrics. These signals help teams understand why certain ideas spread, how audiences respond, and where competitive content outperforms their own. Because BuzzSumo organizes this information by themes, creators, and domains, it becomes easier to map a competitor’s editorial direction and spot emerging trends before they peak.

Content strategists also use BuzzSumo to evaluate influencer impact, identify PR opportunities, or plan campaigns around topics gaining momentum. By combining engagement data with historical insight, the platform supports decisions around content formats, editorial angles, and outreach strategy. This makes it particularly strong for content-driven organizations, digital PR teams, and brands that treat content as a major part of competitive positioning.

The platform’s specialization, however, creates limits. BuzzSumo focuses almost entirely on content and social performance—not deeper competitive indicators like pricing updates, product launches, market entry signals, or corporate strategy changes. Teams seeking broad competitive intelligence usually treat BuzzSumo as one part of a larger toolkit. While it offers archives going back many years, its data depth still centers on content performance rather than enterprise-wide competitive signals, making it less suitable as a standalone CI solution.

As a result, companies often pair BuzzSumo with SEO, market intelligence, or product analytics tools to build a complete picture of competitor behavior. It remains unmatched for understanding what content works—but its narrow focus means it isn’t designed to replace multi-source CI platforms.

|

Item |

Details |

Why it matters for competitive intelligence |

|

Overview |

Content-intelligence platform tracking engagement, shares, backlinks, and trending topics |

Reveals which competitor content influences audiences and shapes market narratives |

|

Best for |

Content marketers, digital PR teams, editorial strategists, and brand marketers |

Helps teams plan content that wins attention and responds to competitor trends |

|

Pricing |

Tiered subscription model; higher limits at upper plans |

Scales with team size and content research volume |

|

Integrations & Delivery |

Alerts, exports, dashboards, influencer discovery |

Makes competitive content insights easy to distribute across teams |

|

Data Coverage |

Social shares, backlinks, influencers, topic trends, historical archives |

Shows what content resonates and how competitors shape audience conversations |

|

Strengths |

Clear engagement metrics, strong trend detection, large data archive |

Supports better content planning and more informed competitive messaging |

|

Weaknesses |

Narrow focus on content, minimal insight into pricing or product strategy |

Works best when paired with broader CI and market intelligence tools |

Best use cases

-

Map competitor content strategies and see which topics drive the strongest engagement

-

Plan content and PR campaigns using real-time trend and influencer data

-

Benchmark brand authority through backlinks, shares, and topic performance

-

Identify rising themes early to guide editorial strategy and creative direction

BuzzSumo excels at uncovering what content performs and why, making it a top choice for content-focused competitive insight. Teams needing deeper strategic intelligence should complement it with broader CI platforms.

WatchMyCompetitor: best competitive intelligence tool for hybrid AI + human-verified insights

Key WatchMyCompetitor standout features

-

AI-driven tracking of competitor websites, pricing pages, product launches, and marketing campaigns

-

Human analyst layer that reviews, interprets, and filters signals for higher-quality insights

-

Real-time alerts and centralized dashboards for monitoring changes as they happen

-

Coverage across news, press releases, digital channels, and competitive assets

-

Integrations with Salesforce, Slack, Teams, and other workflow tools for easier distribution

WatchMyCompetitor blends automated tracking with human review, giving organizations a steady flow of curated competitive intelligence instead of raw alerts. Its AI systems scan competitor websites, news mentions, product pages, and pricing updates to detect shifts as they occur. Human analysts then verify, categorize, and contextualize these findings so teams receive only actionable insights. This hybrid model helps reduce noise and supports clearer decision-making, particularly for companies that lack dedicated CI analysts internally.

The platform also includes dashboards, alert automations, and trend tracking that help teams understand ongoing competitor activity across multiple channels. Because it monitors pricing, news coverage, product changes, and campaign updates, WatchMyCompetitor can serve as an early warning system for shifts in competitive strategy. Many mid-market organizations use its curated reports and simplified interface as an accessible alternative to more complex enterprise CI platforms.

That said, WatchMyCompetitor has a smaller public footprint than tools like Crayon, Klue, or Contify, resulting in fewer independent reviews and less detailed comparison data. Public documentation and user feedback are thinner, which can make it harder to evaluate long-term performance or understand industry-specific strengths. Its niche positioning suggests that it may be more commonly used by mid-market teams or organizations needing a done-for-you CI model rather than those seeking extensive customization or broader strategic intelligence.

Because external visibility is limited, details about pricing, scalability, and advanced features are not as widely discussed as with leading CI platforms. As a result, companies evaluating WatchMyCompetitor may need demos or direct conversations to understand fit and depth of coverage.

|

Item |

Details |

Why it matters for competitive intelligence |

|

Overview |

Hybrid CI platform combining AI monitoring with curated human insights |

Reduces noise while delivering clear, decision-ready intelligence |

|

Best for |

Mid-market teams that prefer curated insights over raw data streams |

Supports organizations without large internal CI resources |

|

Pricing |

Not publicly disclosed; requires sales engagement |

Ensures tailored solutions but limits pricing transparency |

|

Integrations & Delivery |

Salesforce, Slack, Teams, email alerts, dashboards |

Keeps competitive updates visible in daily workflows |

|

Data Coverage |

Website changes, pricing updates, news, product launches, marketing shifts |

Helps teams catch competitor moves early and track long-term trends |

|

Strengths |

Blend of automation + human review, curated insights, easy-to-use interface |

Provides higher signal quality with less manual effort |

|

Weaknesses |

Limited public reviews, smaller user base, less documented than category leaders |

Harder to benchmark against top-tier CI platforms |

Best use cases

-

Receive curated, noise-free competitor change alerts without dedicated CI staff

-

Track pricing, product updates, and campaign launches in real time

-

Monitor industry news and competitor announcements with analyst-reviewed summaries

-

Support sales and strategy teams with clear, validated insights rather than raw data streams

WatchMyCompetitor offers strong hybrid intelligence for teams that want curated, real-time competitor insights, though its smaller public footprint and limited documentation mean buyers must validate fit through demos.

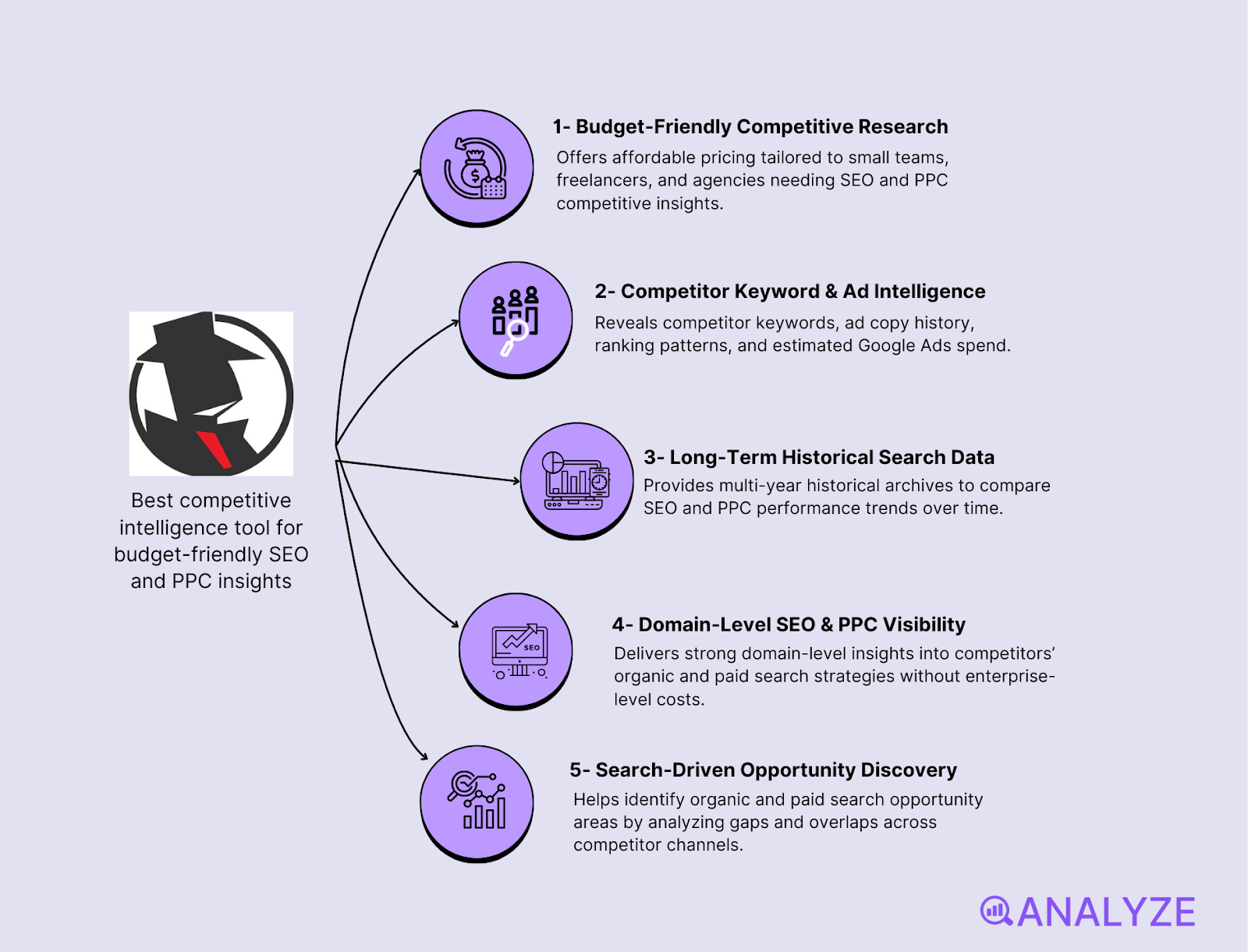

SpyFu: best competitive intelligence tool for budget-friendly SEO and PPC insights

Key SpyFu standout features

-

Affordable pricing for small teams, freelancers, and agencies needing competitive search insights

-

Reveals competitor keywords, ad history, ranking patterns, and estimated Google Ads spend

-

Long-term historical archives supporting trend comparison over many years

-

Strong domain-level visibility into SEO and PPC strategies without enterprise costs

-

Useful for understanding search-driven opportunity areas across organic and paid channels

SpyFu offers an accessible entry point into competitive SEO and PPC research by providing keyword intelligence, ad history, backlink data, and ranking trends at a price point far lower than full SEO suites. It helps teams understand which keywords competitors bid on, how their ads change over time, and what organic strategies they rely on to capture demand. Because it surfaces long-term data, users can see historical shifts in ranking or bidding behavior that reveal where competitors have invested or retreated.

The platform is particularly helpful for small businesses or agencies looking to benchmark against rivals without the cost of enterprise platforms. It simplifies domain-level research so teams can quickly audit search visibility gaps, evaluate keyword opportunities, and craft more informed acquisition strategies. SpyFu’s extensive archive—spanning more than a decade of SERP and ad data—also makes it valuable for spotting long-term market movements in search-driven industries.

Still, SpyFu works with modeled and approximate data, similar to other competitive search tools. It is best suited for identifying patterns rather than for delivering real-time, precision numbers. Because it relies on web scraping and monthly updates, it does not capture deeper competitive indicators like product changes, pricing shifts, or strategic market moves. This limits its usefulness outside search-driven contexts, making it more of a specialized research tool than a full competitive-intelligence solution.

For teams that need broader intelligence across channels or require corporate-level insight, SpyFu becomes one part of a larger toolkit. Larger SEO platforms may offer deeper analytics and more integrations, but SpyFu retains strong value for budget-conscious teams seeking fast, directional insights rooted in organic and paid search behavior.

|

Item |

Details |

Why it matters for competitive intelligence |

|

Overview |

Budget-friendly SEO and PPC intelligence platform with long-term historical data |

Helps teams understand competitor search strategies without high costs |

|

Best for |

Small businesses, freelancers, and agencies focused on search-driven markets |

Makes competitive analysis accessible for teams with limited budgets |

|

Pricing |

Starts around ~$39/month for basic plans |

Significantly more affordable than large SEO suites |

|

Integrations & Delivery |

Data exports, reports, keyword lists, PPC insights |

Supports quick research and light reporting workflows |

|

Data Coverage |

Keywords, rankings, backlinks, ad history, estimated spend |

Shows how competitors attract search demand and invest in paid visibility |

|

Strengths |

Affordable, easy to use, strong historical data, clear SEO/PPC signals |

Delivers practical insights quickly without enterprise overhead |

|

Weaknesses |

Approximate data, limited outside search, not a full CI platform |

Requires complementary tools for multi-channel or strategic intelligence |

Best use cases

-

Identify competitor keywords and ad campaigns to refine SEO and PPC strategy

-

Compare long-term ranking and bidding trends to spot openings or threats

-

Conduct domain-level audits for new clients or competitor analysis projects

-

Support small teams that need search intelligence without enterprise-grade pricing

SpyFu offers strong value for search-focused competitive insight at a low cost, but teams needing broader intelligence will need additional tools beyond SEO and PPC data.

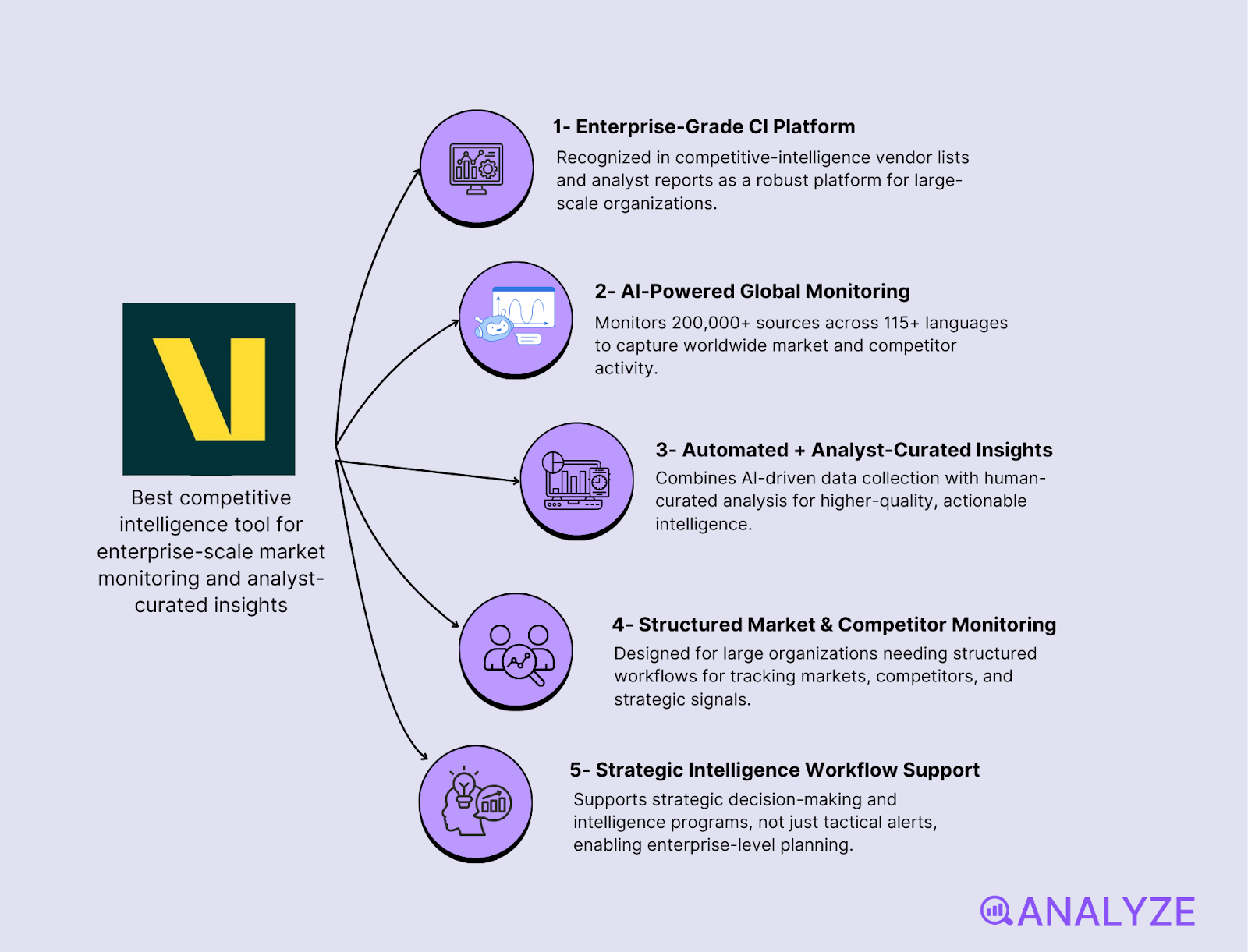

Valona Intelligence: best competitive intelligence tool for enterprise-scale market monitoring and analyst-curated insights

Key Valona Intelligence standout features

-

Enterprise-grade CI platform recognized in competitive-intelligence vendor lists and analyst reports

-

AI-driven monitoring across 200,000+ sources in 115+ languages

-

Combines automated data collection with curated analysis for higher-quality insights

-

Designed for large global organizations needing structured market and competitor monitoring

-

Supports strategic intelligence workflows rather than simple tactical alerting

Valona Intelligence appears consistently in enterprise-focused CI comparisons, often positioned alongside platforms like Comintelli and Evalueserve. Its inclusion in these lists confirms its orientation toward organizations that require structured competitive and market intelligence rather than lightweight monitoring. The platform uses AI to scan large volumes of content across global sources, providing organizations with market signals, competitive updates, and industry insights aggregated into a single environment. Its analyst curation adds context to raw data, helping teams distinguish meaningful developments from noise.

The tool is built for enterprises that operate across multiple regions or industries. Because it monitors hundreds of thousands of sources and supports multilingual coverage, Valona gives global teams a broad view of market shifts and competitor behavior. Its dashboards, briefings, and curated updates help leadership teams align strategy across borders, making it more of a foresight and planning solution than a tactical CI tool. Many companies use Valona when they need structured reporting, market deep dives, or decision-support workflows that require both automation and expert interpretation.

Despite this, Valona remains less publicly visible than major CI brands. Review volume is modest, even on Gartner Peer Insights, where it holds a strong rating but only a small number of total reviews. Public third-party evaluations are limited, and most available information comes from the vendor or from specialized CI buyer’s guides. This smaller online footprint makes it harder for general audiences to evaluate strengths and weaknesses without a formal demo. Its enterprise orientation also suggests a steeper pricing tier and a narrower target audience.

Because public documentation is thin, teams evaluating Valona should expect a more consultative buying process. Its positioning as a comprehensive market and CI solution makes it suited for enterprises with formal intelligence functions, but less appropriate for small teams looking for quick, self-service monitoring.

|

Item |

Details |

Why it matters for competitive intelligence |

|

Overview |

Enterprise CI and market intelligence platform with AI + analyst curation |

Supports structured, high-quality insights for strategic decision-making |

|

Best for |

Large organizations needing multilingual, multi-market intelligence |

Helps global teams track markets, competitors, and industry signals at scale |

|

Pricing |

Enterprise-level; not publicly disclosed |

Indicates a tailored, high-end solution rather than SMB-focused pricing |

|

Integrations & Delivery |

Dashboards, reports, curated briefings, enterprise workflow support |

Makes intelligence easy for leadership teams to consume and act on |

|

Data Coverage |

200,000+ sources across 115 languages; news, markets, competitors |

Delivers broad visibility across industries and regions |

|

Strengths |

AI + human curation, enterprise orientation, multilingual coverage, global scale |

Ideal for organizations that need dependable, context-rich intelligence |

|

Weaknesses |

Limited public reviews, lower visibility, harder to benchmark against leaders |

Buyers must rely on demos and analyst evaluations for fit assessment |

Best use cases

-

Support strategic planning with curated market and competitive intelligence

-

Track global competitors across multiple regions and languages

-

Provide executives with structured briefings and reliable, context-rich updates

-

Augment internal research teams with automated monitoring and analyst interpretation

Valona Intelligence offers deep, enterprise-level market and competitive monitoring, though its limited public footprint means teams must evaluate it through direct demos rather than broad third-party reviews.

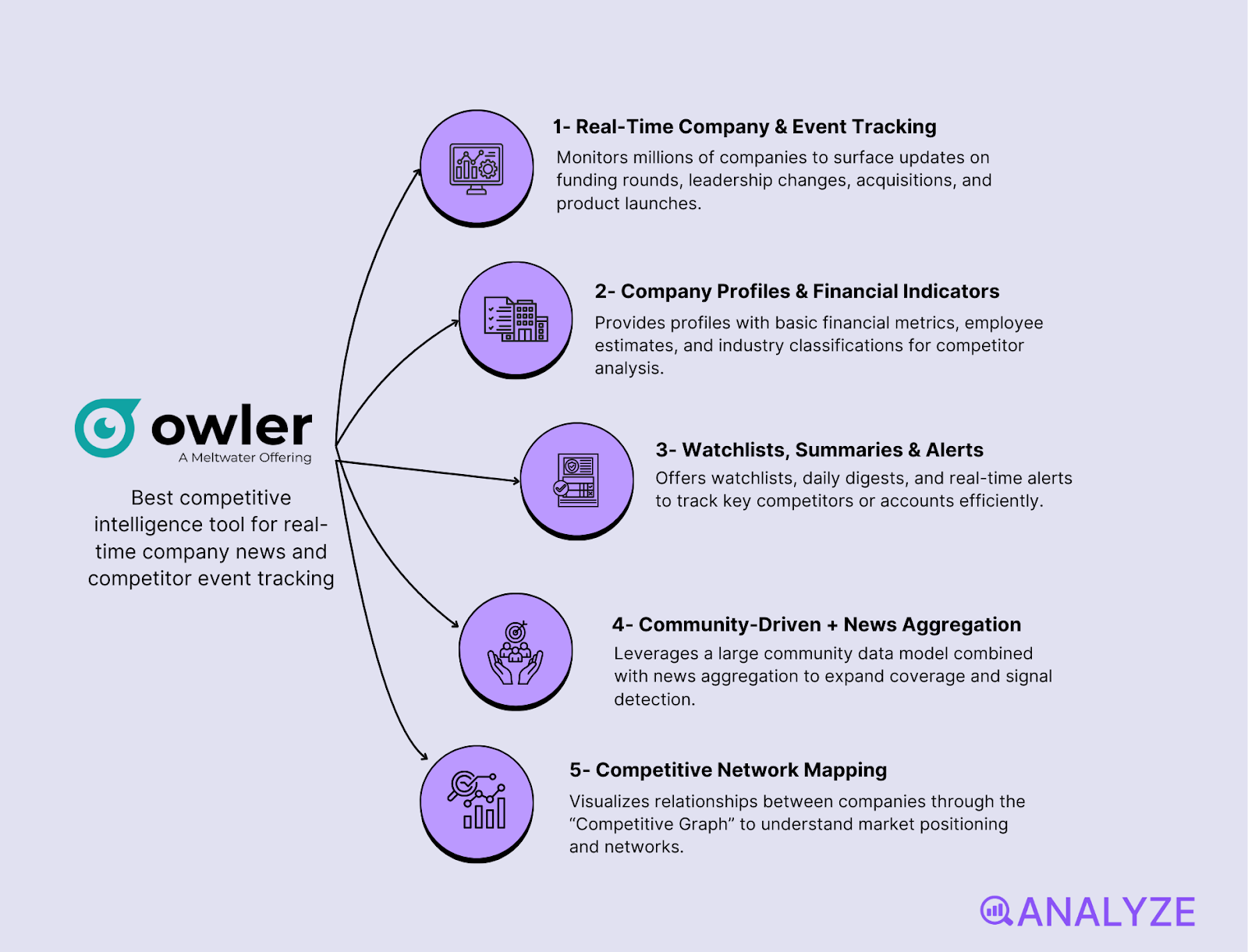

Owler: best competitive intelligence tool for real-time company news and competitor event tracking

Key Owler standout features

-

Tracks millions of companies and surfaces updates on funding rounds, leadership shifts, acquisitions, and product announcements

-

Provides company profiles with basic financial indicators, employee estimates, and industry classification

-

Offers watchlists, daily summaries, and real-time alerts for monitored competitors or key accounts

-

Uses a large community-driven data model plus news aggregation to expand coverage

-

Maps competitor networks through its “Competitive Graph” to show how companies relate across markets

Owler focuses on keeping users informed about company-level developments by monitoring news, press releases, and corporate event signals. It aggregates updates on funding, executive appointments, acquisitions, and new product announcements, allowing teams to stay aware of meaningful changes across competitors or prospects. Its watchlist system makes it simple for users to follow multiple companies at once, receiving daily or real-time alerts that highlight the most relevant activity for sales, marketing, or strategy work.

The platform is especially helpful for sales and business development teams. Alerts on leadership changes, new product launches, or funding rounds serve as sales triggers, offering context for outreach or account planning. Because Owler delivers digestible summaries rather than complex dashboards, smaller teams can quickly adopt it without needing a dedicated analyst. Its freemium model also lowers the barrier to entry, giving startups and SMBs a cost-effective way to monitor competitors and maintain situational awareness.

There are limits to what Owler can provide. It centers on company events and high-level profiles, not the deeper analytics or multichannel intelligence found in enterprise CI platforms. Its reliance on community-updated data means accuracy may vary, and teams using Owler for critical decisions often verify data with secondary sources. For organizations needing strategic forecasting, market modeling, or broad industry intelligence, Owler becomes a complementary layer rather than a full CI solution.

Despite these constraints, the tool remains a practical choice for teams that want fast, straightforward insight into competitor moves. Its strength lies in surfacing corporate events quickly—not in providing in-depth competitive analysis or cross-channel tracking.

|

Item |

Details |

Why it matters for competitive intelligence |

|

Overview |

Company-tracking and alerting platform focused on news, funding events, and leadership changes |

Helps teams monitor meaningful competitor developments without heavy CI overhead |

|

Best for |

SMBs, sales teams, marketing teams, and startups |

Supports sales triggers, prospect research, and quick competitive awareness |

|

Pricing |

Freemium model plus paid upgrades |

Accessible to small teams needing lightweight CI capabilities |

|

Integrations & Delivery |

Email alerts, daily summaries, watchlists |

Makes competitor monitoring simple and easy to adopt |

|

Data Coverage |

Funding news, acquisitions, leadership changes, product announcements, financial estimates |

Reveals company momentum and key strategic shifts |

|

Strengths |

Easy to use, affordable, wide company coverage, strong event alerts |

Ideal for quick competitor updates and prospect intelligence |

|

Weaknesses |

Crowdsourced data may vary in accuracy; limited depth vs enterprise CI tools |

Not suitable as a standalone platform for strategic competitive analysis |

Best use cases

-

Monitor competitor news and corporate events in real time

-

Equip sales teams with timely triggers for outreach or account planning

-

Track prospects and partners using simple watchlists and daily digests

-

Support SMBs or startups needing lightweight CI without enterprise costs

Owler is a practical, accessible tool for tracking competitor events and company news, though teams seeking deeper strategic intelligence will need to pair it with more advanced CI platforms.

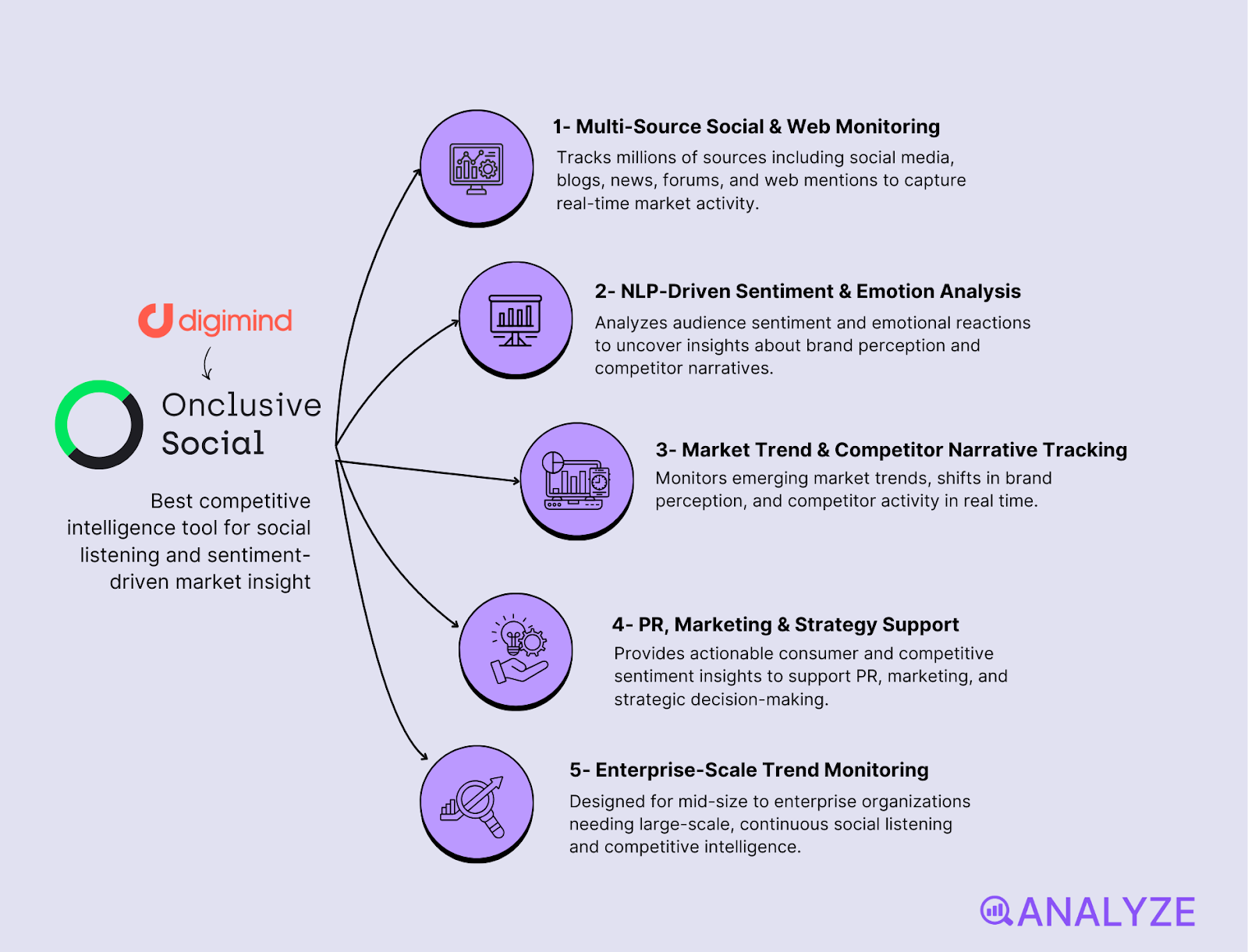

Digimind: best competitive intelligence tool for social listening and sentiment-driven market insight

Key Digimind standout features

-

Monitors millions of digital sources — social media, blogs, news, forums, and web mentions

-

Uses NLP-driven sentiment and emotion analysis to interpret audience reactions

-

Tracks market trends, brand perception, and competitor narratives in real time

-

Supports PR, marketing, and strategy teams with consumer and competitive sentiment data

-

Designed for mid-size to enterprise organizations that need large-scale trend monitoring

Digimind (now part of Onclusive Social) specializes in understanding how consumers talk about brands, competitors, and market trends across the digital ecosystem. It collects data from social platforms, news outlets, review sites, and forums to analyze sentiment and emotional tone, giving teams a clearer picture of public perception. These insights help brands understand how audiences respond to competitor messaging, emerging trends, or major market events. The platform’s strength lies in turning unstructured conversation into structured intelligence that supports decision-making across marketing, PR, and product teams.

Enterprises rely on Digimind for identifying rising competitors, tracking share of voice, and capturing sentiment shifts that signal changes in market momentum. Its ability to benchmark competitor performance and highlight early warnings makes it valuable for teams that need real-time awareness of audience behavior. Digimind fits well within broader CI workflows by offering insight into why markets move — not just how often competitors act — adding a layer of emotional and conversational context to competitive strategy.

Where Digimind focuses on social and market sentiment, its role is narrower than full CI platforms that track pricing, product updates, or financial indicators. It excels at understanding external perception but is not designed to replace tools that provide operational or corporate intelligence. Organizations often pair Digimind with broader CI systems to unify sentiment insights with more structured competitive data. Its enterprise orientation also means smaller companies may find it more than they need unless brand monitoring is a core priority.

|

Item |

Details |

Why it matters for competitive intelligence |

|

Overview |

Social listening and market intelligence platform with advanced sentiment analytics |

Reveals how consumers perceive competitors and market trends in real time |

|

Best for |

Medium to large enterprises, agencies, global brands |

Supports brand health tracking, PR strategy, and sentiment-driven CI |

|

Pricing |

Enterprise-oriented, custom pricing |

Reflects its position as a large-scale sentiment and trends platform |

|

Integrations & Delivery |

Dashboards, alerts, reports, export tools |

Makes consumer and competitor sentiment easy to distribute across teams |

|

Data Coverage |

Social media, blogs, forums, news, web mentions, sentiment & emotion analysis |

Helps teams track narratives, public mood, and competitor reputation |

|

Strengths |

Deep sentiment insights, broad data coverage, trend detection, share-of-voice analysis |

Adds contextual intelligence to marketing, PR, and strategic decisions |

|

Weaknesses |

Narrower than full CI platforms; limited on corporate or product-level intel |

Best used as a complement to broader competitive intelligence systems |

Best use cases

-

Analyze competitor sentiment and understand how audiences react to their campaigns

-

Track emerging market trends to guide product development or content strategy

-

Monitor share of voice and brand perception across social and web channels

-

Support crisis management and PR through real-time sentiment tracking

Digimind offers powerful sentiment and trend intelligence that enriches competitive strategy, though teams seeking full-spectrum CI will likely pair it with broader platforms.

Tie AI visibility toqualified demand.

Measure the prompts and engines that drive real traffic, conversions, and revenue.

Similar Content You Might Want To Read

Discover more insights and perspectives on related topics

11 Best Keyword Tracking Tools for 2026 (Tried & Reviewed)

The 9 Best AI Optimization Tools (Our Top Picks)

Best SEO Software for 2026: Overview & How to Choose

The 9 Best Backlink Building Tools in 2026

The 29 Best Free SEO Tools for 2026